The global rental market is about to undergo one of the biggest shifts in its history. For much of the last fifty years, growth was tied to fleet size and the ability to manage costs. A successful operator typically relied on compact cars and hatchbacks purchased in bulk at discounted rates, rotated vehicles every 18–24 months, and competed primarily on price. Customers wanted something affordable, practical, and available when they landed at the airport or checked into a hotel. Few, if any, asked whether the car produced emissions or how environmentally friendly it was.

That situation has changed. Today, an increasing number of travelers begin their rental inquiry with a simple question: “Do you have electric cars?” In many destinations, especially in Europe, North America, and China, this question is no longer optional but central to the decision-making process. Some customers see EV rentals as part of their lifestyle, others want to test-drive an EV before purchase, and corporate clients often have strict sustainability requirements.

The scale of this change is reflected in the numbers. In 2023, more than 14 million EVs were sold worldwide, representing nearly 20 percent of global car sales. Forecasts suggest that by 2030, EVs could account for 40 to 50 percent of all new cars. Since cars are the core assets of rental operators, these statistics have outsized importance. A change of this scale makes it impossible for operators to view EVs as a side project. Within a single fleet cycle, electrification will become mainstream.

Governments are fueling the transition with grants, zero-emission targets, and large-scale investment in charging stations. Consumers, particularly Millennials and Gen Z, are aligning their spending with their values. Demonstrating advancement on ESG metrics — travel choices included — has become a pressing requirement for many firms. The rental industry, which sits at the intersection of transportation, tourism, and corporate mobility, is directly in the spotlight.

If you’re running a rental company and need a clear path forward, this expert guide is for you. Discover why EVs are no longer optional, what they can do for your business, the challenges to expect, and how to calculate the real cost vs. benefit. We will look at strategies for integration, regional differences, and case studies from both large chains and local operators. We’ll close by peering into the future — where AI-powered decisions, smart energy flows, and EVs that talk to the grid are shaping tomorrow’s rental businesses.

By the end, you will have a clear picture of whether EVs are right for your fleet, how to reduce risks, and how tools such as TopRentApp can simplify management and maximize profitability.

Why EVs Are Becoming Popular in Car Rentals

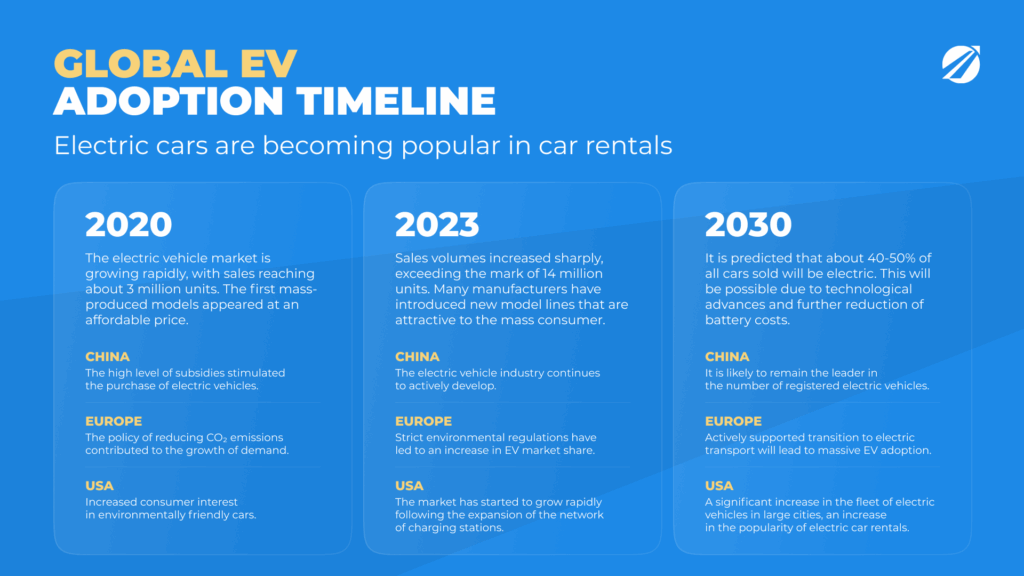

Global EV Adoption

The scale of EV adoption worldwide is unprecedented. In 2020, global sales were around three million units. By 2023, that number had jumped to fourteen million. Analysts at BloombergNEF forecast that annual EV sales could exceed twenty-five million by 2026 and approach fifty million by 2030.

The geography of adoption matters. China leads the world, accounting for more than half of all EV sales in 2023. Domestic manufacturers such as BYD, NIO, and Xpeng have created mass-market EVs that sell at scale, while Tesla’s Shanghai Gigafactory has made China the company’s largest market. Europe accounts for about a quarter of global EV sales, with Norway’s 80 percent EV penetration setting the benchmark. Germany, the Netherlands, and France are also seeing rapid adoption. The United States has lagged but is catching up: more than one million EVs were sold in 2023, thanks to Tesla’s dominance and new models from Ford, GM, Hyundai, and Kia.

In the rental business, these figures directly shape what customers expect. A German tourist accustomed to driving an ID.4 at home expects to see EVs available in Spain or Italy. A Chinese business traveler familiar with BYD or Tesla will be surprised if a U.S. rental fleet offers only combustion cars. Customer expectations cross borders, and operators who fail to adapt risk ceding market share.

Changing Customer Preferences

Just as important as sales numbers are the shifts in consumer behavior. Buyers increasingly treat sustainability as a key criterion. Surveys consistently show that more than 70 percent of travelers prefer eco-friendly options, and around 40 percent are willing to pay a premium for them. Families see EVs as a ticket to avoiding urban congestion charges and LEZ restrictions. Renting an EV gives younger tourists the chance to test electric driving before making a purchase decision. Business travelers are often directed toward EVs under their companies’ green mobility policies.

Concrete examples bring this point to life. In Amsterdam, EV rentals now achieve higher utilization rates than compact gasoline cars, despite higher daily rates. In Paris, where low-emission zones are expanding, corporate clients actively demand EVs for business trips. In Oslo, rental operators without EVs are considered outdated.

