Corporate rentals have matured from a side stream into one of the most resilient profit engines in mobility. Through 2026, companies across sectors are moving away from vehicle ownership and rigid leases toward flexible access that can expand or contract with project work, relocations, and hybrid teams. Instead of counting cars on the balance sheet, executives want mobility that feels like any other business service: predictable, measurable, and easy to scale.

At first glance, the lesson for operators seems simple — yet it reshapes everything. Business clients care less about saving a few dollars per day and far more about service guarantees, consolidated billing, and transparent reporting. They expect the reliability of an in-house fleet with none of the administrative burden. When you consistently meet that bar, a single account can out-earn a hundred short leisure bookings and, crucially, keep earning month after month. This guide lays out how to reach that point in practice: who the buyers are, why rentals beat leasing in many corporate scenarios, where the upside lies, what risks to control, which KPIs actually matter, and how to organize operations, contracts, and sales so B2B becomes a stable, high-margin line of business.

Understanding the Corporate Rental Segment

Who Are Corporate Clients?

SMBs with frequent travel needs

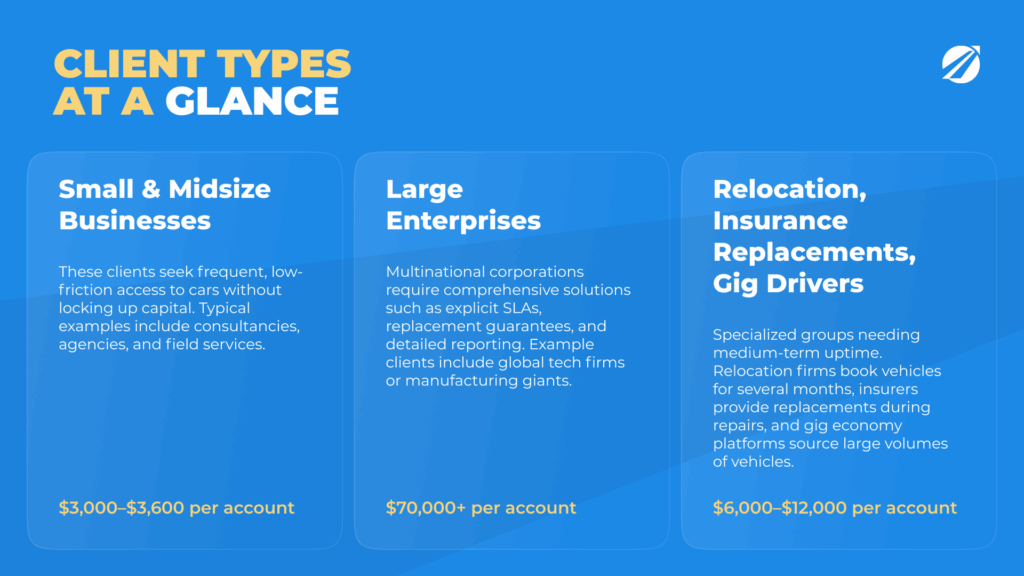

Small and mid-size businesses — agencies, field service firms, clinics, installers, regional sales teams — need frequent, low-friction access to cars without tying up capital. A 40-person consultancy that books a dozen trips a month will gladly trade counter negotiations for a fixed corporate rate, guaranteed availability, and one clean invoice. For the operator, that can mean something like $3,000–$3,600 recurring revenue each month from a single client, with far fewer operational touchpoints than the equivalent number of retail bookings.

Large enterprises with fleet contracts

At the other extreme, multinationals deploy dozens or hundreds of vehicles across regions. Their procurement teams will demand explicit service-level agreements (SLAs), replacement windows measured in hours, reporting down to department or cost center, and insurance provisions that match corporate risk policy. These are complex accounts — think $70,000+ per month for 60 reps on the road — but they are also the ones that anchor a rental business through market swings if you serve them well.

Relocation, insurance replacement, and gig drivers

Not all corporate demand looks like “business travel.” Relocation firms place vehicles for two to six months while families settle. Insurers fund multi-week replacements during repairs. Driver platforms in ride-hailing and delivery outsource access to vehicles at scale. These buyers place a premium on uptime, fast swaps, and billing that matches their workflow more than on shaving five dollars off a headline rate.

