The car rental business in 2025 is no longer the simple volume game it once was. A decade ago, many operators could thrive by stocking large numbers of inexpensive compact cars, setting competitive daily rates, and counting on tourist demand to fill their calendars. Today, the economics are far more complex. Vehicle purchase prices remain historically high, with global supply chains only gradually stabilizing. Interest rates are elevated, which makes financing or leasing more expensive. Insurance premiums have steadily increased, most notably for luxury and EV models. At the same time, customer preferences have evolved: tourists expect crossovers or SUVs with luggage space and safety features, business travelers insist on hybrid or premium sedans, families prefer vans and crossovers with flexible seating, and younger urban customers increasingly demand EVs.

Governments make the picture even more complicated. Electrification is not optional in many regions: the EU has implemented aggressive emissions standards, California has advanced its EV mandates, and Asian markets like China are pushing domestic EV adoption. Failing to follow these trends puts operators at risk of falling behind in both compliance and customer demands.

Building a profitable fleet now demands careful portfolio management. Every car represents both an asset and a liability: it earns through utilization but costs through acquisition, insurance, maintenance, depreciation, and eventual resale. An operator who chooses wisely can achieve payback within eighteen months and capture strong resale value when cycling out vehicles. A poor choice can leave cars sitting idle, losing value every month.

This piece is an in-depth guide for 2025 fleet operators. It examines the best models by six key segments — economy, mid-sedans, SUVs, luxury segment, vans, and EVs — examining how these segments intersect with demand from customers and profitability. This examines by how much categories differ, typical errors, and how management software such as TopRentApp assists with fleet planning. The objective is to provide not only car lists but an economic and strategic platform on which profitable decisions are made.

Why Car Choice Matters for Rental Fleets

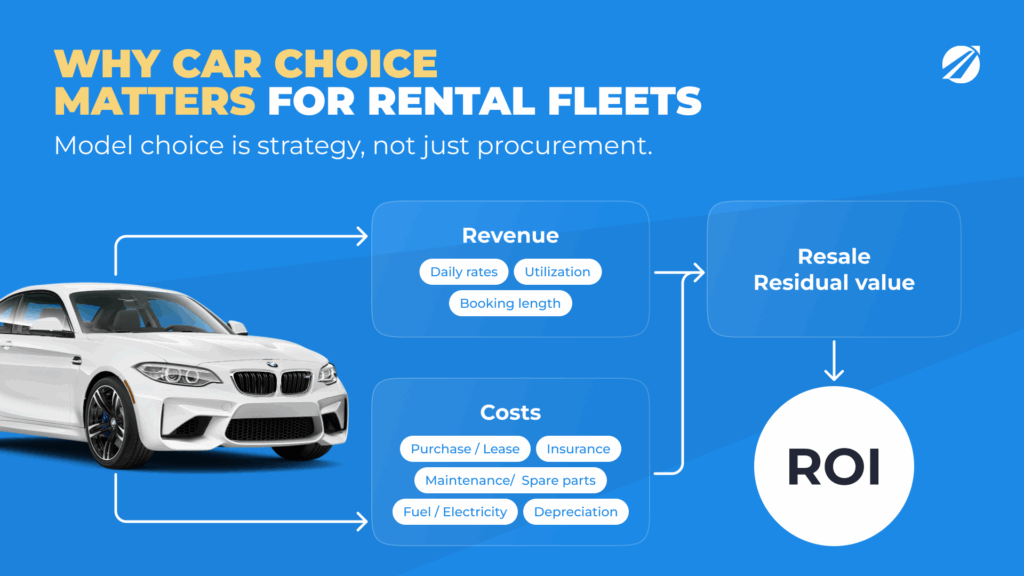

Fleet composition is the foundation of profitability. Marketing, service quality, and location all play a role, but revenue ultimately comes from the cars themselves. Utilization, daily rates, maintenance costs, insurance, depreciation, and resale value combine to define the business model.

Consider two vehicles. A Toyota Corolla Hybrid 2025 costs around $23,000. Rented at $55 per day with utilization of seventy-five percent (about twenty-three days per month), it generates over $15,000 annually. Breakeven arrives in under eighteen months. After thirty months, resale value remains about $13,000, leaving the operator with a strong margin.

Contrast this with a Mercedes-Benz E-Class W214 2025 purchased for $60,000. Even at $280 per day, utilization in a mid-market city may be twelve days per month, generating around $40,000 annually. Depreciation erases more than $25,000 in three years. Unless the operator is in a premium hub like Dubai, profitability is weak or even negative.

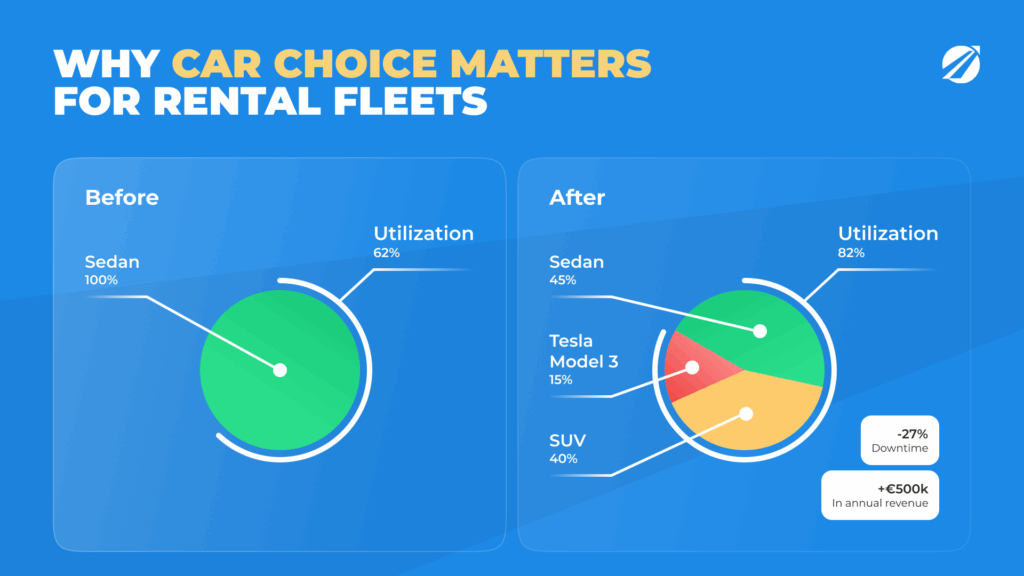

Case studies underscore this point. In Lisbon, a fleet dominated by sedans saw utilization slump to sixty-two percent by 2023 as tourists shifted preferences to SUVs and EVs. After rebalancing — forty percent SUVs (Toyota RAV4s, Hyundai Tucsons) and fifteen percent Tesla Model 3 Highland EVs — utilization surged to eighty-two percent. Downtime fell by twenty-seven percent, and annual revenue rose by nearly €500,000. Marketing spend was unchanged; the gains came entirely from restructured fleet composition.