Government Incentives and Regulation

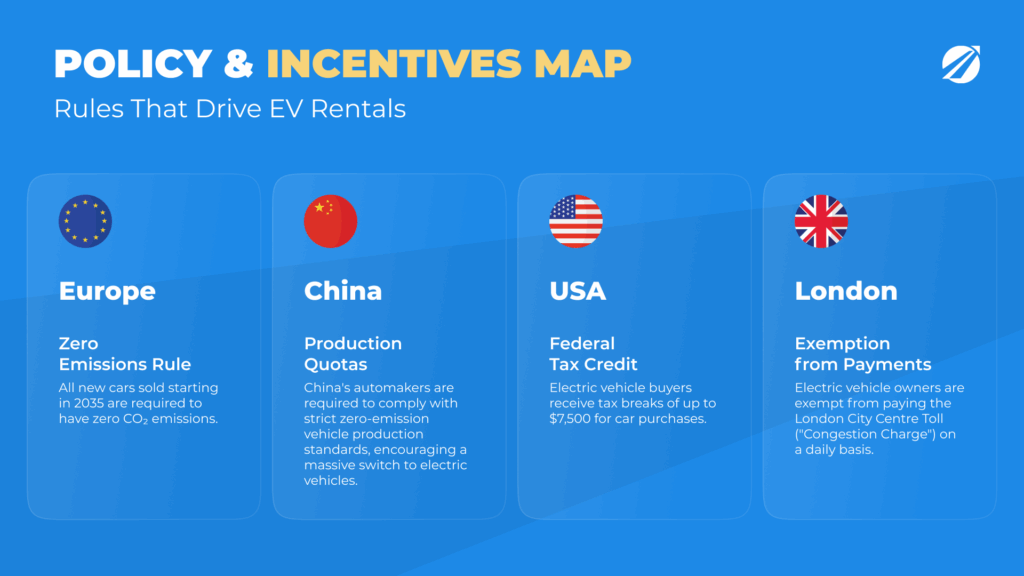

Government action is pushing the transition forward. The European Union has legislated that all new cars sold from 2035 must be zero-emission. Several cities, including London and Milan, already restrict ICE cars in central zones. The United States, under the Inflation Reduction Act, offers up to ,500 in federal tax credits and billions in infrastructure investment. California has mandated 100 percent EV sales by 2035. China combines subsidies with strict automaker quotas, driving the world’s fastest EV adoption curve.

For the rental sector, they create a mix of opportunity and obligation. Incentives lower purchase expenses, while rules punish operators who delay. EV adoption is no longer just about brand positioning — it is about compliance with the future of mobility.

Opportunities in Electric Vehicle Rentals

The adoption of EVs is not just a matter of compliance or environmental awareness. Rental companies see in this one of the most promising growth drivers of the decade. Unlike many other industry changes, EVs open multiple revenue streams simultaneously. New customer segments are reached, innovative models emerge, costs decline, and brand value grows. Businesses that adapt see the transition not just as defense, but as a path to outpace rivals.

New Customer Segments

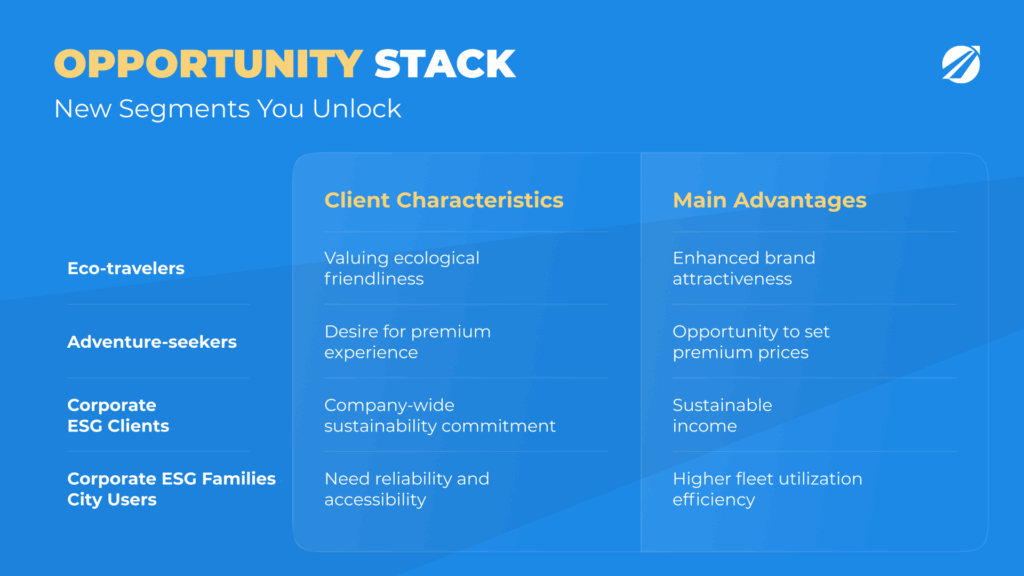

The first and most obvious opportunity lies in reaching new groups of customers who would not otherwise rent from traditional fleets.

Eco-conscious travelers are one such group. Surveys reveal that Millennials and Gen Z are the most sustainability-focused generations to date. More than sixty percent of Gen Z identify climate change as their primary concern when making purchasing decisions. This goes beyond stated intentions — it shapes actions. They deliberately seek out businesses that reflect their values. In Oslo and Stockholm, fully electric rental providers have successfully branded themselves as premium “green mobility” operators, charging slightly higher rates while still achieving superior utilization. Customers seeking travel that matches their personal principles find this message compelling.

Tourists seeking experiences represent another profitable segment. For many, renting an EV is not simply about mobility but about curiosity. A tourist who has never driven a Tesla may book one in Los Angeles for the thrill of experiencing electric acceleration on highways. A family visiting Lisbon may choose a Nissan Leaf or Hyundai Kona Electric because they want to try charging in real-world conditions. Operators report that up to sixty percent of EV renters in Lisbon and Barcelona are first-time drivers. For them, the rental becomes a test drive that can last days instead of minutes. This leaves travelers with a positive memory tied directly to the rental company.

Corporate clients may be the most strategic opportunity. Companies in high-value sectors — from IT to banking to consulting — are pushing employees toward low-emission mobility. This is not just a symbolic gesture — it ties directly into ESG reporting obligations. A Fortune 500 company signing a multi-year contract with a rental provider will look closely at the availability of EVs. In the U.S., one rental firm won a multi-million-dollar deal by pledging that 30% of its fleet would be EVs. For the operator, this delivered stable demand, reliable revenues, and a reinforced client bond.

Emerging Business Models

EVs enable new business models that would have been less feasible with ICE vehicles.

