In 2026, a rental company’s fleet is more than a pool of vehicles — it is a living system that converts capital into dependable daily revenue. Every decision about what you buy, how you maintain it, where you position it, and when you sell it ripples through your P&L, your reputation, and your capacity to grow. Effective fleet management has always mattered, but today it’s the difference between profit and loss — costs are up, rules are tighter, and customers expect more.

The economic context is pressurizing margins. Insurance premiums continue to climb for higher-risk categories; parts and labor remain expensive and, in some markets, scarce; energy prices are volatile; and the cost of a single day of downtime is higher because demand spikes are sharper and less predictable. At the same time, customer expectations have been reshaped by on-demand mobility: people want frictionless booking, fast counter time, and vehicles that feel new, clean, and trouble-free. On the regulatory side, low-emission zones and stricter inspection regimes keep expanding, and digital record-keeping has moved from “nice to have” to a compliance requirement in many jurisdictions.

No fluff here: practical steps with results you can track. You will see which metrics actually drive profit, how to deploy preventive and predictive maintenance, where telematics pays off, how to time replacements based on economics rather than habit, and how to adapt operationally to EVs without introducing bottlenecks. The recommendations apply to multinational brands and to local operators running a dozen cars — the principles are the same, the difference is scale. And throughout, we’ll show how a modern rental management system (RMS) such as TopRentApp turns these principles into day-to-day workflows and decision-grade analytics.

Why fleet management matters more than ever in 2026

Competitive intensity has increased on both the supply and demand sides. Traditional daily rental competes directly with car sharing, subscription models, and peer-to-peer platforms. Price transparency narrows ADR flexibility, so the durable differentiators are fleet readiness, consistent vehicle quality, and the ability to meet demand spikes with the right category in the right place.

Cost pressure amplifies the stakes of each operational decision. A repair that takes a vehicle off the road for three days no longer costs only parts and labor — it eliminates three days of revenue in markets where weekend utilization can exceed 90%. Prolonged lead times for parts create a backlog effect: a cluster of delayed vehicles distorts your category mix, pushes customers into suboptimal upgrades, and can inflate damage disputes simply because vehicles cycle faster once they return to service.

Regulatory momentum introduces additional constraints but also an opportunity to differentiate. Low- and zero-emission zones are expanding in large cities; plate-recognition enforcement makes compliance binary. Fleets that plan ICE/EV mix and charging access now will avoid both fees and last-mile frictions later. Safety compliance is tightening too: ADAS recalibration after glass or bumper work is no longer optional, and documentation requirements are more explicit. An operator who treats compliance as a continuous process within their RMS will have higher availability simply because vehicles aren’t sidelined at the last second for expired documents.

Get this right, and the wins are real — and repeatable. Consider a mid-sized operator in Lisbon that transitioned in early 2024 from calendar-based servicing and spreadsheets to a telematics-integrated RMS with predictive alerts. By aligning service windows to booking gaps and replacing “at-risk” components just before failure, unplanned downtime fell by 27% and maintenance cost per vehicle dropped 18% year over year. Customer satisfaction scores rose by 22% because cars felt newer and warning lights disappeared. Profitability increased without expanding fleet size — proof that management quality, not inventory, is often the fastest route to growth.

Key metrics every rental business should track

Utilization rate

Utilization rate is the heartbeat of a rental operation. It expresses the proportion of time a vehicle earns versus sits idle and is calculated simply as total rental days divided by total available days, multiplied by 100. If a vehicle is rentable for 30 days in a month and booked for 21, its utilization is 70%. Measuring at multiple levels — vehicle, category, and branch — exposes both structural mismatches and local execution issues. A category that lives at 50–55% in peak months likely suffers from poor positioning, an ADR that is out of market, or an oversupplied mix relative to demand.