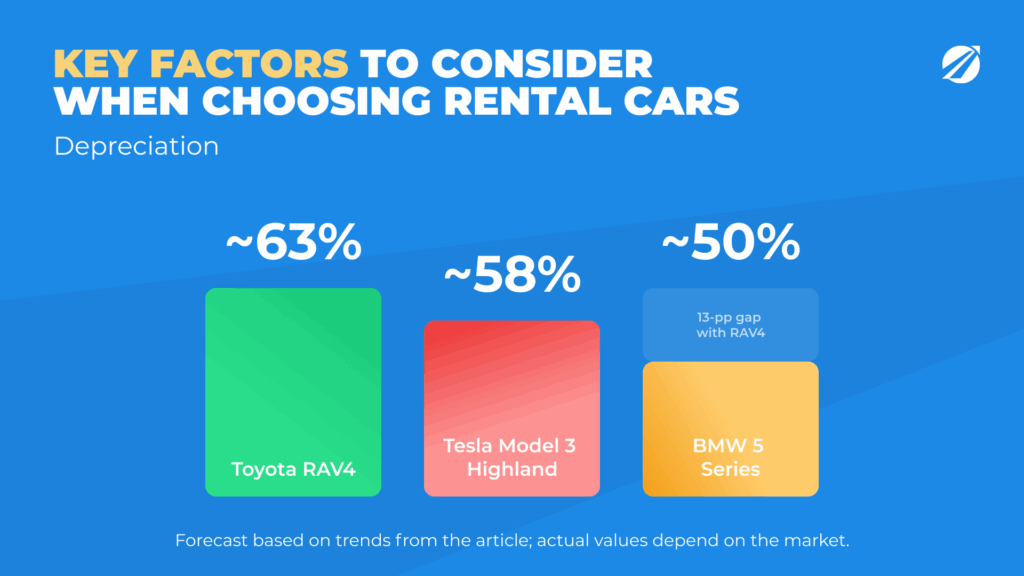

Depreciation further illustrates the stakes. A Toyota RAV4 retains about sixty-three percent of its value after three years, while a BMW 5 Series retains closer to fifty. That thirteen-point gap equates to over $5,000 per vehicle. Across a hundred-car fleet, that difference is half a million dollars. The wrong mix not only undermines revenue but also silently destroys equity.

Profitability comes down to car choice. It is not just procurement — it is strategy.

Key Factors to Consider When Choosing Rental Cars

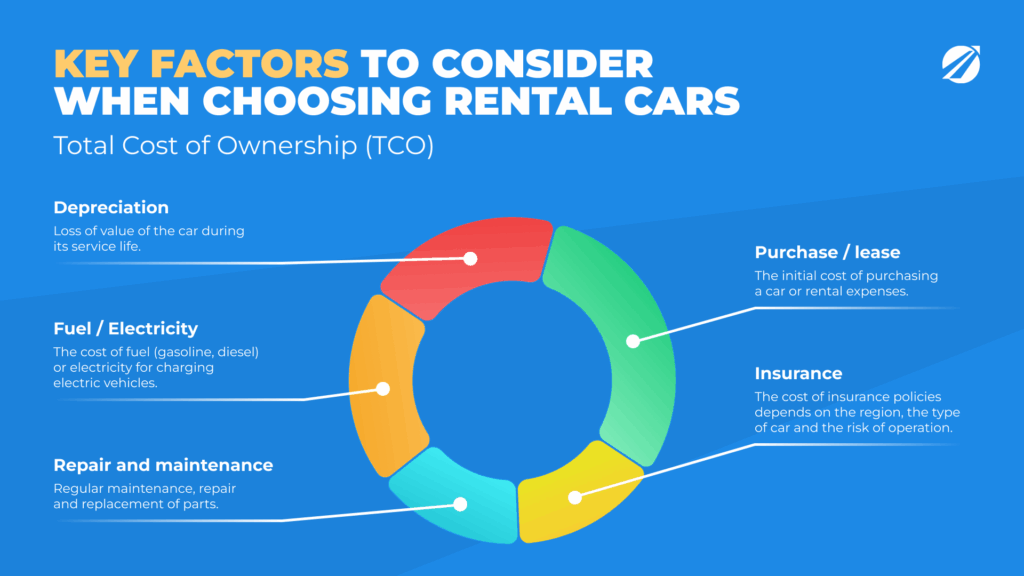

Total Cost of Ownership (TCO)

TCO is the ultimate measure of profitability. It includes purchase price, financing, fuel or electricity, insurance, maintenance, depreciation, and resale. Operators who look only at sticker prices risk making decisions that seem cheap upfront but prove expensive over three years.

Initial Purchase Price

Economy cars like the Toyota Corolla Hybrid, Hyundai i20, and Kia Rio range from $17,000 to $23,000. Mid-size sedans such as the Honda Accord, Hyundai Sonata, and VW Passat cost $28,000 to $35,000. SUVs like the Toyota RAV4, Kia Sportage, and Nissan Rogue are $30,000 to $40,000. Luxury sedans like the Mercedes-Benz E-Class or BMW 5 Series exceed $60,000. EVs such as the Tesla Model 3 Highland, Hyundai Ioniq 6, and Kia EV6 range from $38,000 to $55,000.