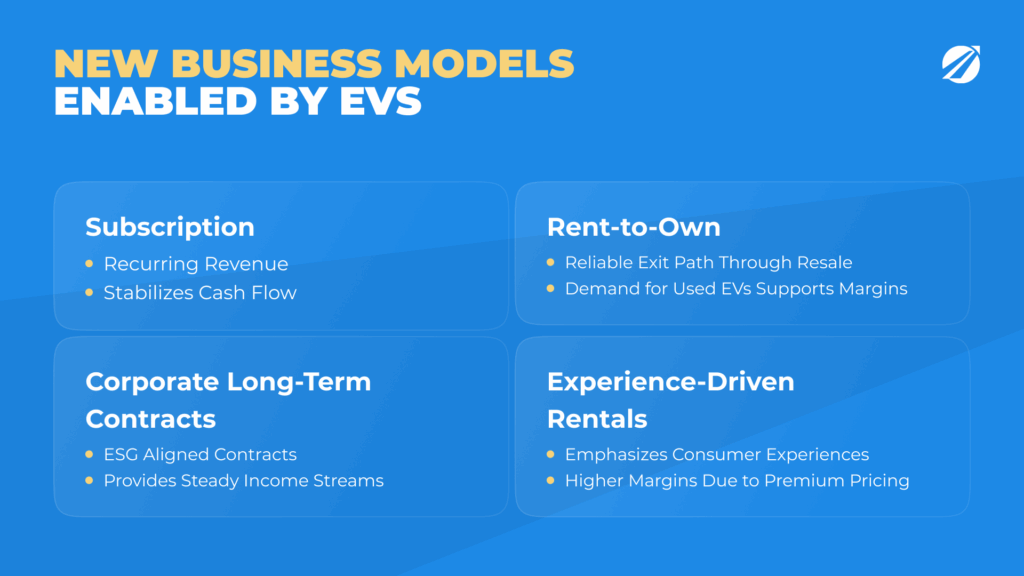

Subscription-based rentals are gaining traction, particularly in large cities. Customers pay a monthly fee for access to an EV, including insurance, maintenance, and in some cases charging. EVs’ lower operating expenses keep this model financially viable, while the concept of “ownership without owning” resonates with city living. For operators, subscriptions create steady recurring revenue rather than volatile daily bookings.

Rent-to-own programs are another emerging model. Here, customers apply part of their rental payments toward eventual purchase of the EV. For many, the chance to trial an EV long-term before ownership — made easier by generous subsidies — is highly appealing. Operators gain a reliable, revenue-positive path for exiting vehicles from the fleet, lowering residual value concerns.

Corporate long-term contracts are particularly attractive. Companies with ESG commitments may prefer to secure blocks of EVs for employees on annual or multi-year terms. Operators benefit from steady bookings and dependable cash flow, limiting reliance on peak tourist periods.

Experience-driven rentals are also expanding. Some operators market EVs as luxury experiences rather than just vehicles. For instance, Tesla-only rental startups in the U.S. position their cars as lifestyle products. Customers pay premium rates not because they need a car but because they want the “Tesla experience.” The same is happening with high-end EVs from Porsche, Audi, and BMW, which appeal to customers who would not normally book traditional rentals.

Lower Operating Costs

Operating costs are among the most compelling reasons for rental companies to embrace EVs.

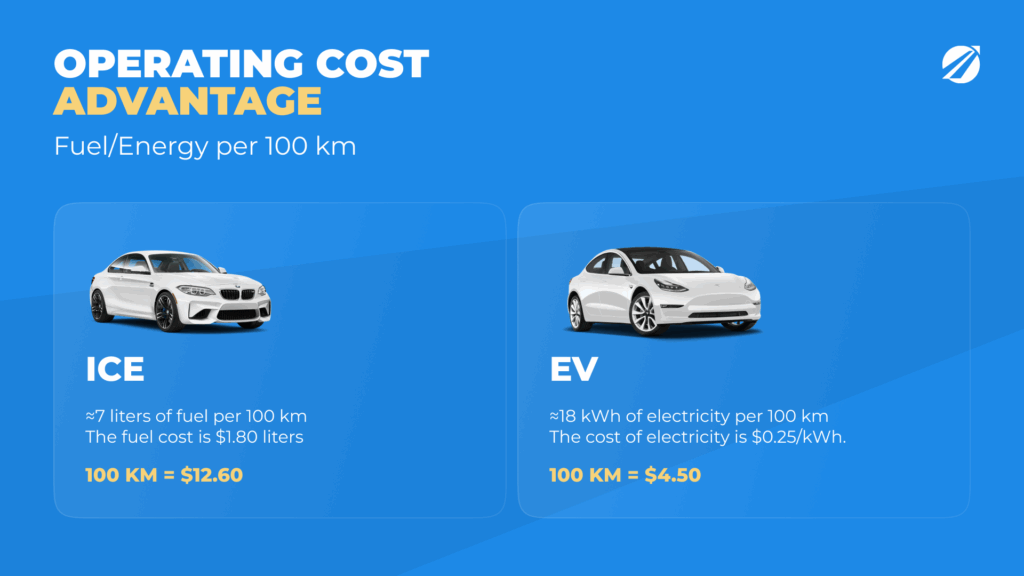

Fuel is a major expense, and here EVs provide a structural advantage. An ICE compact consuming seven liters per hundred kilometers at $1.60 per liter costs around $11.20 for 100 km. An EV consuming eighteen kilowatt-hours at $0.15 per kWh costs $2.70 for the same distance. Over 25,000 km annually, this amounts to more than $2,000 in savings per car. For a fleet of 100 EVs, the savings approach $200,000 per year.

Maintenance costs also drop. EVs have no oil changes, fewer fluids, and simpler drivetrains. Regenerative braking reduces brake wear, often doubling pad life. Industry data suggests 30–40 percent lower maintenance costs compared with ICE cars. For rental fleets with high turnover, this means not only reduced costs but also fewer days lost to servicing.

There are secondary benefits as well. EVs generate fewer vibrations and less mechanical stress, which can extend the life of tires and suspension components. In practice, this means less downtime and higher utilization — critical drivers of profitability.

Marketing and Brand Positioning

The marketing value of EVs cannot be overstated. In competitive rental markets, differentiation is hard to achieve. Price competition squeezes margins, while customer loyalty remains weak. EVs offer a way out of this trap.

Operators with “green fleets” can position themselves as innovative, sustainable, and premium. This message connects with customers as well as strategic partners — from OTAs to hotels to airlines — all needing to highlight sustainability progress. Partnering with sustainable travel platforms can open new distribution channels.

