In 2025, the premium-car rental segment is emerging as one of the most interesting growth opportunities for fleet operators, thanks to rising tourism, business travel recovery, and affluent consumers’ renewed appetite for elevated mobility experiences. According to recent research, the global luxury car rental market is projected to grow from around USD 49.15 billion in 2024 to USD 52.82 billion in 2025 and onward at a CAGR of about 7.8%.

For rental companies, adding luxury vehicles means a different business model in terms of economics, risk profile, and brand positioning. The decision isn’t just “buy better cars and charge more” — it requires deliberate strategy across procurement, pricing, operations, marketing, and customer service.

In this guide, you’ll learn:

- how the luxury rental segment is defined and who the customers are;

- what large opportunities exist (and how to quantify them);

- what major risks and challenges must you mitigate;

- how to build and interpret the right KPIs (TCO, ADR, RevPAV, ROI, LTV);

- which marketing and operational best practices apply;

- how modern rental software (including TopRentApp) can support a premium-fleet strategy.

This article is targeted at rental-company owners and managers who are seriously considering or already moving into the premium segment, and want a practical, expert-level reference rather than high-level fluff.

Understanding the Luxury Rental Segment

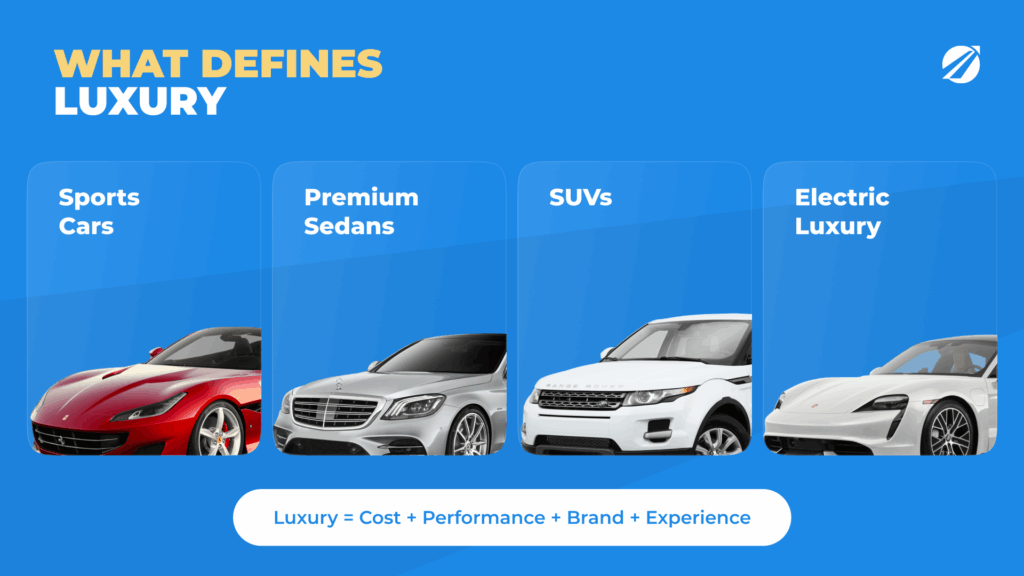

What Defines “Luxury” in Car Rentals

Vehicle categories (sports cars, exotics, high-end SUVs, premium sedans)

In the rental world, “luxury” covers vehicles that sit above the mainstream fleet in terms of purchase cost, brand prestige, performance, or exclusivity. For example:

- sports cars / exotic models (e.g., Ferrari, Lamborghini, Porsche GT)

- premium sedans (e.g., Mercedes-Benz S-Class, BMW 7 Series)

- high-end SUVs (e.g., Range Rover Autobiography, BMW X7, Mercedes G-Class)

- often even high-spec premium electric vehicles (EVs) if positioned correctly

These vehicles bring a higher risk (higher acquisition cost, faster depreciation, more expensive parts) but also command much higher rates.

Typical features and expectations

Customers renting luxury vehicles expect elevated standards:

- Impeccable vehicle presentation and condition (paintwork, interior, service history)

- High performance (engine, braking, ride) + distinctive brand/image

- Premium extras: leather seats, advanced infotainment, maybe driver assist or chauffeur option

- White-glove service: delivery/pickup, concierge handling, flexible scheduling, possibly chauffeur on demand

- Often, demand for special occasions (weddings, VIP events) or business-class usage

Key Customer Profiles

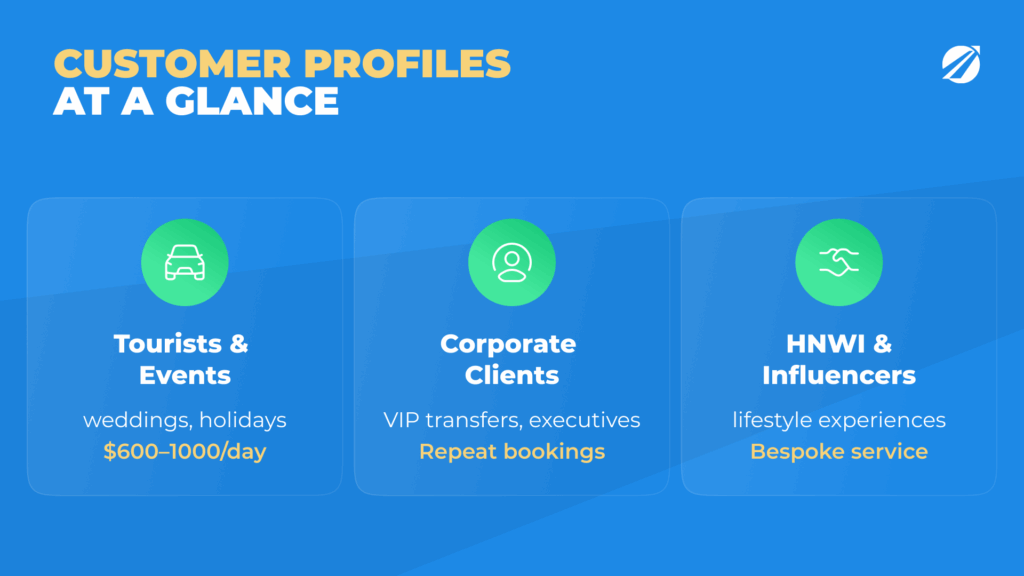

Tourists and special events (weddings, vacations, VIP trips)

One of the largest segments for luxury rentals: holiday travellers in premium destinations, couples or groups organising weddings, VIPs arriving for short stays. Demand tends to be relatively short-term (1–3 days, sometimes more for a holiday drive) but with high ADR (average daily rate). For example, a high-end sports car may rent for USD 600–1,000/day in a luxury holiday destination, while a standard sedan might rent for USD 80–150/day.