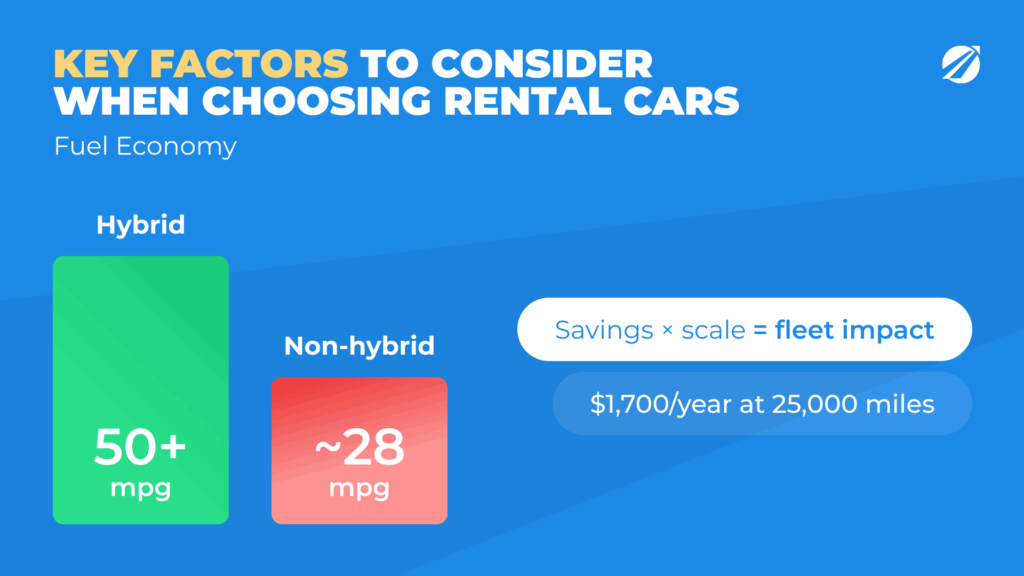

Fuel Economy

Fuel efficiency is a decisive factor. The Corolla Hybrid tops 50 mpg. Compared with a non-hybrid sedan at twenty-eight mpg, that saves $1,700 annually at 25,000 miles per year. Across a fifty-car fleet, the savings exceed $85,000 annually. Honda Accord Hybrids reach forty-eight mpg, while Kia Sportage Hybrids return forty-two.

For EVs, range is the key. Tesla Model 3 Highland offers up to 341 miles WLTP, Hyundai Ioniq 6 338 miles, and Kia EV6 316 miles. Models under 250 miles face customer resistance.

Insurance Costs

Insurance reflects risk profiles. In the U.S., economy cars average $1,500 annually. Mid-size sedans cost about $1,800. SUVs exceed $2,000. Luxury sedans surpass $2,500. EVs are typically 10–15% higher due to battery costs, though lower maintenance offsets this partly.

Depreciation

Depreciation is the silent killer. Toyota RAV4s retain more than sixty percent after three years, while BMW 5 Series sedans retain about fifty. Tesla Model 3 Highland holds around fifty-eight percent. Selling at thirty months rather than thirty-six improves ROI by twelve percent, avoiding steep late-cycle depreciation.

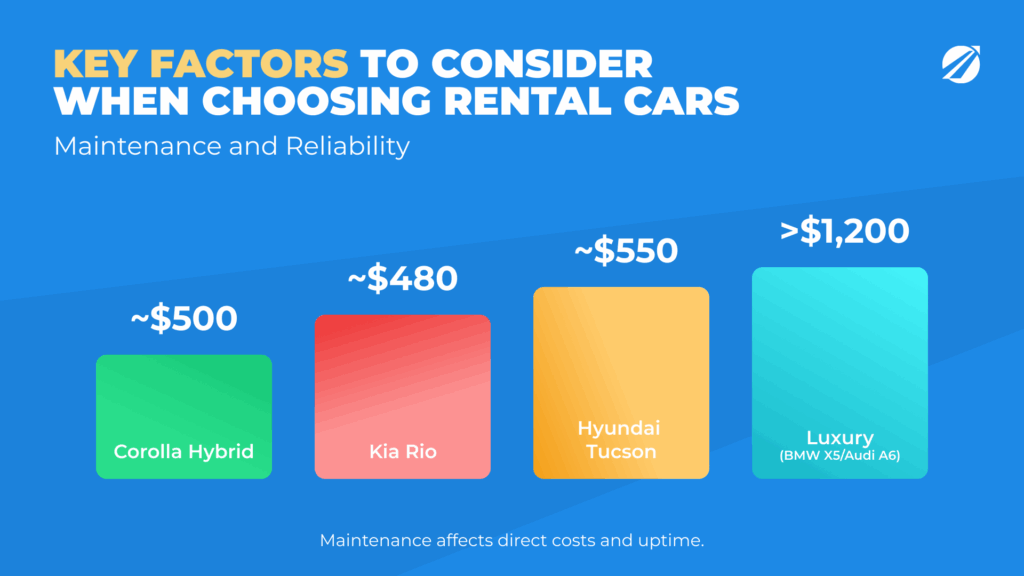

Maintenance and Reliability

Maintenance influences both costs and uptime. A Corolla Hybrid costs about $500 annually to service, a Kia Rio about $480, and a Hyundai Tucson $550. Luxury models like the BMW X5 or Audi A6 exceed $1,200. Spare parts availability is just as important: operators in Miami who experimented with Peugeot hatchbacks suffered weeks-long delays for parts, crushing utilization. Switching to Toyota and Hyundai restored uptime.

Customer Preferences

Tourists seek affordability and luggage space. Business travelers expect mid-size sedans or premium models. Families demand SUVs or vans with flexible seating. Urban customers increasingly request EVs to comply with local regulations or personal preferences. Failing to align the fleet with these expectations ensures underutilization.

Resale Value

Resale closes the financial loop. Selling vehicles around thirty months or before sixty thousand miles optimizes ROI. Operators holding longer often face simultaneous spikes in maintenance costs and steep depreciation. TopRentApp data shows ROI is twelve percent higher for vehicles sold at thirty months versus thirty-six.

Best Economy Cars for Rental Fleets

Key Benefits

Economy cars remain the backbone of most fleets. Not flashy, but they bring steady rentals and quick payback. The Toyota Corolla Hybrid 2025 epitomizes this category. While it costs slightly more upfront than a Hyundai i20 or Kia Rio, its fifty-plus mpg and strong residuals make it the most profitable economy option over three years.

Target Customers

Budget-conscious tourists, students, and long-term renters rely on economy cars. In Warsaw, a sixty-car fleet split between Corollas and Rios achieved eighty-two percent utilization, with ROI in just over fourteen months. These vehicles ensured steady cash flow even during winter low season, subsidizing investments in higher-cost SUVs.

Business Impact

Daily rates between $40 and $60 are typical. Utilization of seventy-five to eighty-five percent is common. ROI occurs within twelve to eighteen months. Economy cars generate the predictable base revenue that covers overhead and keeps the business resilient across market cycles.