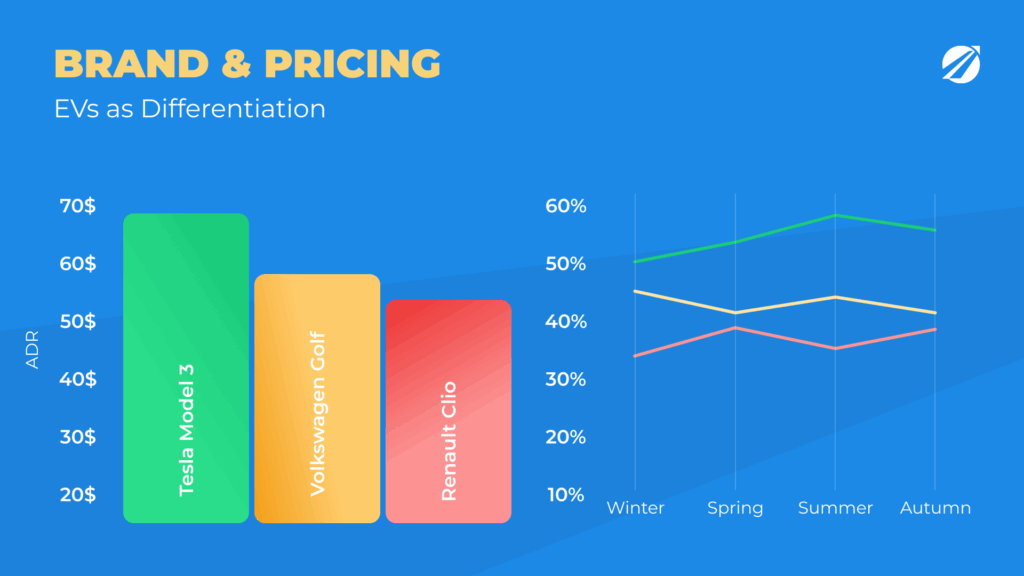

With EVs, companies can position their fleet at premium price points. In the U.S., Tesla Model 3 rentals regularly achieve daily rates 20–30 percent higher than ICE equivalents such as the BMW 3 Series. Even at premium prices, utilization stays strong — showing that customers perceive real value. Operators gain a stronger, more balanced profitability structure.

Government Incentives

Finally, government support makes EV adoption financially attractive.

In Germany, subsidies of up to €6,000 reduce purchase prices significantly. In France, the “bonus écologique” offers up to €7,000. In the United States, the Inflation Reduction Act provides up to $7,500 in federal tax credits. In China, subsidies have historically supported mass adoption, and while they are being phased out, other incentives remain.

Tax breaks and non-financial benefits also matter. EVs often enjoy reduced registration fees, lower annual taxes, and exemptions from congestion charges. In London, EVs are exempt from the £15 daily congestion charge, saving customers significant money and making rentals more attractive. In some cities, EVs also receive preferential parking access.

Challenges in Electric Vehicle Rentals

For all the promise that EVs hold, their integration into rental fleets is far from straightforward. Operational, financial, and customer-facing issues arise in the transition, and poor management of these can drain profitability. Any fleet manager exploring electrification must first understand these obstacles.

Charging Infrastructure: The Core Bottleneck

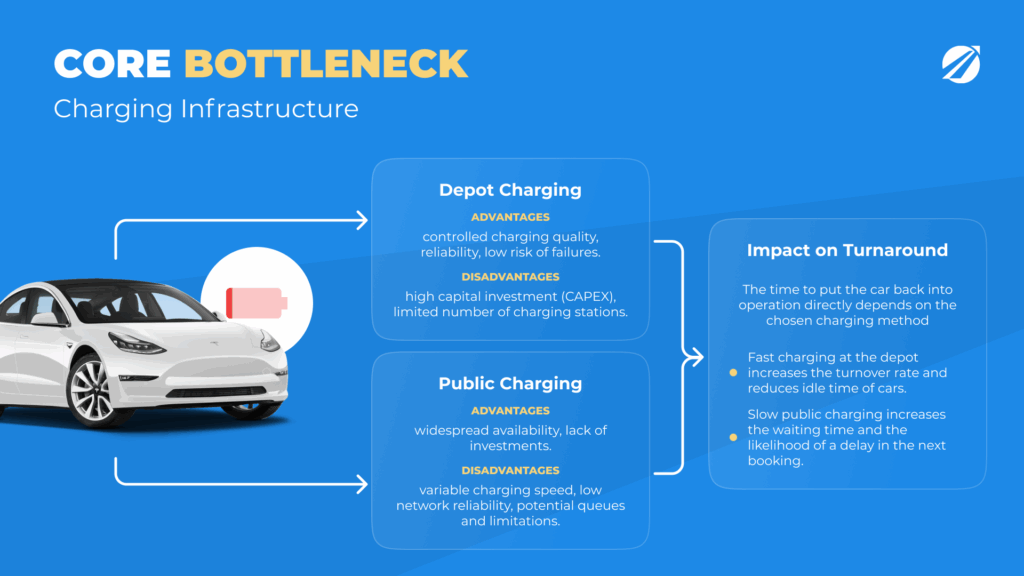

The most visible challenge is the availability of charging infrastructure. Unlike refueling a gasoline car, which takes only minutes and can be done almost anywhere, charging an EV is slower and far less consistent in coverage.

In markets such as Norway, the Netherlands, and parts of California, charging networks are mature enough to support high utilization of EV fleets. However, in much of Southern Europe, rural North America, and many Asian tourist destinations, charging points remain sparse. A family renting an EV in southern Italy may find that the only chargers available are slow AC units located at hotels or supermarkets. Such problems bring both inconvenience and reputational risk through critical customer feedback.

For operators, one response is to invest in private charging infrastructure. Having chargers at depots ensures that vehicles can be returned with low battery levels and still be ready for the next customer within a few hours. The drawback is the substantial investment needed. A single DC fast charger can cost between 25,000 and 150,000, excluding installation, electrical upgrades, and permitting. Even slower AC chargers cost several thousand dollars each. Governments may subsidize part of the cost, but the outlay is still significant.

Infrastructure inevitably triggers questions about how operations are managed. How many chargers are required per vehicle? What happens if multiple cars are returned simultaneously? How can load management be optimized to avoid high electricity bills during peak hours? It becomes evident that charging isn’t simply a technical hurdle but an operational process requiring management tools and strategic planning.

Higher Acquisition Costs

EVs remain more expensive to purchase than comparable ICE vehicles. Since 2010, battery costs have dropped by over 80%, yet they still represent 30–40% of an EV’s price. As a result, EVs are often 30–50 percent more expensive upfront than equivalent combustion cars.