Business travellers and corporate clients

Companies may rent premium vehicles for executive transport, incentives, company events, and VIP airport transfers. This segment can provide repeat bookings (especially for event management firms, MICE, and incentive travel agencies). Because budgets are higher, the rate tolerance is better, yet service and reliability demands are likewise higher.

High-net-worth individuals (HNWI) and influencers

Privately wealthy individuals — or influencers and social-media personalities — may rent luxury vehicles for image, lifestyle, and experience rather than mere transport. This segment often expects the full suite of luxury service (pickup from hotel, driver optional, bespoke extras). Their booking behaviour may be opportunistic (e.g., arriving in the destination city, wanting “something special”).

Opportunities in the Premium Market

Higher Average Daily Rate (ADR) and Margins

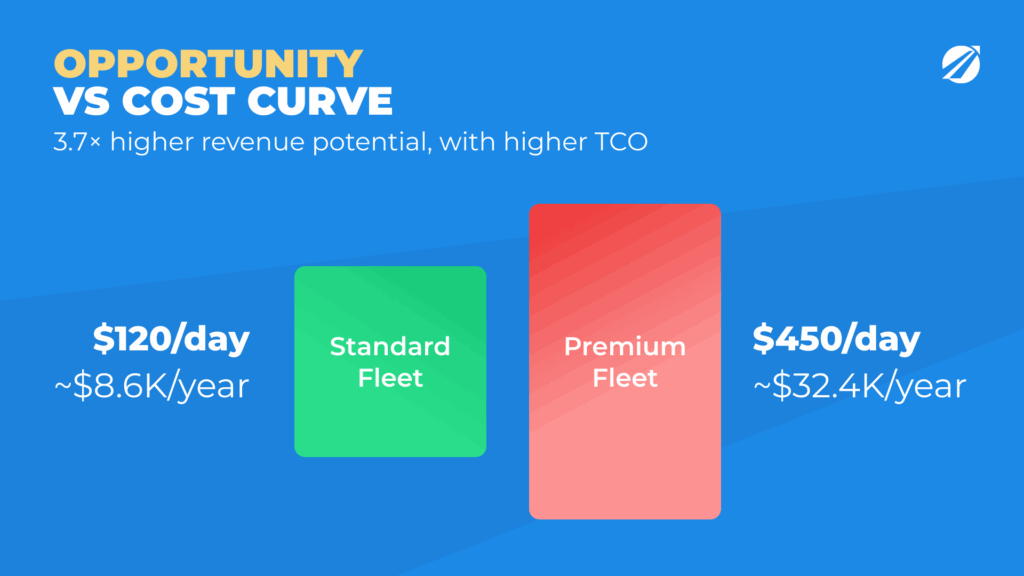

Pricing benchmarks and examples

Because luxury vehicles carry much higher acquisition costs and brand appeal, they can achieve significantly higher ADRs. For example, if your standard fleet averages USD 120/day and achieves 60% utilisation (72 days/year in a 120-day season) => revenue ~USD 8,640/year per vehicle. In contrast, a luxury vehicle at USD 450/day with the same 60% utilisation (72 days) brings USD 32,400/year revenue.

Of course, costs are much higher, but even if TCO is 3× that of a standard vehicle, the revenue upside makes the premium segment compelling.

Some recent market research indicates strong growth prospects: the global luxury car rental market size is expected to grow significantly through to 2030.

Brand Positioning and Prestige

Offering premium vehicles allows your rental brand to move upmarket: you can attract higher-value clients, enhance perception (“we have the best cars”), and gain a marketing advantage. The halo effect benefits your whole fleet (standard + premium) because clients who see you as premium may choose even standard vehicles as “upgrade” choices. This can justify investing in better vehicle condition, higher service levels, and ancillary upsells.

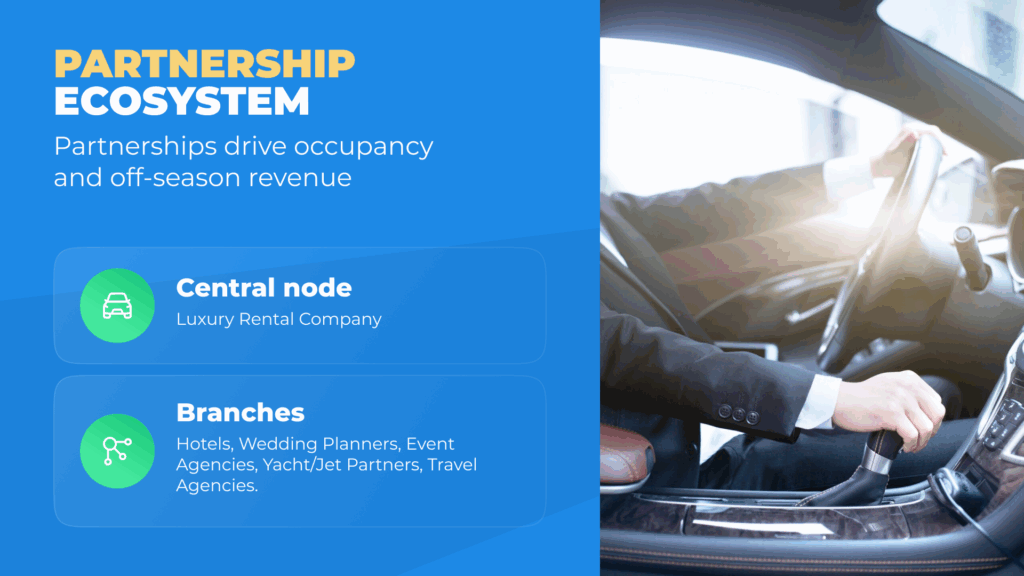

Expanding into Events and Partnerships

Luxury rentals fit well into partnerships with luxury hotels, event planners, wedding agencies, and luxury lifestyle services (yachts, private jets). For example, a hotel concierge can recommend your premium car as part of a VIP guest offering; a wedding planner can bundle a convertible sports car with the event package. These partnerships expand your reach beyond standard tourism channels and help fill low-season inventory when travel demand is lower.