Best Mid-Size and Standard Cars

Key Benefits

Mid-size sedans strike a balance between affordability and professionalism. The Toyota Camry 2025 and Honda Accord 2025 remain leaders, with hybrid versions approaching fifty mpg. The Hyundai Sonata 2025 offers slightly lower acquisition cost while maintaining reliability. The VW Passat still enjoys high recognition and resale strength in Europe.

Target Customers

Business travelers dominate this segment, but families and long-term renters also rely on mid-size sedans. In New York, forty percent of corporate accounts specifically request either a Camry or Accord. These vehicles are now regarded as the standard of professionalism in corporate rentals.

Business Impact

Daily rates of $70 to $90 are common, with utilization around seventy percent. ROI arrives within eighteen to twenty-two months. Sedans don’t make SUV-level margins, but they guarantee corporate demand that keeps revenue steady and the fleet resilient.

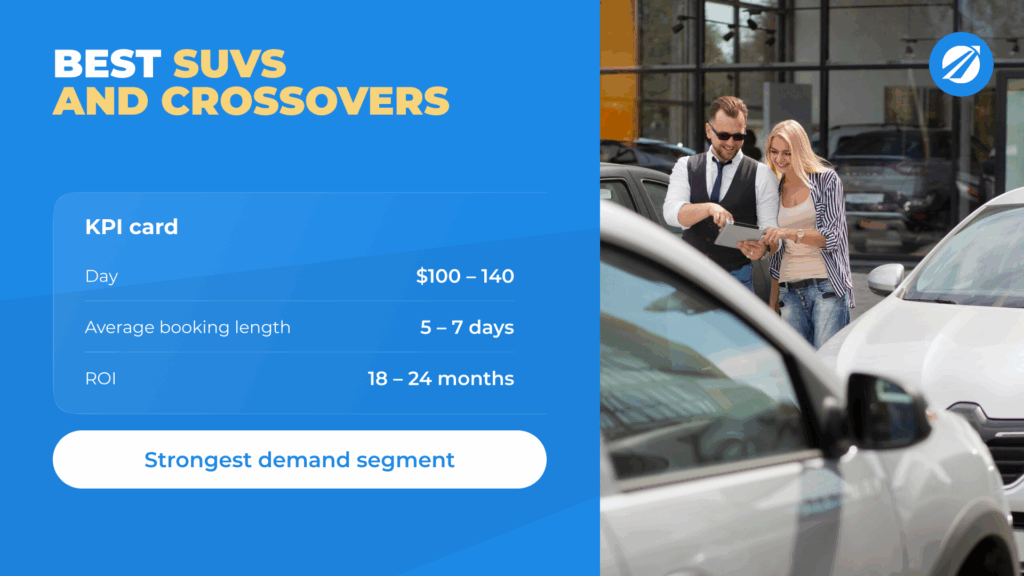

Best SUVs and Crossovers

Key Benefits

SUVs are now the dominant rental segment in nearly every region. Customers view them as the default choice for vacations, business trips, and even urban rentals. They’ve got space, safety, and status — and the latest hybrids keep fuel use and costs in check.

The Toyota RAV4 Hybrid 2025 remains the global leader, offering forty-plus mpg and resale values above sixty percent. Priced around $35,000, it consistently delivers ROI within twenty-four months. Hyundai Tucson 2025 and Kia Sportage 2025 offer slightly lower acquisition costs with strong warranties and high utilization. Nissan Rogue and Honda CR-V are staples in North America, while Peugeot 3008 Hybrid and VW Tiguan are popular in Europe.

SUVs also secure higher daily rates — $100–$140 compared to $70–$90 for sedans — and longer booking durations of five to seven days, reducing turnover costs.

Target Customers

Families, tourists, and adventure travelers form the backbone of SUV demand. Corporate clients increasingly choose SUVs for executives who want comfort and status without stepping into luxury pricing. In Dubai, SUVs represent more than half of many operators’ fleets because families and affluent travelers see them as the baseline. In Lisbon, shifting to a forty-percent SUV fleet lifted utilization by fifteen percent and boosted average rental length by three days.

Business Impact

ROI typically arrives within eighteen to twenty-four months. Despite higher insurance ($2,200 annually versus $1,800 for sedans) and purchase prices, utilization and revenue outweigh costs. Annual revenue per SUV can exceed $30,000 in strong tourist markets, with net profit margins around twenty percent.

Best Luxury Cars for Premium Rentals

Key Benefits

Luxury cars offer prestige, marketing appeal, and high daily rates, but they require careful management. In 2025, the Mercedes-Benz E-Class W214 and BMW 5 Series G60 dominate the executive sedan segment. Daily rates can exceed $300, and in hubs like Dubai, London, and Monaco, reach $400.

Beyond these, the Audi A6 2025 provides strong European branding at slightly lower cost, while the Cadillac CT5 and Lincoln Aviator Hybrid cater to U.S. clients seeking domestic prestige. Luxury SUVs deserve special mention: BMW X5 Plug-in Hybrid, Audi Q7, and Range Rover Sport attract affluent tourists. In Dubai, Range Rover Sport models achieve utilization near seventy percent despite $100,000 price tags.

Target Customers

Corporate executives, VIP tourists, weddings, and events drive luxury demand. In Frankfurt, a dozen E-Class sedans — under ten percent of the fleet — generated over twenty percent of revenue. In Warsaw, by contrast, BMW 7 Series sedans booked poorly, with utilization under thirty percent and heavy depreciation losses.

Business Impact

Utilization hovers at forty-five to fifty-five percent. Depreciation is steep: BMW 5 Series loses $35,000 in three years. Insurance averages $2,500–$3,000 annually, and maintenance exceeds $1,200. ROI is positive only when demand is consistent. A BMW 5 Series rented at $320 daily, fourteen days per month, earns $53,760 annually. Over thirty months, revenue hits $134,000, but depreciation, insurance, and maintenance erode more than $48,000. Profit remains, but thinner than SUVs or mid-size sedans.

Luxury cars must remain under ten percent of the fleet, focused on hubs where demand is reliable. Failing this, they become high-cost assets with little practical return.

Another critical dimension of luxury rentals in 2025 is the rise of plug-in hybrid (PHEV) luxury sedans and SUVs. Models like the Volvo S90 Recharge or the BMW X5 xDrive50e combine prestige with partial electrification. For corporate clients in cities with low-emission restrictions — London, Paris, or Amsterdam — these cars allow access to restricted zones while still offering the image of a premium brand. Daily rates are slightly lower than full luxury sedans, averaging $250–$280, but utilization can be stronger at 60–65%, since corporate clients increasingly select them for regulatory compliance.