For example, a Volkswagen Golf may cost around 28,000, while a Volkswagen ID.3, its electric counterpart, costs closer to 35,000. In the premium segment, the gap can be even larger. Rental businesses feel the pressure strongly, given their thin margins and reliance on discounted fleet acquisitions.

A higher upfront cost extends the payback period. ICE cars often achieve breakeven within 2–3 years, especially when utilization is high. EVs may take 4–6 years, depending on fuel savings, maintenance reductions, and residual values. For operators who rotate vehicles quickly — for example, selling cars after 24 months — this extended payback window is a serious concern.

Insurance and Risk Management

Insurance has emerged as another challenge. Premiums for EVs are often 20–30 percent higher than for ICE cars. The reasons include expensive battery swaps, limited repair shop availability, and unclear long-term risk profiles for insurers.

The battery component brings its own set of difficulties. Although battery fires are extremely rare, they receive significant media attention, which influences insurer perceptions. Often, a damaged battery can’t be repaired and has to be replaced, at a cost of tens of thousands of dollars. Repairing vehicles after accidents takes longer, resulting in higher downtime and diminished utilization.

For rental companies, this translates into both higher premiums and higher out-of-pocket costs when incidents occur. Some insurers are beginning to offer specialized EV policies, but pricing remains volatile. Fleet managers must include these expenses in TCO analyses and explore risk-reduction measures like telematics or driver training.

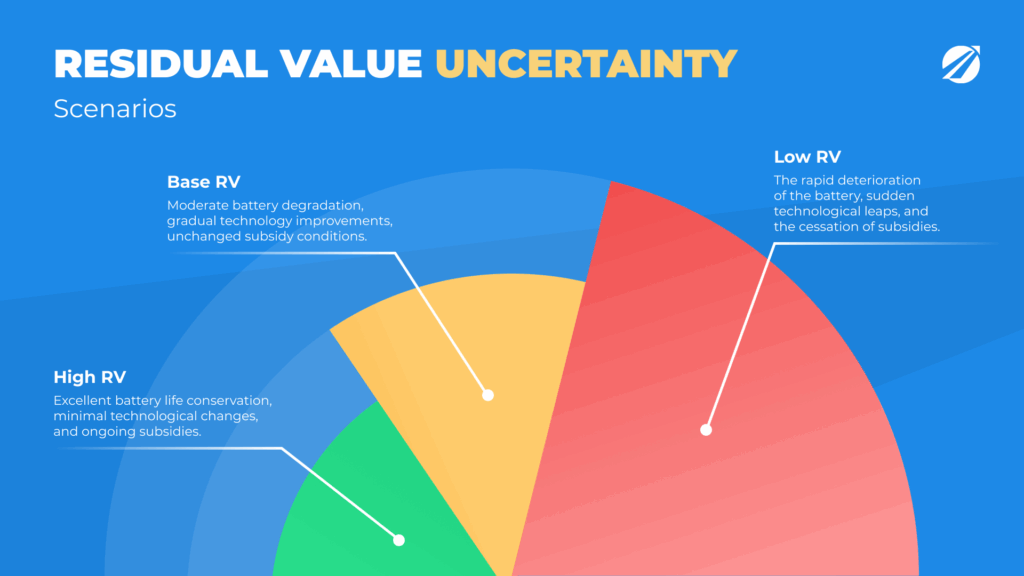

Residual Value Uncertainty

Depreciation ranks among the biggest expenses in fleet management. For ICE cars, residual values are relatively predictable, with decades of market data to guide estimates. For EVs, the picture is less clear.

On one hand, strong demand for used EVs in certain markets, such as Norway and China, supports healthy resale prices. On the other, concerns about battery degradation, rapid technology turnover, and shifting subsidy regimes depress values in other regions. An EV purchased today may face steep competition from models with longer range and faster charging within just two or three years.

Rental firms struggle to schedule fleet turnover due to unpredictable residual values. A miscalculation of even a few thousand dollars per vehicle can wipe out the savings gained from lower fuel and maintenance costs. Some operators mitigate this by adopting rent-to-own models, where customers eventually purchase the vehicles, reducing residual risk. Others negotiate buy-back agreements with manufacturers, though these are less common for smaller players.

Customer Education and Experience

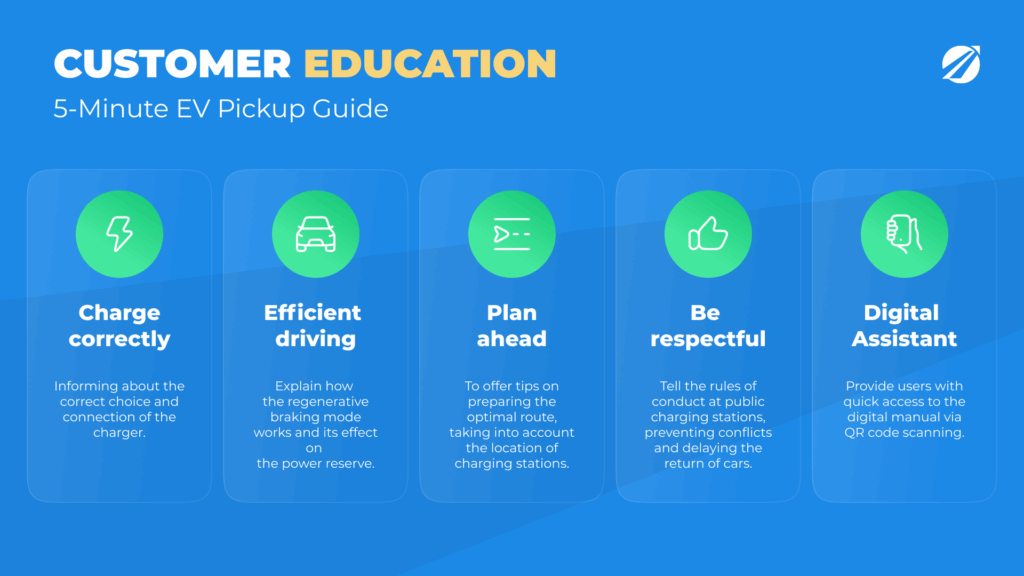

Customer familiarity with EVs remains limited. For many renters, especially older demographics or travelers from regions with low EV penetration, driving an electric car is an entirely new experience. They may not understand regenerative braking, the need to plan charging stops, or the etiquette of public charging stations.