Profit sensitivity to utilization is steep. With an average daily rate of $55, lifting utilization from 60% to 75% adds about 4.5 rental days per 30-day month, or roughly $2,970 per car annually. Multiplied across a 100-car fleet, that’s near $300,000 of incremental topline without adding a single unit. Because fixed operating costs absorb much of the increase, the contribution margin expansion is disproportionately large.

Total cost of ownership (TCO)

TCO is the denominator of your unit economics. It combines acquisition or lease payments, taxes and registration, insurance, energy (fuel or electricity), tires and maintenance, damage repairs, cleaning and turn costs, telematics fees, and depreciation. When you quantify TCO per vehicle and compare it to revenue contribution, replacement decisions become objective rather than anecdotal.

Reducing TCO starts with model choice and standardization. Vehicles with strong residuals and inexpensive, widely available parts have a compounding effect on both depreciation and maintenance. Standardization within each category compresses complexity: fewer part numbers, faster diagnosis, shorter turn times, simpler training, and stronger purchasing leverage. Usage patterns also matter; telematics-driven coaching on harsh acceleration, braking, speeding, and idling reduces wear, energy burn, and incident rates. The final lever is disciplined remarketing: once expected depreciation and maintenance exceed forecast contribution, you are paying tomorrow’s owner.

Maintenance costs and downtime

Not all maintenance dollars are equal. Planned maintenance (PM) is predictable, short, and schedulable around bookings. Unplanned maintenance (UM) is longer, more expensive, and almost always happens at the worst time. Track both direct spend and the shadow cost of downtime (missed rental days × ADR). A $300 brake repair that removes a vehicle for four days at a $55 ADR actually costs $520 when lost revenue is included.

Forecasting maintenance based on the odometer alone is leaving money on the table. Condition-based signals — tire pressure stability, brake temperature patterns, alternator voltage variance, coolant trendlines, 12V battery state-of-health — allow predictive triggers that move 20–30% of UM into PM windows. Each avoided breakdown typically saves 2–5 rental days when diagnosis, parts ordering, and shop scheduling are included.

Customer satisfaction scores (CSAT, NPS)

Customers conflate vehicle condition with company quality. A clean, no-warning-light, like-new feel almost guarantees positive CSAT and NPS; a weak A/C or squeaky brakes can erase excellent counter service. An effective way to institutionalize this link is to tie branch or site bonuses to objective fleet health KPIs: PM on-time rate, re-rent readiness time after return, and damage-per-100-rentals. When those numbers move, your review profiles and repeat rates follow.

Best practices for fleet management in 2026

1. Implement preventive and predictive maintenance

Preventive maintenance follows manufacturer schedules and usage thresholds; predictive maintenance mines sensor and telematics data for early-warning patterns. In practice, you don’t need a perfect algorithm — you need timely, actionable alerts that let you repair in a booking gap rather than on the roadside. Voltage instability that precedes a 12V battery failure, repeated low-pressure events on the same tire, or rising engine temperatures under similar loads are the kinds of signals that, when acted on, convert UM to PM.

A practical operating model looks like this: ingest telematics data into your RMS; set risk thresholds for components that commonly trigger breakdowns; generate work orders automatically when thresholds are crossed; and allocate shop time into the nearest idle window rather than a calendar date. One 300-vehicle compact fleet adopted coolant trend alerts and “replace-at-risk” rules for batteries; within a year, maintenance spend fell 19% and unplanned events dropped from 0.9 to 0.6 per vehicle, freeing roughly 900 rentable days.

2. Use telematics and GPS tracking

Telematics now goes far beyond dots on a map. A modern device or OEM data feed delivers location and geofencing, odometer, ignition status, fuel or state of charge, tire pressures, and driving events such as harsh braking, acceleration, speed, and idling. The immediate benefits are theft deterrence and faster recovery, but the larger value is operational: accurate odometer readings drive precise PM timing; exception alerts route the right signal to the right person; and driving-behavior feedback reduces accidents and wear.