How Decision-Making Works in Corporate Procurement

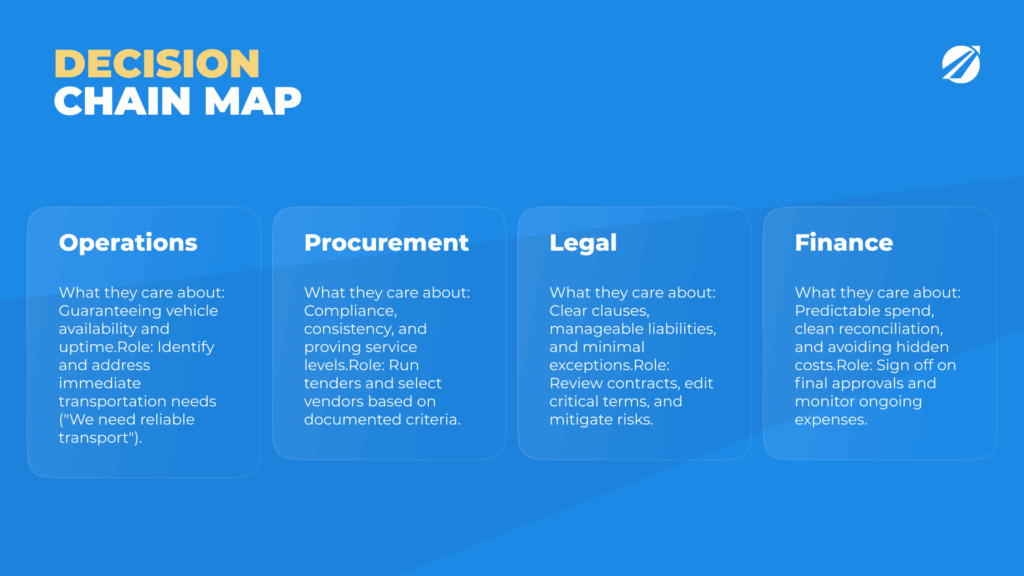

Behind every corporate account stands a decision chain — not a single buyer. In small businesses, the founder or office manager might decide in a day. In mid-size firms and enterprises, the process involves multiple layers: the operational lead who feels the pain (“we need reliable transport”), procurement who runs the tender, legal who edits the clauses, and finance who signs off on the spend. Each one weighs distinct sets of risks, schedules, and motivations.

Once operators understand this structure, their entire sales approach shifts. Procurement looks for compliance, consistency, and proof of service levels. Finance cares about predictability and clean reconciliation, not just unit price. HR values comfort, driver safety, and support channels that reduce internal hassle. When your outreach, proposal, and reporting each speak to those needs, you reduce friction and speed up closing cycles.

For example, a logistics firm in Poland cut its internal approval time from three weeks to five days after the rental operator mapped all stakeholders, built a pricing table that matched the company’s cost centers, and sent sample SLA dashboards that procurement could plug straight into their evaluation template. In corporate rentals, clarity and empathy often close deals faster than discounts.

Opportunities in Corporate Rentals

Long-Term Contracts and Recurring Revenue

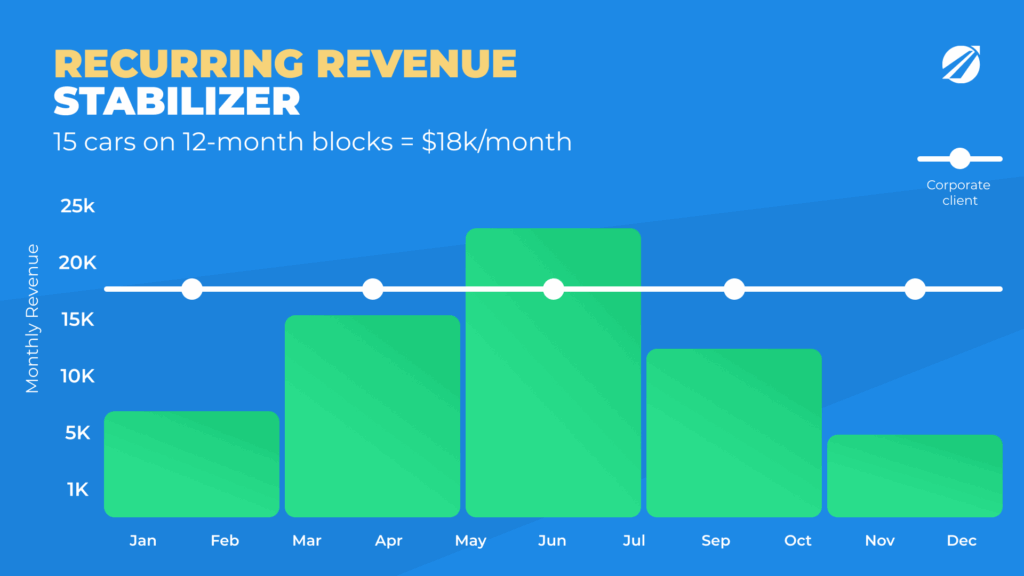

Tourist demand rises and falls with seasons and flights. Corporate contracts, by design, flatten those curves. If a 50-vehicle operator has 15 cars locked into 12-month business blocks at $1,200 per car, that’s $18,000 a month before a single walk-in arrives — $216,000 a year that pays salaries, rent, and finance charges without hoping for sunny weekends.

Higher LTV and Lower Churn

The acquisition effort for a corporate account is heavier — prospecting, demos, proposals, legal review — but the payoff compounds. A relocation firm spending $6,000 a month for two years contributes $144,000 in lifetime value; if your all-in cost to win the account was $4,000, the LTV: CAC ratio sits at 36:1. You’ll rarely see that dynamic with one-off leisure bookings.

Cross-Selling and Upselling Potential

Because corporate buyers optimize for certainty and convenience, they are receptive to premium insurance that caps exposure, executive vehicles for leadership, delivery and swap logistics that eliminate downtime, and even EV or hybrid mixes that support sustainability reporting. If a 20-car account upgrades just five units from $55 to $90 per day for executive use, you’ve added roughly $5,000 monthly without a single new lead. Over a year, that’s a meaningful share of a service manager’s salary covered by one smart nudge.