Confusion at the rental counter can create delays. Customers who do not know how to operate the car may call support lines, reducing staff efficiency. Worse, negative experiences — such as running out of battery or failing to find a charger — can lead to poor reviews.

Rental companies must therefore invest in customer education. Some provide short tutorials at pickup, while others include printed guides or QR codes linking to video instructions. Onboard infotainment helps, yet staff training and preparedness are essential. Employees must be able to explain EV basics quickly and clearly. Consistent standards across locations, backed by training, are essential.

Seasonality and Utilization Patterns

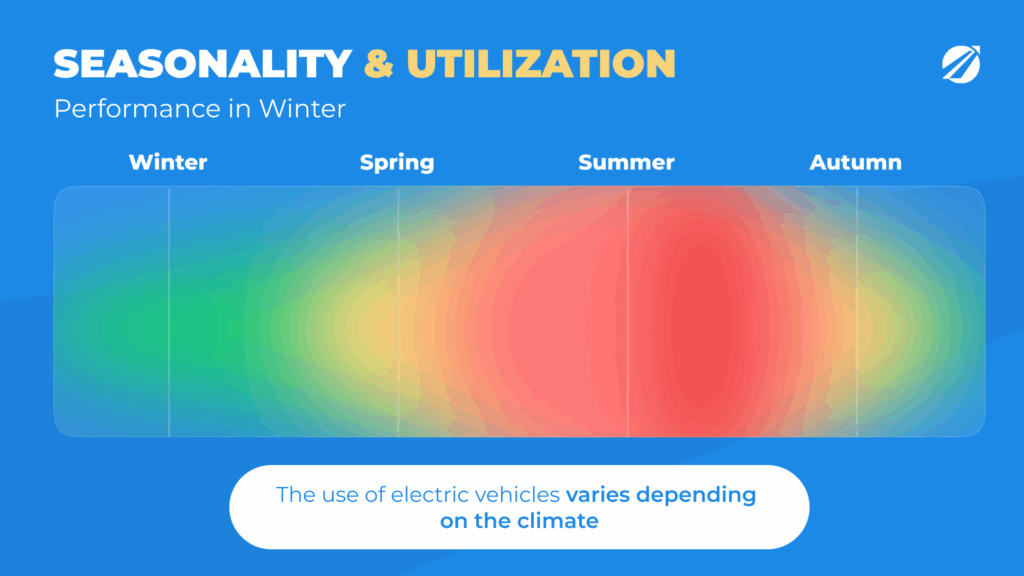

Seasonality adds complexity. In tourist destinations such as southern Europe, EVs may perform well during peak months when customers are more open to experimentation and infrastructure is sufficient. In winter, however, lower demand and reduced range due to cold weather may limit profitability.

EVs also perform best with high utilization. The economics of lower fuel and maintenance costs accumulate with mileage. Fleets with inconsistent demand or vehicles sitting idle for long periods may not realize the full benefits. Small firms and businesses in seasonal regions face these challenges most acutely.

Barriers for Small Operators

Large rental chains often have the capital and scale to absorb the costs of EV integration. Smaller operators encounter higher hurdles.

First, they lack bargaining power with manufacturers. Large chains can negotiate bulk discounts and buy-back agreements, while small companies pay closer to retail prices. Second, they often find it hard to secure subsidies, which are usually linked to bulk fleet buys or complicated applications. Third, limited capital prevents them from building charging infrastructure, leaving them reliant on often-unreliable public networks.

For small operators, the risk of EV adoption is higher. Yet ignoring EVs entirely may also be dangerous, as customers increasingly expect them. Success depends on finding a middle ground: engaging in the shift while keeping risks under control.

TCO, Integration Strategies, and Operational Approaches

Understanding TCO of EVs vs Traditional Cars

For rental companies, the decision to adopt EVs should never be made on gut feeling alone. The key metric is Total Cost of Ownership (TCO). TCO considers the full financial picture: acquisition cost, depreciation, fuel or electricity, maintenance, insurance, taxes, and residual value. Looking only at the purchase price risks missing the long-term economics that can make EVs competitive — or unprofitable.

Example 1: Compact Segment in the United States

Let’s compare a Toyota Corolla (ICE) with a Nissan Leaf (EV) over five years and 100,000 km.

Toyota Corolla (ICE):

- Purchase price: $25,000

- Fuel (7 L/100 km at $1.10/L average U.S. gasoline price): ~$7,700

- Maintenance: ~$4,000

- Insurance: ~$6,000

- Residual value after 5 years: ~$10,000

- TCO ≈ $32,700

Nissan Leaf (EV):

- Purchase price: $30,000

- Electricity (18 kWh/100 km at $0.13/kWh average U.S. price): ~$2,300

- Maintenance: ~$2,500

- Insurance: ~$6,600 (about 10% higher)

- Residual value after 5 years: ~$12,000

- Federal tax credit: –$7,500

- TCO ≈ $21,900

Here, the EV wins decisively because of lower running costs and strong incentives. Without the tax credit, the advantage narrows, but the Leaf still comes out ahead.

Example 2: SUV Segment in Germany

Now compare a VW Tiguan (ICE) with a VW ID.4 (EV) over five years and 120,000 km.

VW Tiguan (ICE):

- Purchase price: €38,000

- Fuel (7.5 L/100 km at €1.80/L): ~€16,200

- Maintenance: ~€5,000

- Insurance: ~€7,000

- Residual value: €15,000

- TCO ≈ €51,200

VW ID.4 (EV):

- Purchase price: €47,000

- Electricity (19 kWh/100 km at €0.30/kWh): ~€6,800

- Maintenance: ~€3,500

- Insurance: ~€8,000

- Residual value: €18,000

- Purchase subsidy: –€6,000

- TCO ≈ €49,300

Here, the EV comes close to parity but is still slightly more expensive. However, if utilization rises (e.g., 30,000 km per year instead of 24,000), the ID.4 becomes cheaper over its lifecycle.

Example 3: Premium Segment in China

A BMW 5 Series (ICE) vs a Tesla Model S (EV) over five years and 150,000 km.

BMW 5 Series (ICE):

- Purchase price: ¥450,000 (~$63,000)

- Fuel (9 L/100 km at ¥8/L): ~¥108,000

- Maintenance: ~¥45,000

- Insurance: ~¥55,000

- Residual value: ¥180,000

- TCO ≈ ¥478,000 (~$67,000)

Tesla Model S (EV):

- Purchase price: ¥750,000 (~$105,000)

- Electricity (20 kWh/100 km at ¥0.8/kWh): ~¥24,000

- Maintenance: ~¥30,000

- Insurance: ~¥65,000

- Residual value: ¥350,000

- Subsidies: phased out in China for premium EVs

- TCO ≈ ¥519,000 (~$72,000)

Here, the ICE vehicle has a slight cost advantage, though the Tesla commands higher daily rental rates, which can compensate. The profitability depends heavily on utilization and customer willingness to pay for the premium experience.