Misuse reduction is measurable. When customers are informed that safe driving is monitored, incident rates decline. After-hours geoalerts on high-value categories reduce unauthorized use, and speed thresholds tailored to local limits create a documented basis for follow-up. Weekly trend reports by branch let you nudge behavior without turning your operation into surveillance; your goal is safety and asset care, not policing.

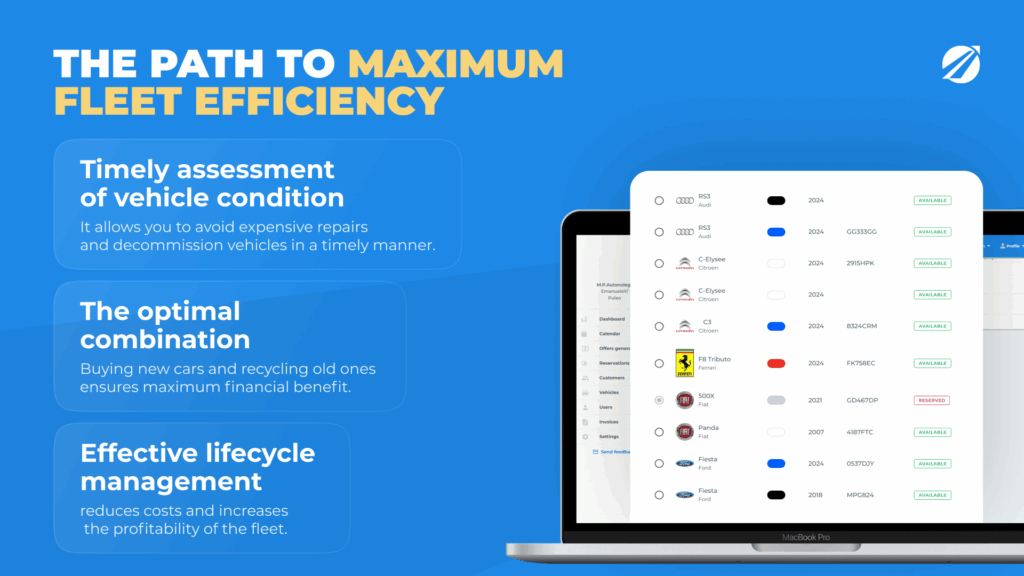

3. Optimize vehicle lifecycle

The correct replacement point is an economic crossing, not a mileage superstition. Project the next 12 months of depreciation, planned maintenance, expected downtime, and the contribution the vehicle can deliver at forecast utilization and ADR. When cost exceeds contribution, it’s time to exit. Residual value curves, auction data, and your maintenance history make the projection more reliable than a rules-of-thumb age or mileage target.

Balancing the fleet across locations prevents premature aging in high-demand branches and underuse elsewhere. A quarterly rebalancing that moves 10–15% of vehicles based on forecast demand, mileage parity, and category mix brings up overall utilization without new capex. Rotation also protects resale by avoiding extreme mileage spreads inside the same model year.

4. Standardize vehicle models where possible

Standardization is a quiet profit lever. Reducing model variety within each category compresses diagnostic time, speeds reconditioning, lowers parts inventory, and shortens training curves — especially for new technicians. You’ll negotiate better—on what you pay now and what you get back later. An operator that standardized 80% of its compact class onto a single model saw parts spend drop 11% and average turn time after return fall by more than half a day, while securing better fleet terms from the OEM.

5. Adopt fuel-efficient and EV vehicles

Fuel-efficient ICE models and hybrids reduce energy cost per kilometer and cushion you against fuel volatility. EVs unlock access to low-emission zones and can materially lower per-mile energy costs where electricity tariffs are favorable. Deployment should follow trip profiles: urban and airport runs with predictable mileage and overnight parking align well with EVs, while long one-way trips suit hybrids and efficient ICE.

Charging must be managed like a resource. Your RMS should display state of charge, charger availability and power, and the next reservation window. Charging during off-peak hours, setting daily charge limits (for example, 80% for routine use), and reserving DC fast charging for exceptions keeps cars ready without stressing batteries or your energy bill. Customer experience improves when vehicles are dispatched with adequate SoC for the planned trip; operational rules enforce that standard.