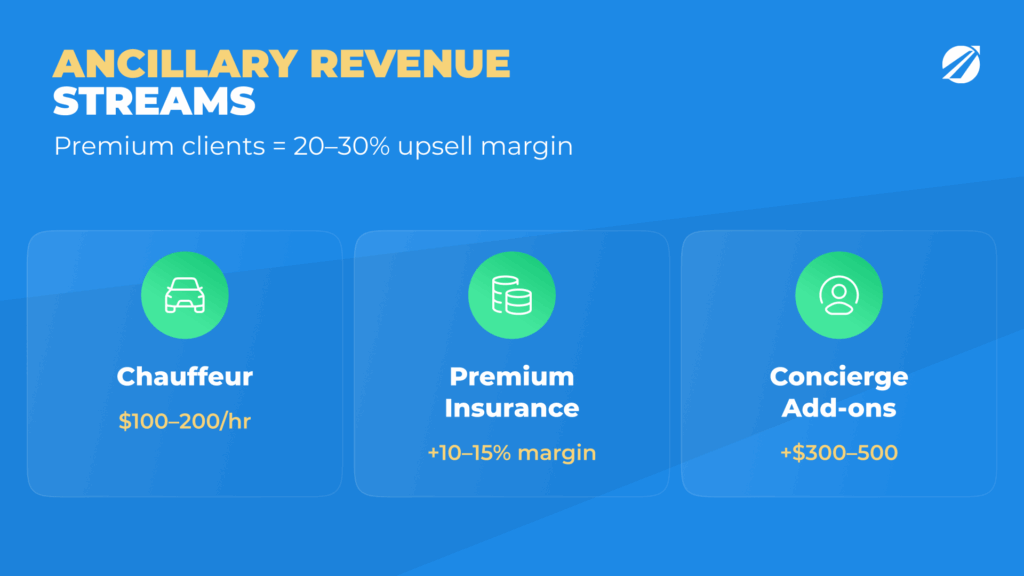

Ancillary Revenue Streams

Premium customers are more open to upsells: chauffeur services, enhanced insurance packages, bespoke concierge add-ons (e.g., airport pick-up in style, personalised branding on vehicle, guided scenic drives). These add-ons often carry high margins: e.g., chauffeur service at USD 100–200/hr, a premium insurance deposit or damage-waiver upgrade can shift cost risk away from you.

Challenges and Risks

High Total Cost of Ownership (TCO)

Purchase price and depreciation curves

Luxury vehicles cost a lot more to buy; they also tend to depreciate faster (and unpredictably) because second-hand markets for exotic or limited production vehicles are narrower. For instance, a USD 200k sports car vs a USD 50k standard sedan: even small shifts in residual value make big differences in cost per rental day.

Depreciation formula example:

Annual depreciation = (purchase price – estimated residual value) / useful rental years

Say purchase USD 200k, residual USD 100k after 5 years, depreciation USD 20k/year. If you rent 100 days/year, the depreciation cost is ~USD 200/day just from capital loss before other costs.

Maintenance, service, and spare parts

Luxury vehicles often require specialist service, OEM parts, and lower tolerances. A minor scratch or wheel repair may run USD 1,000+ rather than USD 300 in a standard car. These costs must be factored into your cost base. Unscheduled downtime (waiting for parts) also reduces utilisation.

Insurance costs and restrictions

Premium vehicles attract high insurance premiums, and insurers may impose strict mileage limits, approved drivers only, higher deductibles. You may face exclusions (e.g., no off-road, no racing) and higher liability in case of damage. Some insurers view exotic vehicles as high-risk for theft/fraud.

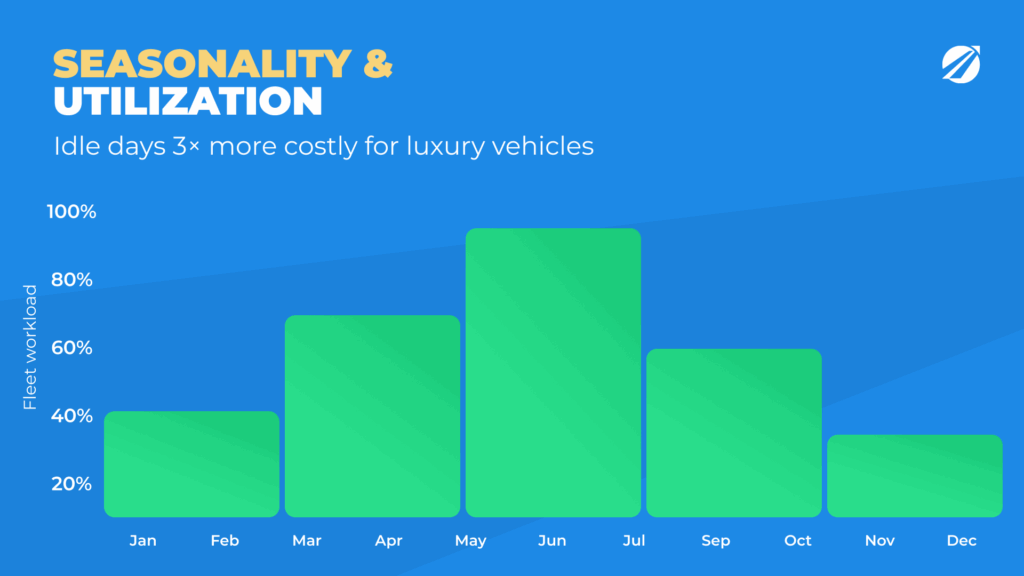

Utilization and Demand Fluctuations

Seasonality and geographic variation

Luxury rentals are even more subject to peaks and troughs than mainstream fleets: demand may spike in high-tourism months, weddings, events, and collapse in the low season. If you buy a premium vehicle but it sits idle 200 days/year, the cost per day becomes untenable. Location matters: a luxury-rental company in a city like Miami, Dubai, London, or Monaco will have much better utilisation than one in a small market without high-value clientele.