Another case comes from Saudi Arabia, where luxury SUVs like the Lexus LX and Cadillac Escalade are highly profitable. Despite six-figure purchase prices, utilization stays above 70% because demand is consistent from both business elites and wealthy tourists. A Riyadh operator reported ROI in just under 24 months for Lexus LX units, driven by daily rates exceeding $400. This demonstrates that luxury is not universally risky — it depends entirely on market alignment.

Depreciation in luxury is steep but varies widely. Range Rover Sport models lose 45% in three years, while Mercedes S-Class sedans can lose more than 50%. Operators must run detailed TCO analysis before committing. TopRentApp data shows fleets that cycle luxury cars within 24 months retain up to 10% higher ROI compared to those holding for 36 months.

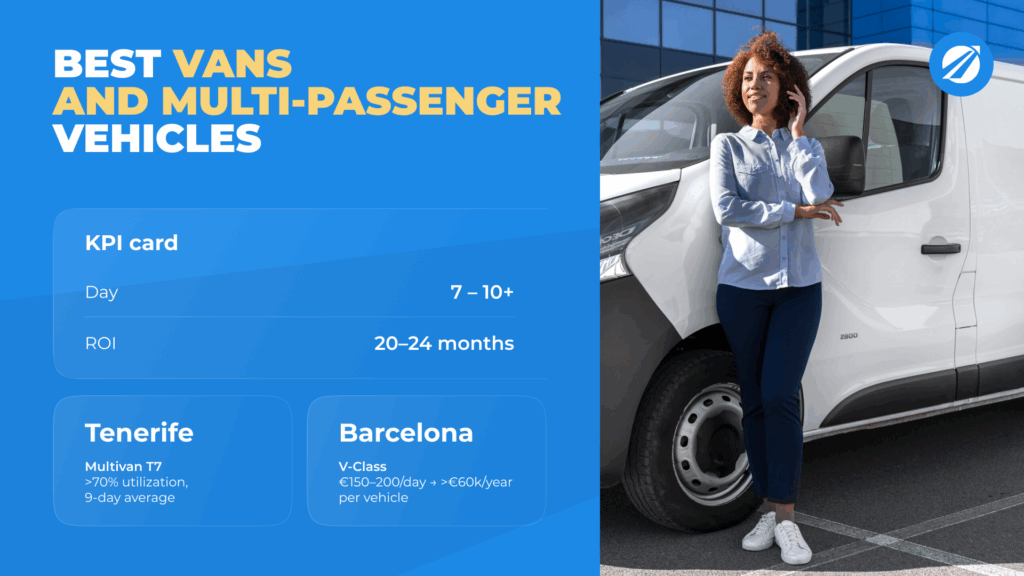

Best Vans and Multi-Passenger Vehicles

Key Benefits

Vans and MPVs may represent a smaller share of fleets, but they serve profitable niches. The Toyota Sienna Hybrid 2025 balances seating for seven with fuel efficiency. The Mercedes-Benz V-Class 2025 defines premium van rentals in Europe. The VW Multivan 2025 and Ford Transit Custom continue to be popular in Europe, while the Chrysler Pacifica Hybrid and Honda Odyssey fill demand in North America.

In Asia, the Toyota Innova Crysta and Suzuki Ertiga dominate family and group travel, often booked for weeks at a time.

Target Customers

Large families, airport transfers, and corporate groups rely on vans. At Barcelona Airport, fifteen Mercedes V-Class vans ran at sixty percent utilization but averaged bookings of seven to ten days at €150–€200 per day. Annual revenue exceeded €60,000 per van despite fewer total bookings.

In India, Toyota Innova bookings often stretch two weeks for family trips. In Los Angeles, Chrysler Pacifica Hybrids appeal to eco-conscious families and corporate shuttle services.

Business Impact

Vans require higher upfront capital and storage but deliver long, high-value bookings. A van with only eighteen rentals per year can generate as much revenue as an economy car with sixty bookings. Resale is strong for Toyota and Mercedes models, with values above fifty-five percent after three years. ROI is usually achieved in twenty to twenty-four months, making vans one of the most stable fleet categories when demand is present.

Beyond standard family vans, specialized MPVs are gaining traction in 2025. The Mercedes EQV, a fully electric van, has been adopted in Germany and the Netherlands for airport transfers. Its range of 260 miles WLTP is sufficient for shuttle services, and daily rates of €180–€220 make it competitive despite higher acquisition cost. Early adopters report strong bookings from corporate clients focused on sustainability.

In the Canary Islands, vans are indispensable. Tourists booking villas or rural accommodations often rent vans for groups of six to eight. An operator in Tenerife reported that a fleet of VW Multivan T7 units maintained utilization above 70% year-round, with booking durations averaging nine days. Despite only 20 vans in a 200-car fleet, they generated nearly 18% of total revenue.

In Canada, cold climates influence van performance. Operators favor Toyota Sienna AWD Hybrids, which combine fuel savings with snow-ready drivetrains. Clients booking ski trips often keep vans for one to two weeks, producing higher average contract values than sedans or SUVs.

Best Electric Cars for Rental Fleets

Key Benefits

EVs are no longer experimental. In 2025, customers expect them on offer—especially in cities. Tesla Model 3 Highland leads with ranges up to 341 miles WLTP. Hyundai Ioniq 6 offers 338 miles, Kia EV6 316. Chinese EVs like BYD Atto 3 and Dolphin are entering Asian fleets thanks to low purchase costs and subsidies.

Target Customers

Eco-conscious tourists, urban renters, and corporate ESG-driven accounts form the primary demand base. In London, twenty Kia EV6 units reached seventy-six percent utilization, largely from corporate clients. In Oslo and Amsterdam, where infrastructure is mature, EV utilization tops eighty percent. In weaker markets, utilization drops twenty points due to charging concerns.