6. Train your staff for better fleet care

People turn policy into results. Driver-facing training should cover smooth driving, handling warning lights, avoiding curbing damage, and returning EVs above a minimum SoC. Shop training must cover model-specific PM, EV safety, brake service patterns on regenerative systems, and ADAS calibration triggers. Branch staff should be proficient with consistent inspections, photo documentation, and checklist-based turns embedded in the RMS.

Incentives aligned to metrics drive durable behavior. Recognize branches for PM on-time compliance, low damage per 100 rentals, and same-day re-rent readiness. Reward technicians for first-time fix rates and accurate diagnosis. Publish a simple scoreboard; what’s visible improves.

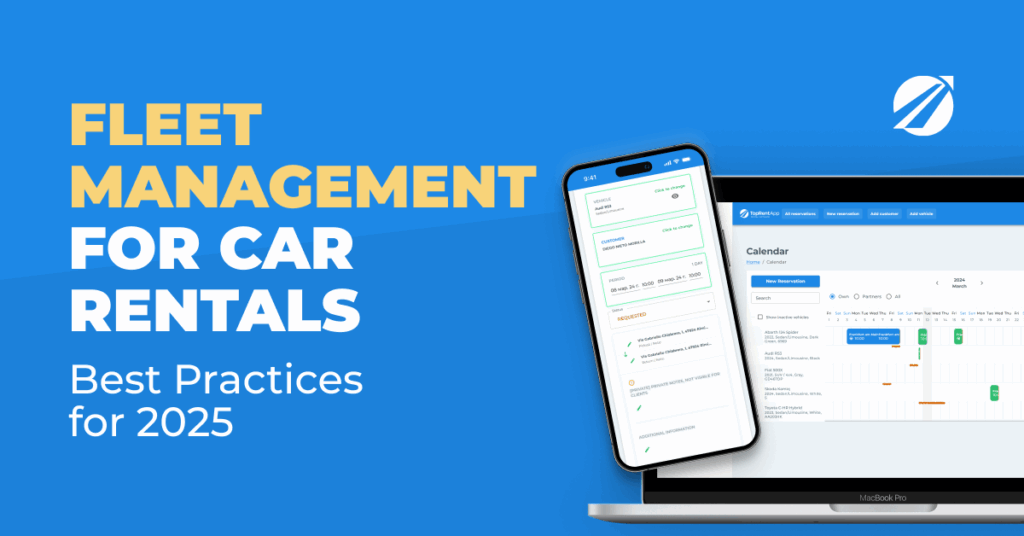

7. Leverage fleet management software

Manual spreadsheets cannot orchestrate a 2026 fleet. A modern RMS centralizes identity, status, bookings, maintenance, damage, compliance, and economics per vehicle, then automates the obvious actions and escalates exceptions. TopRentApp integrates telematics, bookings, and maintenance so odometer or health signals trigger service tasks, turn-time SLAs raise alerts, and compliance dates lock vehicles that can’t legally be rented. Managers see utilization, contribution margin, PM compliance, and turn times by vehicle, category, and branch in real time. Finance sees a clean audit trail: every cost, status change, and assignment is timestamped and attributed.

Operators report less effort for more control: missed PMs disappear, reconditioning becomes predictable, and asset decisions shift from opinion to data. A Berlin mid-sized operator adopting TopRentApp eliminated most manual data entry and cut admin hours by more than half, reassigning staff to customer-facing roles that improved reviews and upsell success.

8. Have a clear replacement and disposal policy

Replacement should be routine, not a crisis. Define target holding periods by class, residual value floors, and quality gates for de-fleet (tire depth, brake life, cosmetic standard, no warning lights). Decide exit channels — OEM buy-back, auction, or retail partners — before vehicles reach the threshold so dwell time between “decision” and “sold” is minimal. Align replacement waves with demand cycles: introduce new units before peak and retire at the earliest low-season window to minimize revenue disruption.