Risk of low occupancy in off-peak

Because of the higher cost, each unbooked day is a bigger drag on profitability. Utilize dynamic pricing (see section on software), but also consider diversification (corporate contracts, chauffeur hire, long-term business leases) to smooth occupancy.

Risk of Damage, Fraud, and Theft

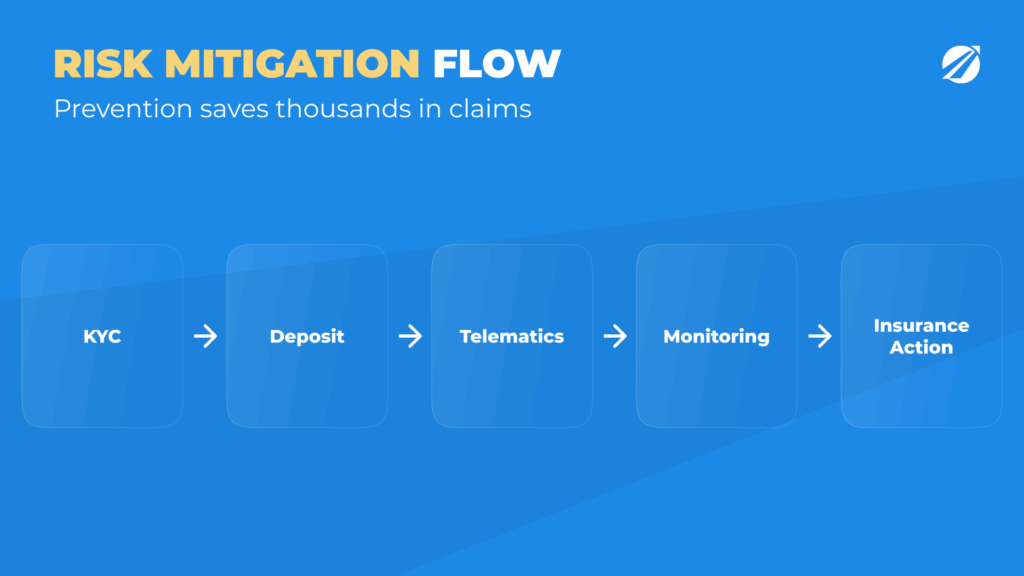

Screening customers (KYC, deposits, credit checks)

Premium vehicles attract risk: unqualified drivers, “experience” rentals gone wrong, influencer stunts, and high-speed damage. You must define strict customer-qualification rules: age minimum (e.g., 30 yrs+), driver licence history check, higher security deposit (USD 5k+), and credit-card pre-authorisation. Use driver-face verification or identity-verification systems.

GPS, telematics, and monitoring solutions

Install telematics that monitor vehicle location, speed, geofence, and driving behaviour. This helps reduce misuse risk and gives evidence in case of damage. Many insurers may mandate telematics for high-value vehicles. Monitoring also helps with maintenance planning and cost control.

Customer Expectations and Service Demands

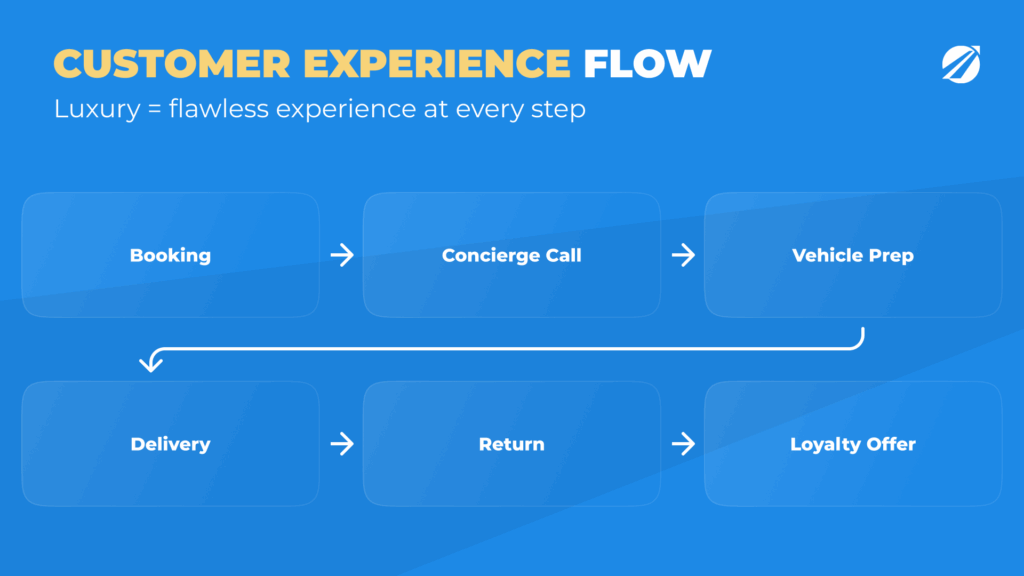

Personalized experiences, 24/7 support

Premium customers expect premium service: concierge-style support, immediate response to issues, and high flexibility. If you under-deliver, you may damage your brand and reputation quickly. For example, if a VIP client is dropped off early morning and expects a pristine, charged-up EV with a full tank and valet service, missing that expectation means lost future business and negative word-of-mouth.