Integration Strategies

For operators, knowing the economics is only the first step. The bigger question is how to integrate EVs successfully.

Start Small, Scale Gradually

A cautious approach is best. Begin with a pilot program of 5–10% EVs in the fleet. Operators can trial demand, learn directly from customers, and measure day-to-day expenses. Running a pilot limits exposure and builds team expertise before scaling up.

Choose the Right Models

Model selection should align with customer demand.

- Urban markets: compact EVs like the Nissan Leaf, Renault Zoe, or Chevrolet Bolt are ideal.

- Family and leisure markets: crossovers such as the Hyundai Kona Electric, VW ID.4, or Tesla Model Y fit better.

- Premium markets: Tesla Model 3 or S, Audi e-tron, BMW iX, or Mercedes EQC attract corporate and luxury clients.

Range matters, but should match real-world usage. Overpaying for 600 km of range when most customers drive 150 km daily is unnecessary.

Plan Charging Solutions

Relying only on public charging exposes operators to risk. Partnerships with networks such as Ionity (Europe), Electrify America (U.S.), or Tesla Superchargers provide coverage, but depot charging is essential for turnaround efficiency.

Governments often subsidize up to 50% of charging infrastructure costs, making it more accessible. Smart load management can cut electricity costs by scheduling charging during off-peak hours.

Train Staff and Educate Customers

Staff must be confident explaining EV basics: charging connectors, regenerative braking, driving dynamics. Customers should receive a short briefing at pickup, plus digital guides via QR code or app. Fewer complaints and accidents through training translate into happier customers.

Use Fleet Management Software

Managing EVs without software is risky. Costs are dynamic, charging varies, and maintenance cycles differ from ICE cars. Tools like TopRentApp allow managers to:

- Monitor utilization in real time

- Calculate breakeven points for each vehicle

- Track electricity expenses and maintenance costs

- Generate automated profitability reports

This data-driven approach transforms EV adoption from a gamble into a controlled strategy.

Operational Strategies: Small vs Large Operators

The approach to EV integration differs significantly between small local companies and large international chains.

Small Operators

For small operators, capital constraints and limited bargaining power make EV adoption more challenging. They cannot easily negotiate bulk discounts or buy-back guarantees. Subsidies may require complex applications that are difficult to navigate.

Recommended strategies for small operators are:

- Starting with very small pilots (even 2–3 EVs) focused on specific customer segments, such as eco-conscious tourists.

- Leveraging rent-to-own models to reduce residual value risk. Customers eventually buy the EVs, creating an exit strategy.

- Partnering with hotels or airports to share charging infrastructure, reducing capital expenditure.

- Marketing EVs as experience products, charging premium rates for customers eager to try electric driving.

Large Operators

Large international chains have more resources but face different challenges. The scale of their operations makes cross-market complexity unavoidable.

Strategies for large operators include:

- Negotiating bulk purchase agreements with manufacturers, securing discounts and residual value guarantees.

- Coordinating infrastructure investments across regions, often in partnership with energy companies.

- Using EVs as a marketing lever to attract corporate contracts and improve brand image.

- Deploying advanced telematics and AI tools to optimize fleet allocation and charging schedules.

In practice, large operators are often the first to adopt EVs at scale, while small operators focus on niche strategies. Success is possible with either path, provided it aligns with demand and financial strength.

Case Studies, Regional Differences, Future, and Conclusion

Case Studies: Lessons from the Market

EV integration looks different depending on market and scale — real-world case studies highlight these nuances. Successes and setbacks alike are on display, giving operators clear takeaways they can apply to their own EV strategies.

Hertz — Large-Scale Transformation

In 2021, Hertz announced its plan to purchase 100,000 Teslas to electrify its fleet. It elevated the company to market-leader status and delivered significant media coverage. For the vast majority of motorists, leasing cars from Hertz meant adoption of EVs. Expanding too quickly proved harder than expected during the rollout. Insurance premiums rose sharply, repair times were longer than expected, and the company had to negotiate access to charging networks. Yet the visibility and corporate traction achieved showed the real branding impact of going electric.

Avis Norway — Market Alignment

Operating in one of the most EV-friendly countries, Avis Norway shifted nearly 40 percent of its fleet to electric vehicles. Customer satisfaction rose, as many travelers expected EVs by default. Yet infrastructure expenses proved to be a major challenge for the company. Depot charging setups were necessary, though they demanded heavy capital investment. The lesson: strong customer demand can justify heavy investment, but infrastructure must be scaled carefully.

Lisbon Local Operator — Targeted Strategy

A small Lisbon-based company added 20 Nissan Leafs and marketed them as “eco-city cars.” By offering free charging at its depot, the operator increased utilization by 15 percent. Corporate clients also responded positively, booking EVs for business trips. The example underlines that EV success for small operators comes from specialization and reliable charging support.

Europcar France — Urban Focus

Europcar introduced EVs in French cities with robust charging networks, focusing on corporate travelers. Utilization was high in Paris and Lyon, but weaker in rural areas where infrastructure lagged. The firm concentrated EVs in cities and relied on ICE cars for areas with limited infrastructure. The lesson is clear: EV rollouts must follow a geographic strategy.

BlueIndy (Indianapolis) — A Cautionary Tale

BlueIndy launched as an EV car-sharing service with support from the city of Indianapolis. The project, though backed by major investment, struggled as unreliable charging and range concerns led to low usage and dissatisfaction. The service shut down in 2020. The lesson is that without reliable infrastructure and strong customer education, even well-funded EV rental or sharing initiatives can fail.

Tesla-Only Startups in the U.S.

Several startups have emerged offering only Teslas. They sell the idea of a premium experience and price the cars above standard rates. Utilization has been strong, particularly in cities like Los Angeles and Miami, where Teslas are aspirational products. However, insurance costs and limited repair networks reduce profitability. It works, though limited to markets with wealthy, experience-focused clientele.

Dubai Luxury Rentals

In Dubai, EV adoption has been slower overall, but premium rental companies now include Tesla Model X, Porsche Taycan, and Audi e-tron in their fleets. These cars attract affluent tourists and business travelers seeking the latest in automotive technology. EVs are marketed less as eco-friendly and more as luxury experiences, aligning with the city’s brand.