Operational readiness speeds time-to-revenue: pre-assign plates, activate telematics, prepare branding kits, and load vehicle profiles into the RMS ahead of arrival. Aim to make new units rentable within 24–48 hours of delivery.

9. Reduce idle time and no-show impact

Idle time hides in the seams between return, inspection, cleaning, minor repair, and dispatch. Measure each step and remove friction. Stagger staffing to match return peaks; pre-allocate inspection tasks; and use mobile checklists with photo capture so documentation happens where the car sits. Where demand is bursty, dynamic reallocation moves vehicles to branches with confirmed bookings inside the next 48–72 hours.

No-shows and late cancellations are a reality, but their impact can be softened. Automated reminders keep things from slipping through the cracks. When cancellations occur, your RMS should surface a prioritized list of nearby bookings that can be upgraded or reassigned, preserving utilization. TopRentApp supports this by pairing live availability with the booking queue so vehicles rarely sit idle longer than necessary.

10. Ensure compliance with local regulations

Compliance lapses are expensive and demoralizing because they block revenue at the last second. Treat compliance as a continuous background process. Track license and inspection expiries, emission stickers, seasonal tire rules, insurance certificates, and ADAS calibration records inside the RMS. Configure lockouts so non-compliant vehicles cannot be assigned to rentals. Store documents with the vehicle record and make renewal tasks visible on the same operational board as PM and cleaning. When compliance is automated, availability increases simply because “paperwork surprises” disappear.

How technology is shaping fleet management in 2026

Technology’s role is to remove guesswork and compress cycle time from signal to action. IoT sensors catch anomalies early; telematics adds context about use and location; and AI helps you forecast demand, schedule maintenance, and position inventory. When these layers feed a single system of record, you orchestrate the whole lifecycle rather than chase problems.

Demand forecasting blends past bookings with seasonality, events, weather, and flight data to predict which cars you’ll need — and where. Instead of moving vehicles reactively after you feel a shortage, you schedule transfers a day or two ahead, lifting utilization without adding units. Routing optimizers respect charger capacity, shop schedules, and traffic, minimizing unnecessary moves while ensuring readiness.

Payments and CRM integrations are equally pragmatic. A payments layer that supports pre-authorizations, incremental holds, and instant refunds reduces disputes and speeds counter time. CRM sync ensures consistent, timely communications: pre-trip reminders, upgrade offers tailored to the booking, and post-rental surveys that capture feedback while the experience is fresh. You get a feedback loop: what customers feel sets your to-do list. If A/C complaints spike at one branch, you zero in on maintenance there.

More and more, the wins are process tweaks—not moonshots. A regional operator layered predictive maintenance on telematics data and scheduled staff to mirror forecasted return peaks. Average turn time fell from 7.2 hours to 4.8, weekend utilization rose by nine points, and overtime costs dropped 14% within a quarter. The system didn’t do the work — it made the steps visible and in order, so people could win.

Common mistakes in fleet management (and how to avoid them)

The most expensive errors are often invisible day to day. Ignoring analytics — particularly utilization by category and branch, and TCO versus contribution — locks you into habitual decisions that misallocate vehicles and mask underperformance. Running cars until they “feel old” backfires because repair costs and customer dissatisfaction climb sharply near the end; you are effectively subsidizing the next owner’s value.

Inconsistent or unwritten procedures drain capacity. If intake inspections vary by staff member or shift, damage will be missed and warranty claims will fail. If cleaning standards are undefined, re-rent readiness will oscillate and frustrate front-of-house teams. Embed SOPs into your RMS: checklists with photos for intake, cleaning, minor repair, test drive, and sign-off. When the steps live in the system, they happen more consistently — and when they don’t, you can see and fix the gap.