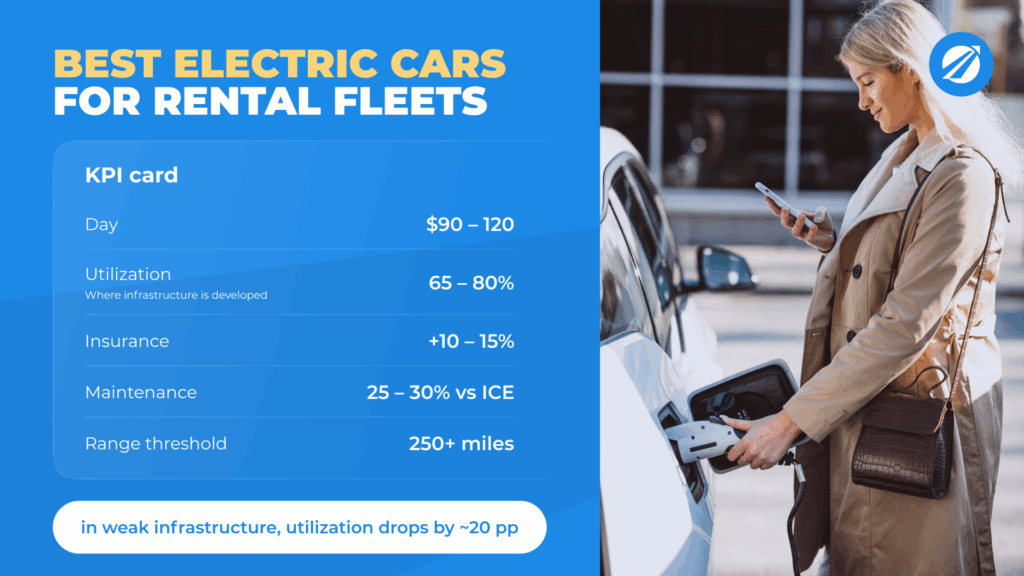

Business Impact

Daily rates of $90–$120 and utilization of sixty-five to eighty percent are typical. Maintenance is 25–30 percent lower than ICE cars due to fewer moving parts. Insurance is higher — ten to fifteen percent more — but offset by lower fuel and servicing costs. Over a thirty-month cycle, EVs can match or exceed hybrid ROI if charging infrastructure is robust.

Charging Infrastructure Considerations

Infrastructure remains decisive. In California, Norway, and the Netherlands, EV fleets thrive. In Southern Europe, adoption lags due to limited charging. Operators offering depot-based charging gain an edge, reducing renter anxiety.

Insurance and Maintenance Challenges

Insurance premiums remain elevated, but expected to decline as EV adoption broadens. Battery replacement is rare within rental lifecycles but must be factored into residual value. Operators should cycle EVs before warranty expiration to minimize risk.

Regional Considerations in Car Choice

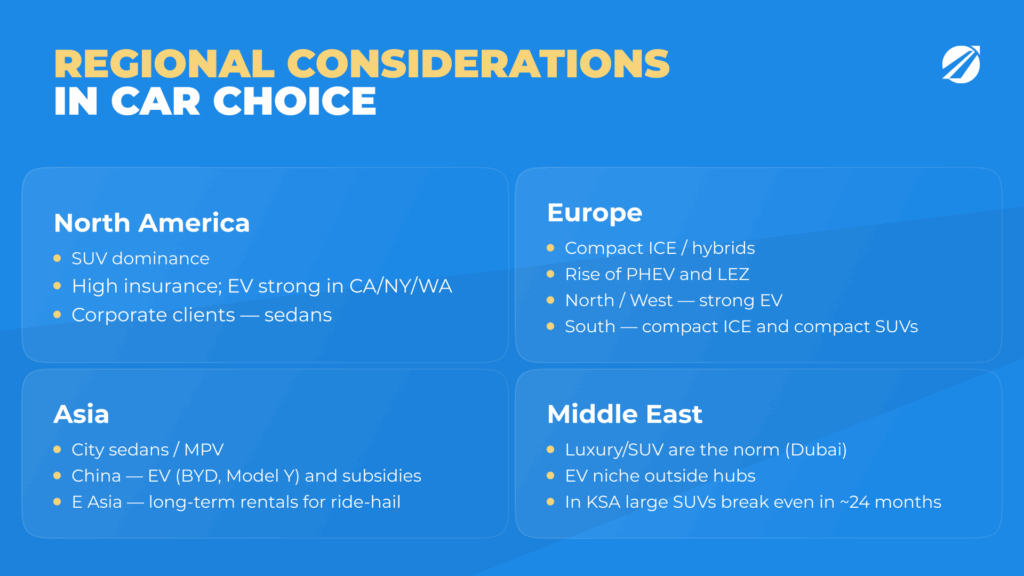

North America

North America remains dominated by SUVs, reflecting both cultural and practical realities. The rise comes from more road trips, suburban lifestyles, and people’s love of bigger cars. Toyota RAV4, Honda CR-V, Ford Escape, and Nissan Rogue are top performers in fleet utilization. Hybrid trims are particularly valuable as fuel prices fluctuate — RAV4 Hybrid averages over forty mpg, compared to twenty-eight mpg for traditional crossovers.

Cars like the Camry and Accord remain core to corporate rentals. In markets like New York or Chicago, business travelers often insist on sedans, viewing SUVs as less professional. Daily rates for sedans hover at $75–$95, with utilization around seventy percent, producing stable ROI.

EV adoption is regionally concentrated. California, New York, and Washington support strong infrastructure, allowing Tesla Model 3 Highland, Hyundai Ioniq 6, and Chevrolet Bolt EUV to achieve utilization above seventy-five percent. In states with limited charging, however, utilization lags by up to twenty points. Operators who invested too heavily in EVs outside supportive markets found cars idle.

Insurance premiums are among the world’s highest. Litigation risk drives average insurance for SUVs to $2,200 annually, versus $1,500–$1,800 in Europe. Operators who ignore these costs struggle with TCO.

In Canada, the path to EV adoption comes with distinct challenges. Tesla Model Y and Hyundai Kona Electric are popular, but cold weather reduces range by up to 30%. Operators in Toronto and Montreal report higher customer complaints in winter unless vehicles are pre-heated and charging information is clearly explained. To compensate, daily rates are set slightly lower ($85–$100) compared to California ($110–$120).

Europe

Europe is defined by compact cities, high fuel prices, and strict emissions regulations. Economy hatchbacks — VW Golf, Renault Clio, Peugeot 208, Ford Fiesta — remain fleet essentials. They rent at €40–€60 daily, with utilization often above eighty percent.