White-glove delivery and pickup

Consider offering delivery/pick-up at the hotel or airport, a pro driver hand-off, vehicle briefing. These are cost items (staff time, logistics), but enhance customer satisfaction and justify higher rates. Standard “counter pickup” may not suffice for the premium segment.

KPI Framework for Luxury Rentals

Average Daily Rate (ADR) vs Effective Daily Rate (EDR)

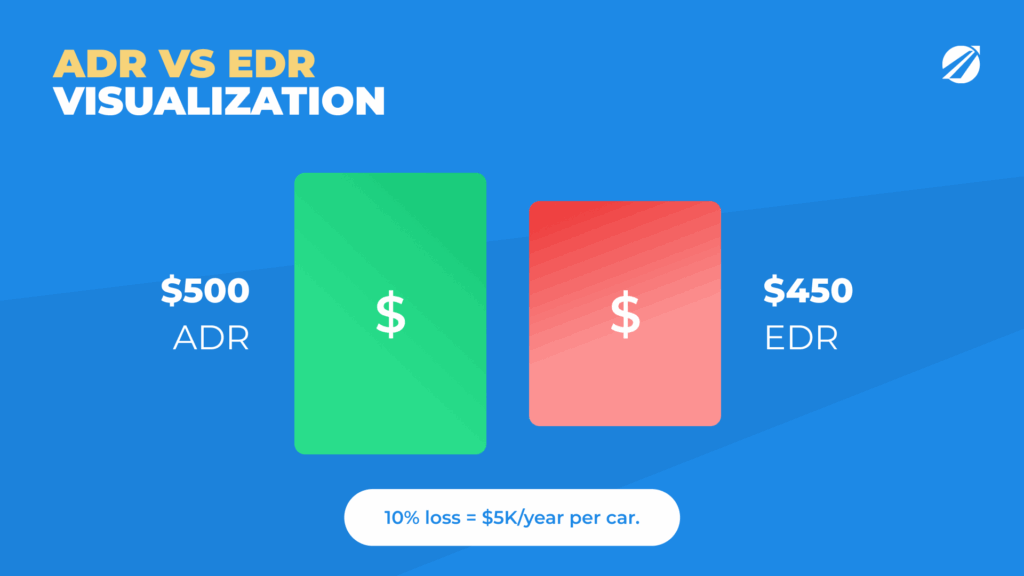

In the luxury rental business, your average daily rate is one of the most important levers of profitability. It represents the typical amount you earn per day of rental, before considering any discounts or special offers. However, the number that truly matters is the effective daily rate — the revenue you actually retain after those discounts, free upgrades, and promotional deals are applied.

In premium segments, the gap between listed and realized rates can be significant. For example, you might advertise a sports car at 500 USD per day, but once you account for seasonal discounts, loyalty offers, or multi-day packages, the actual income per rental day might fall closer to 450 USD. On paper, it looks minor, but across dozens of bookings, the lost revenue can easily reach several thousand dollars.

Discounting, when used excessively, undermines both brand perception and margins. Luxury clients rarely choose based on price alone — they buy into the experience, reliability, and prestige. Maintaining rate discipline is therefore a core part of managing a premium fleet. It’s better to hold your price and deliver exceptional service than to chase occupancy through discounts that quietly erode profitability.

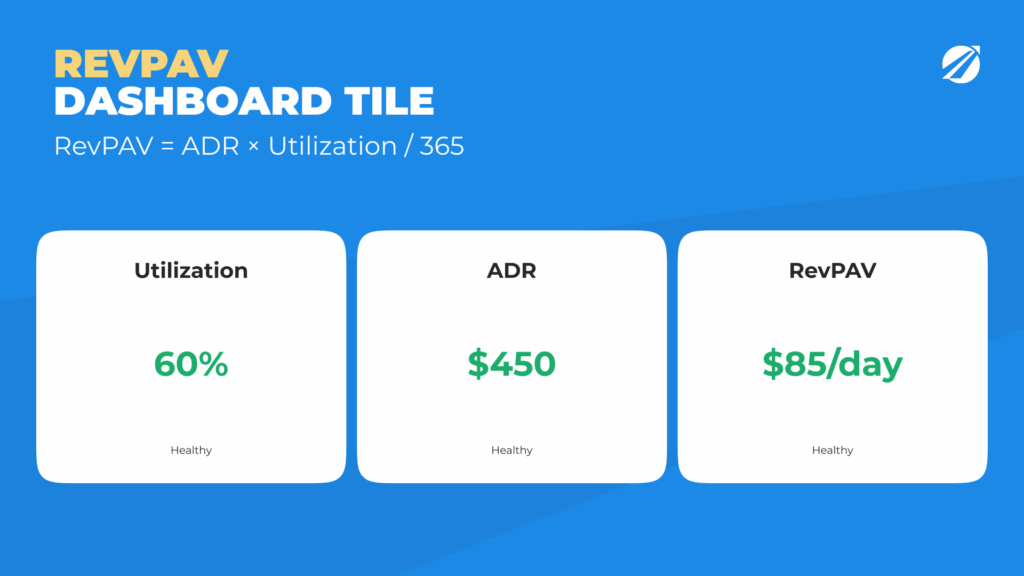

Revenue per Available Vehicle (RevPAV)

While daily rates show how much a single booking earns, revenue per available vehicle reveals how efficiently your assets perform over time. It measures the average amount of money each vehicle generates across the entire year — including both rented and idle days. In other words, it connects utilisation and pricing into one clear performance indicator.

For a luxury car that brings in around 31,000 USD in annual rental income, the daily contribution spread across the whole year might translate to roughly 85–90 USD per calendar day. This figure helps you understand whether your pricing and utilisation balance is strong enough to cover ownership costs, which can easily exceed 50,000 USD per year once depreciation, insurance, and maintenance are included.

Tracking this metric regularly allows managers to see beyond surface-level utilisation percentages. Two vehicles might both appear busy at 60 % utilisation, but the one achieving higher average revenue per available day is clearly working harder for your bottom line. For premium fleets with heavy capital exposure, that distinction often determines whether the asset is a profit engine or a financial liability.