Market Positioning and Competitive Advantage

A handful of recognizable logos on your website does more than flatter the ego: it reframes you as an enterprise-capable provider. The moat isn’t price; it’s competence. Clean SLAs, quiet reliability, transparent reporting, and consolidated billing are rarer in rental than one might expect. If you can deliver those consistently, rivals that rely on retail mechanics will struggle to follow.

Predictable Utilization and Fleet Planning Advantage

One of the least appreciated advantages of corporate rentals is predictability. Unlike retail, where fleet allocation feels like weather forecasting, B2B contracts let operators plan months ahead. When you know that 20 vehicles are blocked under 6- or 12-month commitments, you can plan servicing, replacements, and disposals with surgical precision instead of reaction.

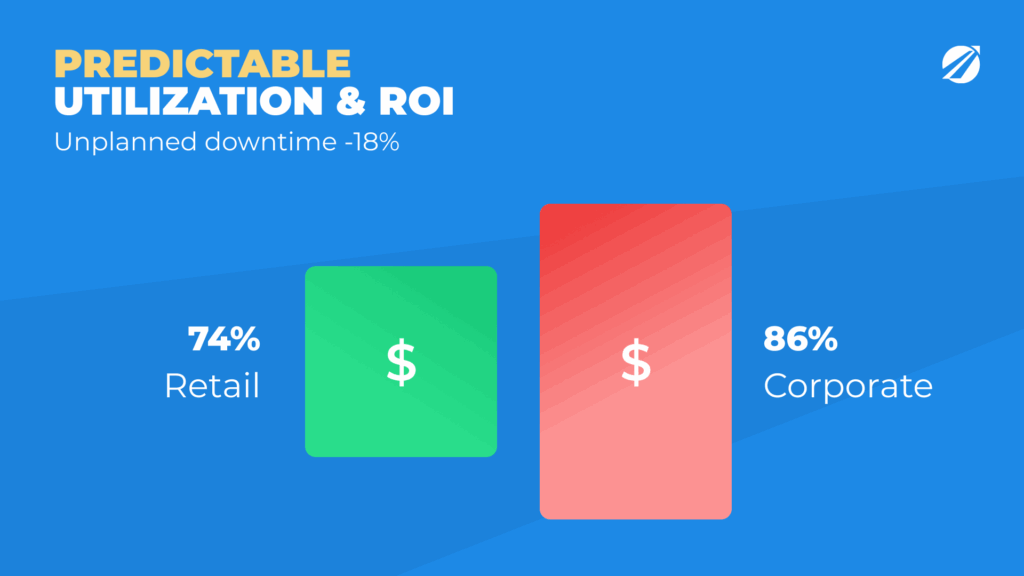

This planning stability directly impacts ROI. Vehicles spend fewer days idle, workshop scheduling becomes efficient, and resale timing can be optimized around actual mileage instead of arbitrary cycles. A 100-car operator who shifted 30% of its fleet to recurring corporate contracts saw average annual utilization climb from 74% to 86%, while unplanned downtime fell by nearly 18%. That reliability boosts more than profitability — it strengthens trust with lenders and suppliers, reducing financing costs and enhancing your credit standing.

When utilization becomes predictable, capital is deployed more effectively. When your baseline revenue is known, you can negotiate better lease terms, order vehicles in bulk with OEMs, and reduce the “panic buying” that erodes profit during peak seasons. Put simply, consistent B2B demand turns fleet management from reactive to strategic. It lets you operate proactively rather than defensively — a hallmark of mature rental operations.