SUV demand is rising, though compact models lead the market. Popular choices such as the Nissan Qashqai, Peugeot 3008 Hybrid, and VW Tiguan attract families while maintaining efficiency. Plug-in hybrids are increasingly necessary due to low-emission zone access in cities like Paris, Berlin, and Milan. Peugeot 3008 Hybrid and VW Passat GTE ensure compliance while maintaining ROI.

Premium compacts like Audi A3, BMW 1 Series, and Mercedes A-Class have carved a niche. In Berlin, A-Class units rent at €100 daily with utilization above seventy-five percent, targeting business clients unwilling to book economy models.

EV adoption is strong in Northern and Western Europe. Tesla Model 3 Highland, VW ID.3, and Renault Zoe lead demand. In Amsterdam, EVs represent over twenty percent of some fleets, with utilization at eighty percent. In Southern Europe, weaker infrastructure slows adoption. A Lisbon operator who introduced Renault Zoe units reported utilization at just fifty-five percent due to limited charging.

Depreciation is harsher for non-mainstream brands. A Polish operator discovered that Citroën C4 EVs lost resale value fifteen percent faster than VW ID.3 or Toyota hybrids, damaging ROI. Brand selection matters as much as segment choice.

Southern Europe, particularly Spain, Italy, and Greece, continues to rely heavily on compact ICE cars for tourists. Fiat Panda, Seat Ibiza, and Citroën C3 dominate budget fleets. However, demand for SUVs is rising even here. On the Balearic Islands, Peugeot 2008 and Renault Captur models rent at €70–€90 daily with strong summer utilization.

Asia

Asia’s diversity makes fleet strategy highly localized. In dense cities like Tokyo, Bangkok, and Singapore, compact sedans dominate. Toyota Corolla, Honda City, and Hyundai Accent rent at high frequency, often for short trips. Utilization exceeds eighty-five percent in Bangkok for Honda City units, with daily rates around $40.

In India and Southeast Asia, MPVs like Toyota Innova and Suzuki Ertiga lead group rentals. Bookings often last one to two weeks, catering to family travel. In Singapore and Hong Kong, premium SUVs and sedans dominate corporate fleets, with Mercedes E-Class and BMW 5 Series in high demand.

China is increasingly EV-led. BYD Dolphin, BYD Atto 3, and Tesla Model Y dominate rental EVs. Increased utilization stems largely from government incentives and ongoing infrastructure development. In Shenzhen, BYD Atto 3 units achieve seventy-eight percent utilization at daily rates of ¥450, producing ROI in under two years.

In Southeast Asia, rental fleets are being influenced by ride-sharing apps. Operators in Manila and Jakarta increasingly purchase Toyota Vios and Mitsubishi Xpander to rent to ride-hailing drivers on long-term contracts. Utilization is nearly 100%, with vehicles generating stable monthly cash flow rather than daily tourist bookings.

Middle East

The Middle East is unique for its luxury orientation. Dubai exemplifies this: Lexus RX, Range Rover Sport, and Mercedes G-Class fleets thrive, with daily rates above $250 and utilization steady despite purchase costs. Operators view these vehicles not as luxuries but as essentials, since affluent tourists expect them.

Economy sedans still have a place. Toyota Corolla, Nissan Sunny, and Hyundai Elantra cater to residents and long-term rentals. Daily rates of $40–$60 produce steady income alongside high-end vehicles.

EVs are emerging but concentrated in premium niches. Tesla Model S and Lucid Air are requested by wealthy tourists, but infrastructure outside Dubai and Abu Dhabi remains limited. Utilization for EVs in most of the region is below fifty percent, making them risky unless subsidies or partnerships offset costs.

In Saudi Arabia, operators find strong profitability with large SUVs like GMC Yukon and Lexus GX, both priced above $70,000. Despite high acquisition costs, long booking durations (often a week or more) and affluent demand keep ROI within 30 months. In Oman and Qatar, luxury sedans like Lexus ES and BMW 7 Series also perform well, targeting diplomatic and corporate travelers.

How to Balance Your Fleet: Economy, Standard, Luxury, and EVs

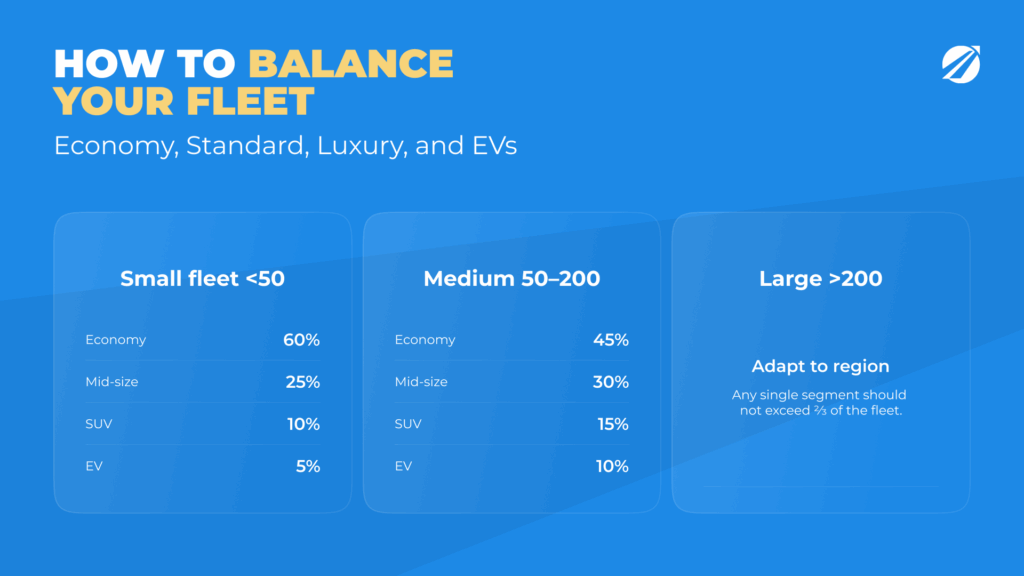

Balancing is about resilience. Fleets overloaded with one category risk collapse if demand shifts. Balanced fleets secure broad demand and steady income.

Small fleets (<50 cars) should stick with conservative ratios: 60% economy, 25% mid-size, 10% SUVs, and 5% EVs. This ensures baseline revenue while cautiously testing newer categories.

Medium fleets (50–200 cars) can diversify further: 45% economy, 30% mid-size, 15% SUVs, and 10% combined luxury/EVs. This approach serves both leisure and corporate travelers while paving the way for expansion into premium and EV markets.