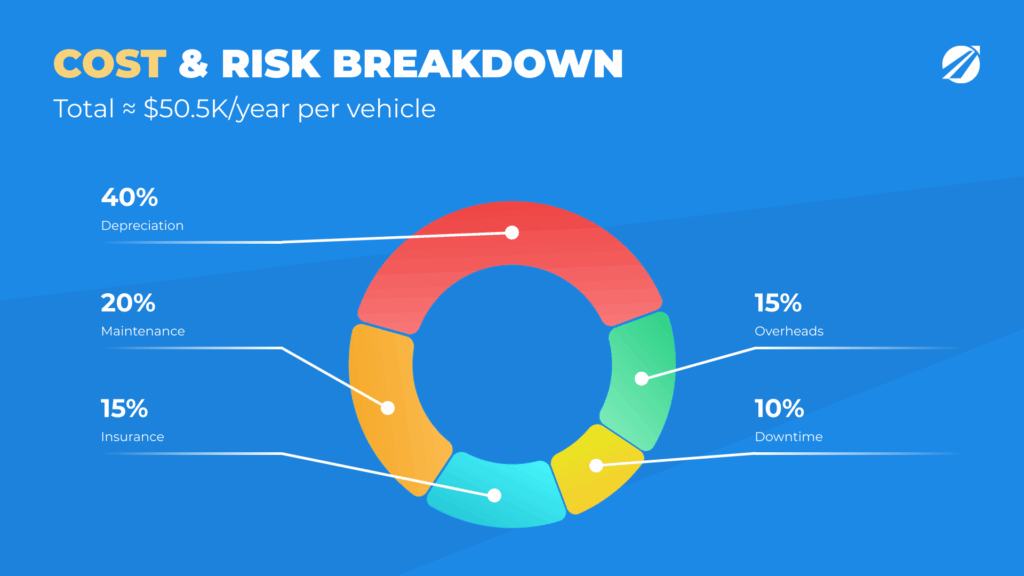

Total Cost of Ownership (TCO)

TCO = Purchase cost + depreciation + maintenance + insurance + tag/licence + downtime cost + other overheads.

Breakdown example:

- Purchase cost: USD 200k

- Residual after 5 years: USD 100k → depreciation USD 20k/year

- Insurance: USD 8k/year

- Maintenance/service/spares: USD 10k/year

- Downtime cost: e.g., 15 days/year × USD 500/day (lost revenue) = USD 7.5k/year

- Overhead allocation: USD 5k/year

Total TCO per year ~ USD 50.5k

If the vehicle earns USD 31.5k revenue/year (as above) → negative margin. So you must either raise rates, increase utilisation, reduce costs, or shorten the ownership period.

Contribution Margin and ROI

Contribution margin per vehicle = Revenue – variable and attributable fixed costs (insurance, maintenance, depreciation if charged as cost)

ROI = (Net profit per year ÷ capital invested) × 100

Example continuing above: If net profit = –USD 19k, ROI is negative. If you improve utilisation to 150 days/year (at USD 450/day = USD 67,500 revenue) and maintain TCO USD 50.5k → net profit USD 17k → ROI on USD 200k investment ~8.5%. That may be acceptable for the premium segment. Benchmarking ROI targets is essential.

Customer Lifetime Value (LTV) vs Customer Acquisition Cost (CAC)

Premium clients often have high LTV (repeat rentals, referrals), but CAC (marketing, concierge service, onboarding) is also higher. LTV can be estimated as:

LTV = average booking value × number of bookings per client per year × average lifespan (years)

Example: Booking value USD 1,200 (3 days at USD 400/day) × 2 bookings/year × 3 years = USD 7,200 LTV. If your CAC is USD 1,500 (premium-marketing, high-touch service), you still have a reasonable ratio (~5:1). You should monitor that for the premium channel.

Marketing Strategies for Luxury Rentals

Online Presence and SEO

Ensure your website positions the luxury fleet clearly: high-quality photography, video content, 360° tours, testimonials, luxury language (not “just rental” but “experiential mobility”). Optimize for keywords: “luxury car hire [city]”, “premium car rental wedding”, “VIP chauffeur sports car rental”. In the luxury segment search intent is specific and focused. Make sure you also build pages for each vehicle class and partner service (chauffeur, event hire). Use schema markup for vehicles/offerings, and ensure mobile experience is seamless since many high-net-worth clients search on the go.

Partnerships and B2B Channels

Hotels, airlines, travel agencies, and luxury clubs

Form partnerships with premium hotels (concierge recommending your cars), private-jet terminals (FBOs), travel agents specialising in high-end travellers, and event planners. Offer them commission/white-label listings or “preferred supplier” status. Corporate partnerships: incentive-travel firms, MICE organisers, luxury lifestyle services (yachts, villas) may bundle your cars.

Social Media and Influencers

For luxury rentals, visual branding and lifestyle cues matter. Instagram and TikTok are effective discovery channels: showcase not only cars but “experience” (scenic drives, couples picking up a car at a high-end hotel, interior shots). Partner with influencers or micro-influencers in travel, luxury lifestyle to drive awareness. Use targeted ads (geo + interest: luxury travel, weddings, corporate travel). But also track ROI: ensure you link influencer posts to tracked bookings or dedicated landing pages.

Customer Retention and Upselling

Create loyalty programmes tailored to premium clients: e.g., “Platinum Club” with early access to new models, complimentary chauffeur upgrade, discounts on multi-day bookings. Use email marketing (but highly personalised). Upsell from a premium sedan to an exotic sports car, or from self-drive to chauffeur-driven service. When a client books for a wedding, upsell a convertible as an “arrival experience”.

Operations and Customer Experience

Vehicle Management

Maintenance and service schedules

Premium vehicles must be maintained beyond “just acceptable.” Use scheduled preventative maintenance, track service intervals, and keep a full documented history. Downtime kills profitability—if the car is out of service for several days for a small repair, you lose high-value booking days. Budget for a “reserve vehicle” of similar class or partner-fleet arrangement to cover downtime.