Training shortfalls show up as repeat losses: curb rash concentrated in one site, ADAS not calibrated after a windshield swap, EVs returned with near-zero SoC that then block a charger for hours. Treat these not as one-off mistakes but as process signals. Address them with targeted coaching, visible metrics, and simple rules that protect the next booking (for example, “EVs must be turned over above 60% SoC during peak hours”).

Fleet management for electric and hybrid vehicles

Electric and hybrid fleets operate under different physics and, therefore, different constraints. Energy planning is the first. Vehicles must be dispatched with sufficient SoC for the booked trip, and charging should be scheduled into idle windows. Your RMS should show SoC, charger availability, and power, and time-to-ready against the next booking. With mixed tariffs, shift as much charging as possible to off-peak hours; reserve DC fast charging for exceptions and pre-trip top-ups.

Battery health is the second. Track state of health (SoH), fast-charge ratio, and deep-discharge events. Operational rules — such as routine charging to 80% and avoiding chronic low SoC — slow degradation, maintain range, and preserve resale value. Because EV brakes wear differently due to regeneration, schedule periodic cleaning and lubrication even when pad wear is low; conversely, tire wear can be higher on torquey EVs, so rotate more frequently.

Service pathways change as well. Many EV issues are software or sensor-related; keeping firmware updated and calibrations current is part of maintenance, not an afterthought. Body and glass shops must be capable of ADAS calibration to keep safety systems functional. A central record in the RMS of all calibrations and software updates is useful for both safety and resale.

Infrastructure planning closes the loop. Map charger count and power to your peak return/pickup pattern. If you regularly receive a wave of returns late afternoon and send a wave of departures early morning, your AC charger count and power must support overnight top-ups. In dense urban environments, partnerships with public charging networks expand your footprint; embedding those locations into customer communications reduces range anxiety and support calls.

How fleet management software can transform your rental business

The common thread across the practices in this guide is centralization and automation. A modern RMS eliminates blind spots, enforces process, and converts raw activity into decisions. TopRentApp is built around that premise: one system of record for every vehicle’s identity, live status, bookings, maintenance, damage history with photos, compliance documents, and economics.

Telematics data flows into that record so odometer and health signals can automatically create work orders, hold vehicles that can’t legally be rented, and reserve resources such as shop bays or chargers. Turn-time SLAs surface bottlenecks in real time. Managers get live dashboards for utilization, PM on-time rate, re-rent readiness, and contribution margin by vehicle, category, and branch. Finance teams get a clean, auditable trail for every cost, assignment, and status change.

On the commercial side, TopRentApp’s booking layer connects availability and profitability. If a cancellation hits, the system can instantly surface candidates for reassignment or upgrade; if a vehicle crosses a de-fleet threshold — maintenance spend out of band, repeated UM, or accelerating EV SoH decline — it appears on a replacement list with the economics to support action. Integration with CRM keeps customer messaging consistent from pre-trip reminders to post-rental surveys and next-offer timing.

Operators who implement this stack report momentum rather than magic: PM compliance rises because reminders become scheduled work; average turn time falls because steps are visible and owned; utilization climbs because cars are in the right places at the right times; and replacement decisions stop being arguments and start being math.

Conclusion – smarter fleet management = stronger profits in 2026

The logic of 2026 rewards operators who manage fleets as disciplined, data-driven systems. Measure what matters, maintain before you break, position assets where demand will be, standardize what you can, and let software orchestrate the routine so your team can focus on exceptions and customers. When you do, the metrics move together: downtime shrinks, utilization rises, vehicles feel newer for longer, and reviews improve because trips are reliably uneventful.

This shift is not about buying the flashiest technology or electrifying overnight; it is about aligning people, processes, and tools around the single objective of keeping safe, compliant, clean vehicles earning with minimal friction. The businesses that execute on this will grow by design, not by luck.

Managing a rental fleet becomes easier with automation and actionable insights.

👉 Request a free demo and explore how TopRentApp improves fleet visibility, maintenance planning, and utilization.

A car rental fleet management software helps you stay competitive in 2026 and beyond.