Challenges and Risks

High Service Expectations

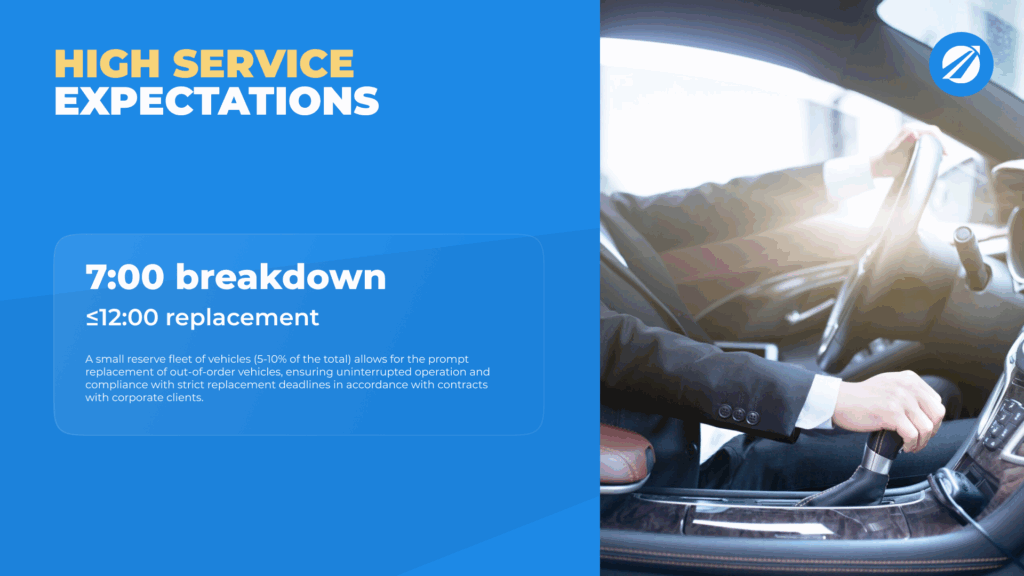

Corporate cars are work tools. A salesperson without a car misses meetings; a field engineer without a van misses SLAs. That’s why B2B contracts measure replacement time in hours and uptime by quarter. Keeping a 5–10% buffer fleet looks like inefficiency on a spreadsheet and like professionalism when a car fails at 7 a.m. and the replacement is on site by lunch.

Contractual Complexity

Unlike counter agreements, corporate contracts are living documents. Mileage caps, geography limits, driver eligibility, deductible levels, sustainability requirements, report formats — they all land in the fine print. Negotiation cycles can run for weeks. You’ll want robust templates, a clear process for change orders, and someone who knows when “a small extra report” should be an addendum with a price tag.

Credit Risk and Late Payments

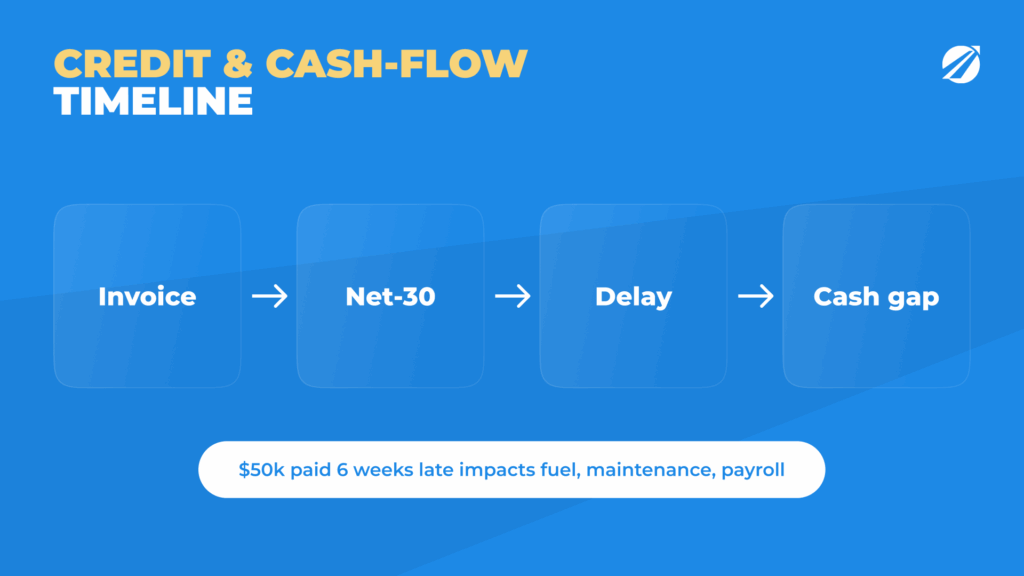

Retail transactions fund themselves; corporate ones do not. Net-30 or net-60 terms are normal, and cash can lag well beyond that if finance teams are slow. A $50,000 invoice paid six weeks late is a problem if you planned fuel, maintenance, and payroll on punctual receivables. Tier credit lines and deposits by counterparty strength; run credit checks; set caps for young firms; and build dunning sequences into your billing rhythm so you don’t discover aging debt by accident.

Operational Demands

A corporate account isn’t a series of bookings; it’s a relationship with goals and consequences. You’ll need account managers who own the SLA scoreboard, call logistics without being asked, and surface opportunities to optimize cost for the client. You’ll need policies for rapid scaling up or down without whiplash. You’ll probably need partner operators in adjacent cities to make “nationwide coverage” a promise you can keep.

Staff Training and Internal Alignment

Serving corporate clients requires a different internal culture — one closer to enterprise service delivery than traditional car rental. Every department must understand the contract commitments, the escalation paths, and the financial stakes of delay or miscommunication. The same five-minute mistake that barely registers in retail — like a misplaced key or missed inspection — can trigger a breach of SLA or a penalty in B2B.

Front-line teams should know the basics of each key contract: which clients have guaranteed replacements, which have strict mileage caps, which vehicles belong to which departments. Regular briefings, even ten minutes weekly, reinforce accountability and prevent expensive misunderstandings.

Operators that invest in training see measurable returns. One mid-size firm in Central Europe launched short “SLA briefings” twice a week for staff, walking through recent cases and discussing what worked or failed. Within two months, service complaints fell by 40% and incident handling times dropped by a third. Internal alignment also supports morale — teams understand why standards are high and see how their precision translates into retained revenue.

In B2B rentals, excellence isn’t only about fleet quality or pricing; it’s about operational discipline. The best operators turn professionalism into a habit, making every staff member part of the service promise that corporate clients are paying for.