Telematics for monitoring usage

Install telematics to monitor mileage, driving style (harsh braking, rapid acceleration), geofencing, and speed alerts. Set defined thresholds (e.g., no more than 300 km/day, no outside certain geofences) and build condition-based maintenance triggers (e.g., after 5,000 km or 2 weeks of track-like driving). Use telemetry data for customer debriefing and damage prevention.

Customer Handling

High-touch onboarding and service etiquette

When a luxury client arrives, you might provide an orientation of the vehicle (features, drive modes, controls), a premium welcome kit (branded bottle of water, tote, phone charger), ensure the car is spotless, full tank/be charged (for EV), and ready. Staff should be trained in “luxury service” rather than standard rental desk service. Early arrival, friendly driver/agent greeting, photo of vehicle before hand-off.

Delivery and pickup protocols

Offer delivery to hotel/airport/private jet terminal/luxury residence. Time-windows should be accurate (±15 min). Staff should be in premium attire, and vehicles have a dedicated parking slot or valet. At return, provide a full wrap-up (fuel/charge status, mileage, damage check) and ideally a “thank you” touch (photo of next-day availability, loyalty offer).

Staff Training

Professionalism and presentation

Staff represent your brand. For the premium fleet, they must dress appropriately (smart business attire), have premium branding, and be comfortable dealing with affluent clients. They should know the vehicles’ features and speak confidently about them. Mistakes or downtime in service are more visible in the luxury segment.

Handling VIP clients

Train staff for VIP protocol: discretion, confidentiality, flexible scheduling, willingness to go beyond standard terms (e.g., last-minute extension, chauffeur switching, itinerary changes). Document service standards and escalation paths. Often, these clients may prefer minimal contact and maximum ease.

Legal, Insurance, and Compliance

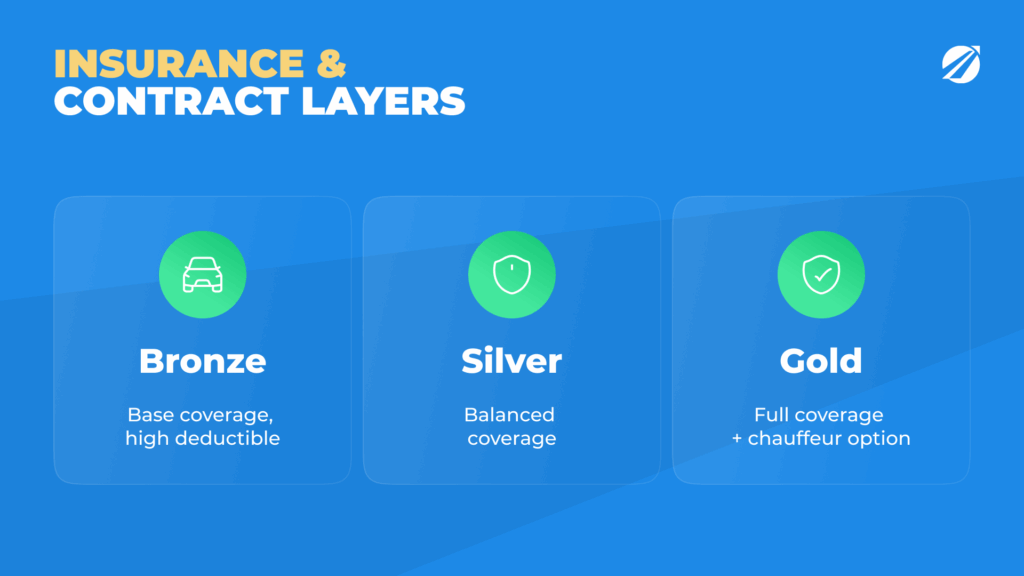

Insurance Models for Luxury Fleets

Premium vehicles require specialised coverage: higher premiums, higher deductibles, restrictions on drivers (minimum age, license tenure), exclusion of certain usages (track days, off-road). Ensure your policy covers damage, theft, and third-party liability at elevated levels. Consider “loss of use” insurance if the vehicle is out of service for a booking. Negotiate with the insurer based on telematics/monitoring data to reduce premiums.

Contract Clauses and Waivers

Contracts must reflect higher risk: security deposits (USD 5k–10k or multiple of daily rate), excess mileage charges (e.g., beyond 300 km/day add USD X per km), fuel/charge policy (client returns full tank/full battery), no modifications or off-plan driving. Include driver-age minimum (e.g., 30+), driving-licence history, KYC checks, and credit-card hold. Consider damage-waiver fees or excess reduction upgrades for clients willing to accept higher risk.

Regulatory Considerations

Luxury car rental may be subject to additional taxation, licensing or luxury-vehicle restrictions in some jurisdictions (e.g., higher road tax, VIN-tracking, parking restrictions). In certain markets, you may face special treatment for exotic/oversize vehicles (import duties, insurance loading). Ensure you comply with local regulations (in Ukraine/EU, this may include fleet-licensing, VAT treatment, etc.). Stay aware of evolving EV/fuel-emission legislation (see, for example, EU proposals).

How Rental Management Software Supports Luxury Fleets

Dynamic Pricing and Yield Management

Premium fleet requires more sophisticated pricing: adjust rates by season, events (e.g., F1 race week, wedding season), model popularity, lead-time, and utilisation. Software like TopRentApp provides the tools to define pricing rules, auto-adjust inventory rates, and yield manage across vehicle classes. This ensures you don’t leave money on the table or overprice and lose bookings.

Customer Screening and Digital Contracts

High-value clients require strict screening: driver-license verification, age checks, credit/deposit validation, and digital contract signing. TopRentApp supports digital contracts, driver-profile management, deposit holds, KYC workflows, and integrates with your CRM to track the premium customer segment.