The cases emphasize that without context, the picture is incomplete. EV adoption strategies must match customer demand, infrastructure availability, and financial capacity.

Regional Differences in EV Rentals

EV adoption in rentals looks very different depending on geography.

Europe

Europe is the global leader in EV adoption for rentals. Northern Europe, particularly Norway, has normalized EV fleets, with some operators offering nearly 100 percent electric vehicles. Western Europe follows with strong subsidies and regulatory pressure. Southern Europe lags due to weaker infrastructure but faces growing tourist demand from northern Europeans who expect EV options.

United States

Adoption varies widely. The leading states — California, New York, and Washington — combine generous incentives with dense charging networks. Central and southern states lag behind. For nationwide operators, this creates complexity: EVs perform well in coastal urban markets but underperform in less developed regions.

China

China dominates global EV adoption. Domestic brands such as BYD and NIO supply affordable vehicles that are widely available. Rental companies in major Chinese cities already have large EV fleets. In some urban areas, EV rentals are the default option. However, the market is highly competitive, and margins are tight.

Middle East

Adoption is slower, but EVs are positioned as luxury experiences. In Dubai and Abu Dhabi, Teslas and high-end European EVs are marketed to affluent tourists. Investment is going into infrastructure, but priorities favor prestige over widespread rollout.

Southeast Asia

Adoption is at an early stage, but ride-hailing platforms are driving demand. Firms like Grab are testing EV fleets as governments roll out electrification incentives — a trend rental operators in Thailand, Singapore, and Indonesia are monitoring closely.

The Future of Electric Vehicle Rentals

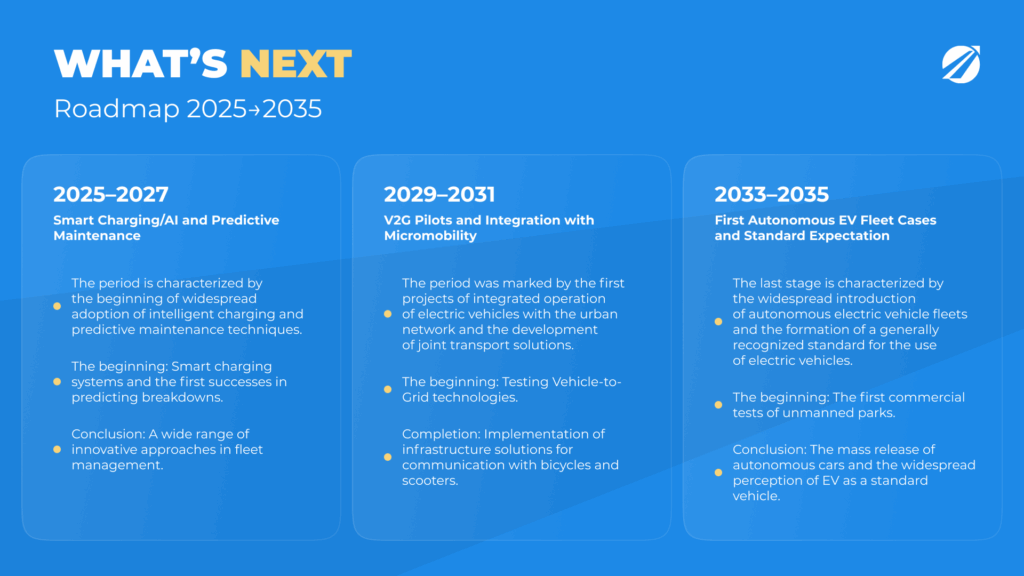

Looking ahead, EV rentals will continue to evolve rapidly. The next ten years will be shaped by a number of key trends.

1. Vehicle-to-Grid (V2G)

EVs are essentially mobile batteries. In the future, fleets could sell electricity back to the grid when vehicles are parked. This means idle assets could be monetized as revenue streams. Large-scale operators could use V2G to offset power expenses and turn it into a profit source.

2. AI and Smart Charging

Artificial intelligence will optimize charging schedules, shifting demand to off-peak hours and balancing loads across depots. With AI predicting demand, vehicles can be charged to the right levels ahead of bookings, saving money and enhancing efficiency.

3. Predictive Maintenance and Connected Cars

Predictive Maintenance and Connected Cars Connected EVs provide data in real time. Fleet managers can monitor battery health, predict when parts need replacement, and schedule maintenance proactively. Less idle time results in higher operational usage.

4. Integration with Urban Mobility

Rental companies may increasingly integrate EVs with micromobility options such as e-scooters and bikes. Bundled offerings could allow customers to book a Tesla for intercity trips and an e-scooter for last-mile travel, all through one platform.

5. Autonomous EV Fleets

Autonomous EV Fleets. By the 2030s, autonomous driving may converge with electrification. Autonomous EV fleets offer the potential for near-continuous operation, slashing both downtime and labor overhead. While widespread deployment is still years away, operators should monitor developments closely.

6. Market Forecast to 2035

By 2030, EVs are expected to represent 40–50 percent of global new car sales. By 2035, some regions such as Europe and China may exceed 70 percent. For rental companies, this means that within a single fleet cycle, electrification will no longer be optional. Customers will expect EVs as standard.

Conclusion — Are EVs Right for Your Rental Business?

For rental businesses, electric vehicles can unlock new value — if managed strategically. On the opportunity side, they attract eco-conscious travelers, tourists seeking new experiences, and corporate clients with sustainability mandates. Reduced fuel and upkeep costs, stronger brand perception, and the potential for premium pricing make EVs attractive, further supported by government subsidies.

On the challenge side, EVs require higher upfront investment, rely on uneven charging infrastructure, and face higher insurance premiums. Residual values are uncertain, and customers often need education. For small operators, barriers are particularly high, while large operators must manage complexity across regions.

The path forward is clear: start small, test demand, and scale gradually. Choose models suited to your market, invest strategically in charging, train staff, and educate customers. Gain control over fleet operations—monitor in real time and act on insights, not guesswork.

The transition to EVs is not a question of if, but when. Operators who move fast will outpace the competition, build brand trust, and profit in the long run.

With TopRentApp, you can simplify EV management. Know your numbers at a glance. From profitability tracking to breakeven insights, the platform gives you the tools to optimize EV performance and ROI.

Managing an EV fleet requires precise planning and automation.

👉 Request a free demo and see how TopRentApp supports charging workflows, fleet monitoring, and pricing optimization.

An EV rental software helps improve efficiency and profitability.