KPI Framework for Corporate Rentals

Utilization Rate (UR)

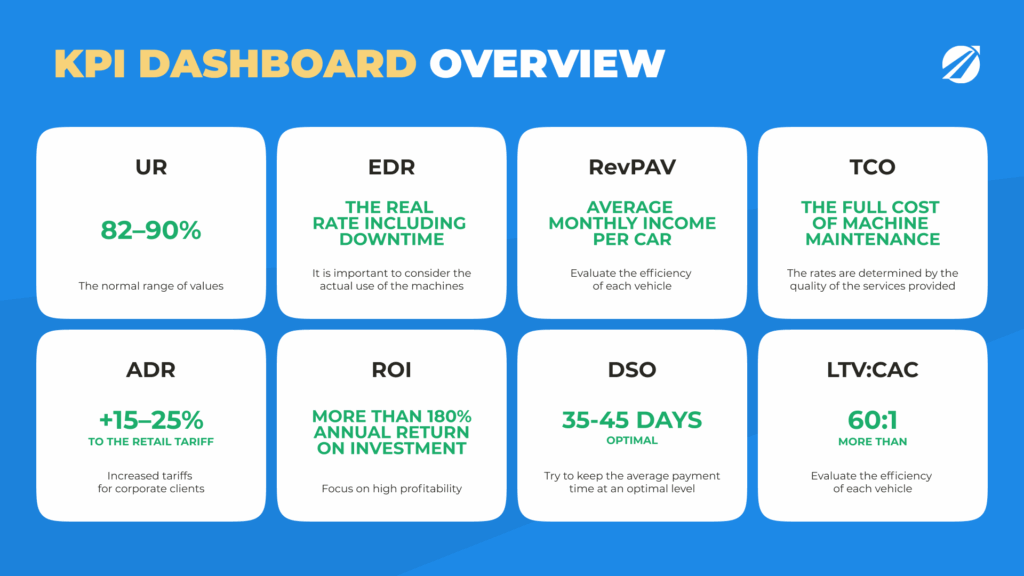

UR is rented days divided by available days across the contracted fleet. Corporate utilization is typically higher because blocks run longer and weekends don’t break the rhythm. If 50 cars are available for 30 days (1,500 days total) and you post 1,320 rented days, UR of 88% is excellent. Protect it — but don’t chase 100% at the cost of reliability. A few vehicles held in reserve can be the difference between a calm email and a penalty clause.

Average Daily Rate (ADR) and Effective Daily Rate (EDR)

ADR is the familiar ratio: revenue divided by rented days. EDR divides revenue by total contract days, capturing the cost of idle time that’s still “on you” under a commitment. If $18,000 covers 360 rented days, ADR is $50. If, because of client patterns, only 330 days were actually used, EDR drops to $45. Use the pair in renewal talks: ADR explains price; EDR reveals utilization truth.

Revenue per Available Vehicle (RevPAV)

RevPAV bakes price and utilization into one number: segment revenue divided by the number of vehicles in that segment. If 20 business-dedicated cars generate $90,000 a month, RevPAV is $4,500. Compare that to a 40-car retail segment at $120,000 total — $3,000 RevPAV. The lesson is consistent: steadiness often beats peaks.

Total Cost of Ownership (TCO)

TCO tallies all recurring costs per unit: lease or finance, insurance, maintenance reserve, taxes and fees, and depreciation. Suppose a mid-size sedan runs $550 for the lease, $120 insurance, $60 for maintenance reserve, and $200 depreciation each month. At $930 TCO against $1,200 billed, contribution is $270 per unit. Across 20 cars that’s $5,400 a month — meaningful margin you can defend because it’s anchored in service, not a headline rate.

Contribution Margin and ROI

Contribution (revenue minus variable costs) is the money left to cover fixed overhead and profit. ROI puts contribution into context against the capital you invested to acquire, prepare, and place the fleet. If 15 cars carry $10,500 monthly TCO and bring $18,000 revenue, contribution is $7,500 a month or $90,000 a year. If the onboarding spend — including deposits, accessories, and the time your team spent on legal — was $50,000, a year-one ROI of ~180% is a fair benchmark for a healthy contract set.

Cash-Flow Optics and Forecasting

Revenue without receivables discipline can lull operators into complacency. Tie your AR aging, deposit balances, and renewal calendar into a simple rolling 90-day cash-flow view so a single late $100,000 invoice doesn’t trigger emergency cuts. On the planning side, forecast utilization and renewal probability by account. If operators consistently calibrate within ±5–10% of actual demand, they avoid over-buying and the depreciation that follows.

Customer Lifetime Value vs CAC

B2B CAC includes research, outreach, demos, proposals, and legal — not just ad clicks. But LTV dwarfs it when you run accounts well. A $6,000 CAC for a three-year, $120,000-per-year contract yields $360,000 LTV and a 60:1 LTV:CAC ratio. Few marketing motions in rental return that kind of multiple.

Benchmarking and Data Maturity

Measuring KPIs is only the first step; understanding what “good” looks like is what makes the data useful. Too many operators collect numbers in isolation without comparing them to meaningful baselines. Through benchmarking, managers develop the focus and perspective to decide with confidence.