Large fleets (>200 cars) must adapt to regional context. In Los Angeles, operators maintain 30% SUVs, 20% EVs, and the remainder split between economy and sedans. In Dubai, fleets lean heavily into luxury SUVs, sometimes 30% of inventory, because demand sustains it.

The principle: no single category should exceed two-thirds of the fleet. Diversification protects against demand shocks and seasonal volatility.

Common Mistakes in Choosing Rental Cars

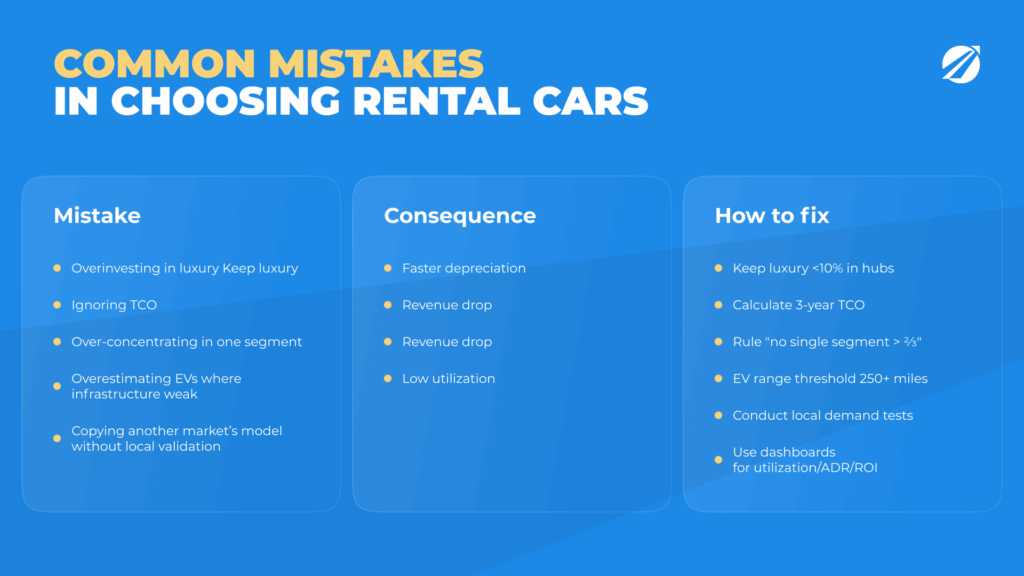

Over-Investing in Premium

Many operators chase prestige without market data. One Warsaw company added BMW 7 Series sedans expecting to capture corporate demand. Utilization was under 30%, and depreciation of €40,000 per car in three years destroyed profitability.

In Los Angeles, an operator bought Tesla Model X units hoping tourists would pay $300 daily. Infrastructure supported EVs, but demand didn’t. Utilization averaged only 35%, and depreciation wiped $40,000 per car.

Ignoring TCO

Focusing only on sticker price leads to disaster. A Romanian operator chose budget Dacia sedans, assuming low cost guaranteed profit. But poor fuel economy and weak resale erased savings. By contrast, Toyota Corolla Hybrids cost more upfront but outperformed in TCO by $5,000 per car over three years.

Misjudging Customer Demand

A Warsaw operator stocked Renault Talisman sedans just as tourists began demanding SUVs. Utilization was under 50%. When competitors offered RAV4s and Tucsons, bookings shifted away.

In Barcelona, one company underestimated demand for vans, holding only two MPVs. Families turned to rivals who offered Mercedes V-Class fleets. The operator lost an entire market segment.

Under-Diversification

Operators who put 80% of fleets into one segment are vulnerable. A Greek company ran nearly all compact cars. When demand shifted to SUVs, utilization collapsed. Competitors with diversified fleets maintained revenue.

The lesson: use data, not assumptions. Track utilization, TCO, and resale to guide fleet composition.

Overestimating EV demand is becoming a frequent error. A Spanish operator added 25 Renault Zoe EVs expecting high utilization. But limited charging infrastructure in Valencia left cars idle. Utilization was only 40%, and resale values collapsed by 20% compared to Tesla or VW EVs. Lesson: infrastructure must guide EV investments, not assumptions.

Neglecting climate suitability is another overlooked issue. In Canada, operators who purchased Nissan Leaf EVs faced range loss in winter, frustrating customers. ROI dropped below projections, even though daily rates were attractive.

Copying foreign strategies often fails. A Turkish operator copied a Dubai model, investing in Range Rovers. But Istanbul lacked sufficient premium tourist demand. Utilization fell below 35%, producing heavy losses.

Finally, failing to monitor utilization in real time leads to sunk costs. Cars may look busy, but without utilization and ROI dashboards, operators miss early warning signs. One Lisbon operator discovered through TopRentApp that three Nissan Juke models were producing half the revenue of Hyundai Tucsons despite similar utilization rates, because daily rates were lower. Only data revealed the hidden weakness.

How Rental Management Software Helps Optimize Fleet Choices

Modern fleet management requires real-time insights. Gut feeling is no longer enough in 2025. TopRentApp provides dashboards showing utilization, profitability, and TCO per car. It automates ROI checks and spots weak performers.

One Lisbon operator improved utilization by 12% and profit by $2,000 per car annually after adopting TopRentApp. The system spotted which sedans weren’t performing and suggested moving money into SUVs and EVs instead. Within a year, the fleet was rebalanced, and profits rose without adding vehicles.

Software shifts management from reactive to proactive. Instead of guessing when to sell or what to buy, operators see the exact numbers and act before problems escalate.

Conclusion – Building a Profitable and Balanced Rental Fleet in 2025

Profitability in 2025 is about alignment: matching fleet composition to customer demand, balancing categories, and treating cars as financial assets. Economy cars deliver stability. Mid-size sedans secure corporate accounts. SUVs drive margins and long bookings. Luxury vehicles create prestige when limited to niche demand. Vans bring in profitable family and group bookings; EVs cover today’s eco demand and prepare fleets for tomorrow.

Mistakes — over-investing in luxury, ignoring TCO, misjudging demand, or failing to diversify — are costly but avoidable. The operators who mix up their fleets and watch utilization are the ones who stay strong.

The future is data-driven — TopRentApp gives managers insight into utilization, profit, and when to replace vehicles. Cars are no longer guesses — they are measurable assets.

👉 Use TopRentApp to optimize your fleet, maximize ROI, and grow confidently in 2025 and beyond.