Maintenance Scheduling and Alerts

With premium vehicles, maintenance timing is critical to protect the brand and reduce downtime. TopRentApp’s fleet-management module enables you to schedule service alerts based on mileage/hours/time, track service history, manage parts inventory, and allocate vehicles off-market when needed proactively rather than reactively.

Analytics and Profitability Reports

To assess whether your premium fleet is profitable, you need granular data: utilisation by model/segment, ADR vs cost, downtime, revenue per available vehicle, contribution margin, and ROI per vehicle. TopRentApp offers dashboards and reporting modules tailored for rental-fleet operations, enabling you to compare standard vs premium performance, spot under-performing assets, and make informed procurement decisions.

TopRentApp as a Solution for Premium Rentals

In summary: if you are managing or planning to manage a premium-fleet segment, TopRentApp becomes a strategic tool—not just booking software. It supports your high-end pricing strategy, high-touch service workflows, risk-mitigation (deposits/KYC), maintenance/telematics integration, and provides the KPI framework to ensure your investment in premium vehicles translates into profitable performance rather than a cost sink. For fleet owners and managers serious about premium mobility, TopRentApp should be considered the backbone of your operations.

Case Studies and Best Practices

A Boutique Luxury Rental Startup

Let’s imagine a small operator in a popular leisure destination (e.g., the Côte d’Azur or Dubai) that starts with three premium vehicles: a convertible sports car, a high-end SUV, and a luxury sedan. They define target ADRs: USD 600/day for the convertible, USD 450/day for the SUV, and USD 350/day for the sedan. Utilisation target: 80 days/year (since high-season concentrate). TCO per vehicle is analysed: purchase, service, insurance, and downtime. Using TopRentApp, they manage online bookings, concierge hand-off, integrated telematics, and dynamic pricing during peak event weeks (e.g., yacht show, film festival). After year one, they achieve revenue USD 156k (3 vehicles × average USD 52k each) with TCO combined USD 120k → net USD 36k → positive ROI ~12%. They partner with luxury hotels for referrals and build a strong Instagram presence. Key lessons: start small, focus on high-yield days, service excellence differentiates, and systemise everything early.

A Large Operator Adding Premium Cars

A larger rental company with a mixed fleet and regional presence decides to add a “premium sub-brand”. They allocate 20 vehicles (various high-end models) and treat them as distinct from their mainstream fleet, both operationally and in branding. They set up: a dedicated premium-fleet manager, a premium pricing matrix, a concierge service, chauffeur option. They use TopRentApp to integrate premium inventory separately, track utilisation vs mainstream, monitor idle days and maintenance downtime carefully, and report monthly on premium-fleet KPIs (RevPAV, net margin, ROI). Year-end analysis shows the premium fleet achieved ADR 3.5× mainstream, utilisation slightly lower (50 % vs 60 %), but net margin per vehicle was still 2× mainstream due to premium pricing and ancillary upsells. They also learned to adjust the vehicle replacement cycle every 3 years rather than 5 years in the standard fleet because depreciation risk is higher in the exotic/premium segment.

Lessons Learned and Pitfalls to Avoid

- Don’t assume premium vehicles will perform like standard ones: higher cost + lower utilisation risk = greater upside only with control

- Avoid mixing premium vehicles into the standard fleet without separate branding/operations — service expectations differ

- Under-estimating downtime cost kills margin in the premium segment

- Giving deep discounts to fill idle days can erode brand and margin — better to accept an idle day than drop price too far

- Failing to partner with luxury-channel B2B (hotels, events, corporates) limits reach to high-value clients

- Skipping telematics or strong customer screening leads to disproportionate damage/claim costs in premium vehicles

- Not tracking premium-specific KPIs (e.g., ROI per vehicle, net margin premium vs cost) means you can’t judge whether the strategy works

Conclusion — Building a Profitable Luxury Rental Business

Key Takeaways

- The luxury car rental segment is growing and offers a compelling revenue opportunity: global market size projected to expand significantly.

- To succeed, you must treat the premium fleet as a separate business stream: different vehicles, higher cost structure, higher rate environment, higher service level, and higher risk.

- Focus on key customer segments (tourism/special events, corporate, HNWI) and tailor service and pricing accordingly.

- Rigorously monitor core metrics: ADR, RevPAV, TCO, ROI, LTV. Use realistic assumptions and stress-test worst-case scenarios (low utilisation, high downtime).

- Marketing and partnerships matter: online brand presence, influencer/lifestyle channels, B2B alliances (hotels, events, travel agencies).

- Operations must be flawless: maintenance, telematics, customer service, delivery/pick-up protocols, staff training—all need to reflect a premium brand.

- Legal/insurance/compliance complexity is higher: higher premiums, stricter contracts, greater risk of theft/damage, regulatory environment, especially if you deal with exotic vehicles or EVs.

- Software underpins success: a platform like TopRentApp drives dynamic pricing, streamlined customer onboarding, maintenance scheduling, data analytics—in short, it allows you to manage the complexity rather than rely on spreadsheets and hope.

Balancing Opportunities and Risks

Luxury rentals can deliver higher margins and elevated brand positioning—but the margin for error is narrower than in standard rentals. A single large damage claim, an extended downtime, and persistent idle calendar days can turn a “premium success” into a loss-making asset. Therefore, it is essential to handle premium fleet proactively: careful procurement (choose vehicles with solid residuals), disciplined cost control, strong partnerships, and robust systems.

Use TopRentApp to Manage and Scale Your Luxury Fleet

If you’re serious about entering or scaling the premium-car rental segment, now is the time to implement a system built for that complexity. TopRentApp gives you the architecture to manage high-value vehicles, apply dynamic pricing, onboard VIP customers, monitor fleet health, and track profitability vehicle-by-vehicle. Don’t treat premium as just “another car category” — treat it as a strategic business stream, and let TopRentApp be your operational and analytical backbone.

Premium rental services require exceptional precision and customer experience.

👉 Request a free demo to discover how TopRentApp supports VIP workflows, dynamic pricing, and premium fleet control.

A luxury car rental software helps maintain elite service standards.