In mature corporate rental operations, a utilization rate (UR) between 82–90% is healthy; below that suggests overcapacity, above that hints at risk to service reliability. ADR for business segments is typically 15–25% higher than retail, reflecting the value of uptime guarantees and premium vehicles. Average Days Sales Outstanding (DSO) — how long it takes to collect invoices — ranges from 35 to 45 days in well-managed fleets.

Tracking these metrics consistently lets operators identify weaknesses early. If your EDR is lagging behind peers, you might be overcommitting cars on fixed contracts or mispricing downtime. If RevPAV grows but ROI stagnates, it may indicate cost creep in maintenance or insurance. The goal isn’t just to hit a number — it’s to know why you’re hitting it and what to adjust.

Advanced operators also mature their data over time. Instead of manual spreadsheets, they connect live dashboards to accounting and telematics feeds, automate KPI updates, and run quarterly performance reviews per client. Such openness builds assurance internally and legitimacy externally, meeting the growing corporate demand for transparent, data-supported renewal processes.

Marketing and Sales Strategies for B2B Clients

Targeting and Outreach

LinkedIn, email sequences, and networking

The buyer is rarely the driver. Aim for procurement, HR, travel coordinators, and the heads of teams who own mobility budgets. Build a focused list of ideal accounts, approach with useful, relevant messages (not generic brochures), and show evidence — one page that looks like the report they’ll receive monthly says more than an adjective-heavy deck. Pair digital outreach with a local presence: chambers of commerce, industry breakfasts, and trade fairs where buyers go to reduce risk by meeting suppliers face to face.

Responding to RFPs and Tenders

How to structure proposals and pricing

Clarity and proof of value are what win RFPs. State the scope and the outcome first (“we will keep 60 reps at ≥95% uptime across five cities, with replacements in ≤6 hours”), then show the machine behind it: SLA table, pricing by class and mileage, example dashboard, escalation path, and two concise case studies. The aim is to make your buyer look credible internally. If the finance lead can lift your utilization chart into their deck, you’ve helped them sell you.

Partnerships and Channels

Travel agencies, relocation firms, insurance companies

Not every enterprise will come directly. Travel agencies bundle cars with flights and hotels; relocation outfits standardize city arrivals; insurers prefer a single, dependable partner across a region. A single well-run partnership can be worth a cold email campaign that ran for a year. The economics are simple: low acquisition cost, recurring mid-term bookings, and a buyer who already trusts you from prior cases.

Building Trust and Authority

Case studies, certifications, testimonials

Risk-averse procurement teams default to suppliers who look like a safe choice. Publish two or three short, specific case studies (problem → approach → SLA performance → result). Keep testimonials tight and tied to outcomes. If you’ve earned relevant certifications — quality management, data security, sustainability — make them easy to find. And make your corporate page look like it belongs in a board packet, not only on a tourist page.

Nurturing and Retention

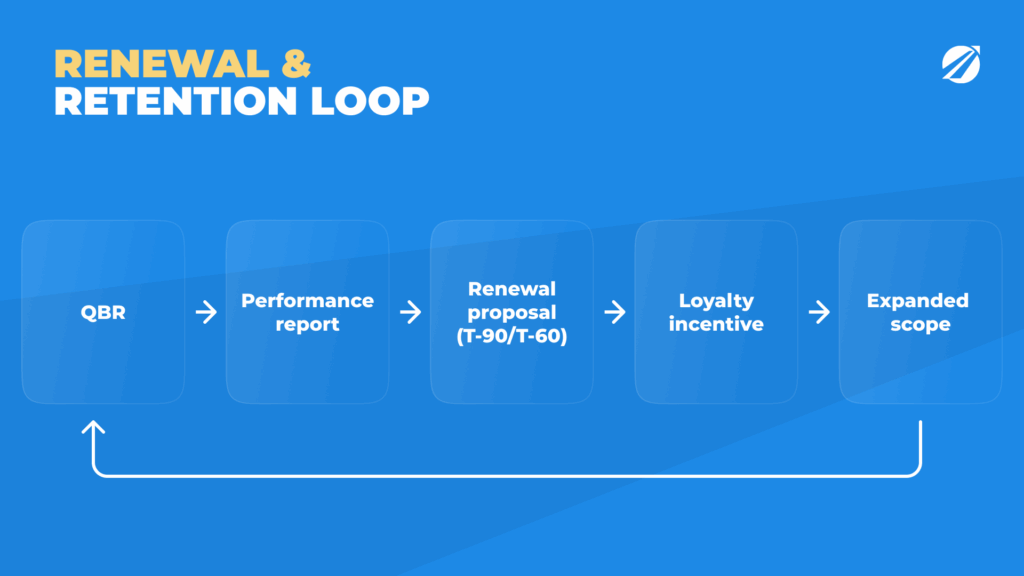

Winning a corporate client is only half the game; keeping them is where the profit lies. B2B rentals thrive on relationships that deepen over time — each renewal builds trust, reduces acquisition cost, and increases share of wallet. That’s why successful operators treat retention as a structured process, not a happy accident.

Start with regular reviews. Schedule quarterly business reviews (QBRs) where you share utilization stats, incident metrics, and service improvements. These meetings ensure that your performance story is heard — and your reliability remembered — before procurement launches its next competition. Presenting a clear renewal proposal 60–90 days before contract end can lift retention rates dramatically.

Then, shape the journey around the client’s needs. Corporate accounts expect recognition: a dedicated contact, fast escalation paths, and reports tailored to their departments or regions. Send monthly summaries that highlight both performance and savings achieved. When clients see quantified value — “uptime maintained at 97.6%” or “incident response cut by 23%” — they view you as a partner, not a vendor.

Reward loyalty. Introduce renewal bonuses, discounted delivery for extended contracts, or flexible upgrades for long-term clients. One operator in Croatia implemented quarterly review calls combined with “renewal comfort” incentives — free delivery for contracts over 12 months — and retention jumped from 68% to 84% within a year.

Retention is the quiet growth engine of corporate rentals. Every satisfied client becomes a reference, a testimonial, and often a gateway to other departments or subsidiaries. In this segment, keeping one happy account is often worth chasing ten new ones.

Operations and Customer Experience

Account management and SLAs

Assign a named account manager to every corporate client. Their job is to know the contract, the drivers, the usage rhythm, and the renewal date — and to act before the client asks. Keep a one-page SLA living document that both teams recognize: replacement window, uptime target, maintenance cadence, report dates, and escalation contacts. Operators who install this simple operating system see renewal rates lift and noise fade.

Billing and invoicing models

Monthly invoicing, consolidated billing, automated payments

Corporate finance teams don’t want to reconcile dozens of receipts. They want one invoice with the right splits by department or location, the PO referenced correctly, and no surprises. Manual compilation invites errors that quickly turn into trust problems. When contracts generate invoices automatically from bookings, mileage, and incident fees, disputes fall, and collections accelerate. The difference between “we think we sent it” and “it’s ready in the portal on the fifth” is a relationship.

Fleet flexibility and replacements

Be ready to swap vehicles as the client’s needs shift. If a project moves out of city centers, SUVs may replace compacts; if a national conference spikes demand, partner capacity can save your SLA. Write swap rules into contracts so billing transitions are clean. A day of downtime for a ten-person sales team can cost a client thousands; the operator that prevents that loss becomes a line item the CFO protects.

Reporting and analytics for clients

Send reports that make decisions easy: utilization by department, spend by cost center, incident logs with time-to-resolution, and, where relevant, emissions data that feed sustainability reporting. When clients can answer their own “How many cars are we actually using?” from a portal rather than an email chain, they trust you more and ask for fewer favors.

Preventive maintenance and driver onboarding

SLA compliance is easier when maintenance is proactive. Scheduling by mileage or telematics triggers — say every 10,000 km — and coordinating temporary swaps avoids reactive scrambles. A brief driver orientation reduces confusion about insurance, charging rules for EVs, and app workflows; over time that education shows up as lower incident frequency and fewer tense calls.

Creating a white-glove experience

Small touches — Sunday evening delivery for Monday projects, branded key tags, a direct hotline — send a signal that you operate at your client’s level. They make the premium segment feel earned, not arbitrary. One operator who introduced Sunday drops on a consulting account saw the fleet expand by two-thirds within a year; the marginal logistics cost paid for itself many times over.

Legal, Insurance, and Compliance

Contract structures

Deposits, cancellation policies, and liability

Corporate contracts balance flexibility with protection. Reduced deposits paired with bank guarantees, partial-return clauses that allow a client to hand back up to 10% of cars each quarter, liability caps that prevent open-ended claims, driver eligibility, and geographic limits are all common. You want to make expectations transparent but keep the agreement realistic on both ends.

Insurance models for corporate fleets

Coverage tiers and deductibles

Offer coverage options that convert uncertainty into a fixed line item. Some clients will accept a higher deductible to keep rates down; others will pay more for zero-deductible peace of mind. If a $25,000 vehicle suffers $8,000 in damage, the difference between a $5,000 deductible and a $1,000 one is real money in a department budget. Framing those choices clearly improves upsell odds and reduces friction when incidents happen.

Tax and regulatory considerations

Cross-border rentals raise VAT questions and, in some regions, long-term rentals blur into leasing for regulatory purposes. Keep multi-branch accounting neat and audit trails tidy. Increasingly, enterprise buyers also track fleet emissions. If you can segment reports by powertrain and show reductions from hybrids or EVs, you’re not just compliant — you are helpful.

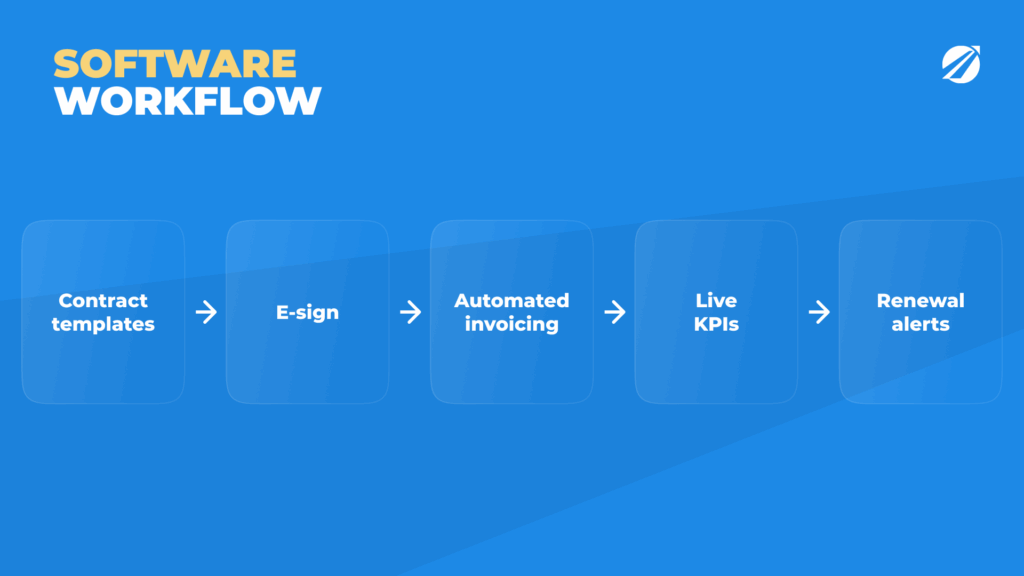

How Rental Management Software Supports Corporate Rentals

Manual spreadsheets and email forwarding can’t sustain corporate-scale operations. Dedicated software is the difference between “we’re coping” and “we are in control.”

Contract templates and e-signature

Corporate agreements are long and customized. Templates let you adapt terms in minutes instead of days; e-sign lets both sides close in hours. Shorter cycles mean faster revenue and less chance for momentum to stall as documents bounce around inboxes.

Automated invoicing and payment tracking

When invoices generate automatically according to contract rules — and reminders fire exactly when they should — billing stops being a monthly fire drill. Finance teams see what’s owed, by whom, and for how long at a glance. Cash-flow surprises become rare.

Utilization and profitability dashboards

Live views of UR, ADR, EDR, RevPAV, and contribution by client or vehicle turn feelings into facts. Before you bid, scenario models show how a rate change, utilization assumption, or coverage tier affects margin. During the contract, those same panels tell you when to reallocate cars or push for a mid-term adjustment.

Alerts for renewals and expiring contracts

Renewals are where the economics of B2B shine, but only if you see them coming. Alerts at T-90 and T-60 force the cadence: schedule the review, bring the performance deck, and have a draft renewal on the table before the client asks. Many operators recover six figures annually just by never missing the moment.

Case Studies and Best Practices

Small operator winning a corporate account

A 35-car company that lived on airport leisure decided to pursue relocation firms. They offered eight cars at a fixed monthly rate with a 12-hour replacement SLA and simple monthly usage reports. The first client, cautious at first, signed for a three-month pilot; by month six the fleet grew to twelve cars and the account represented $151,200 a year in recurring revenue. Winter stopped being scary; planned upgrades became possible. The lesson wasn’t “grow your fleet fast” — it was “grow your credibility fast.”

Large rental firm scaling B2B contracts

A 2,000-vehicle operator in Spain wanted revenue that didn’t vanish after summer. They landed a pharma account for 100 cars with six-hour replacements nationwide and quarterly reviews. With strong dashboards and automated billing behind the scenes, utilization hovered around 88%, renewals were teed up well in advance, and the account expanded to 150 cars — over €2 million a year. That combination of visible competence and quiet reliability opened doors with insurers and telecoms who had watched from the sidelines.

Lessons learned and pitfalls to avoid

Three mistakes repeated. First: overpromising replacement times without the network to honor them; penalties and churn follow. Second: skipping credit checks for shiny logos; one default can erase a year’s profit. Third: sending inconsistent spreadsheets instead of dependable dashboards; procurement teams don’t have patience for “we’ll get back to you” after a quarter end. In B2B, transparency is part of the product.

Conclusion — Building a Strong Corporate Rental Business

Key takeaways

Corporate rentals aren’t big retail — they’re a different model. They reward operators who run like their clients: on process, on numbers, on commitments kept. If you lock in a base of recurring revenue, measure the right KPIs, and keep your promises under pressure, you’ll discover that steady utilization at a sensible rate beats chasing peak ADRs that disappear when the weather changes.

Balancing opportunities and risks

Yes, sales cycles are longer, contracts heavier, and payments slower. But if you structure credit carefully, standardize contracts, keep a modest buffer, and make reliability an operating principle, the result is revenue that doesn’t care about tourist seasons. That stability is the foundation on which you can experiment — EV mixes, new regions, higher-touch service tiers — without betting the company each quarter.

Use TopRentApp to win, manage, and retain corporate clients

To make all of this repeatable, you need more than good intentions — you need a system. TopRentApp brings corporate-grade tooling into a single workflow: contract templates with e-signature to close faster, automated consolidated invoicing and payment tracking to protect cash flow, utilization, and profitability dashboards to price and steer accounts with data, and renewal alerts so lifetime value isn’t left to chance. If corporate rentals are your next growth engine, put the right software behind them and turn complexity into a competitive edge.

Winning corporate clients requires reliability, consistency, and professional workflows.

👉 Request a free demo and see how TopRentApp standardizes operations, reporting, and invoicing.

A corporate rental management software helps you build long-term business relationships.