In 2026, boat and yacht rentals stand out as a driving force within the international travel and leisure industry. What was once a niche market dominated by luxury travelers and specialized charter companies is now entering the mainstream. Families on vacation, groups of friends celebrating milestones, and even corporate teams planning incentive trips are all turning to water-based experiences. Growing household spending power, improved air connectivity, and the cultural embrace of experiential travel are together driving a transformation in demand.

International data points to the same momentum. The yacht charter market alone is projected to exceed $35 billion by 2030, expanding at an annual growth rate of around 6–7%. Short-term leisure boat rentals, supported by digital platforms such as GetMyBoat, Click&Boat, and Boatsetter, are growing even faster. These platforms, often described as the “Airbnb of the seas,” have lowered entry barriers by connecting independent operators directly with international travelers.

Yet, opportunity comes hand in hand with complexity. As high-value assets, boats and yachts carry heavy acquisition expenses, sharp depreciation curves, and constant servicing needs. Unlike cars, which can be rented year-round in most locations, maritime assets are heavily exposed to seasonality, weather disruptions, and regulatory hurdles. Licensing, insurance, and safety obligations are strict, and the risks — ranging from passenger accidents to fraud — can threaten profitability if not managed carefully.

It is intended for business owners and executives weighing the decision to launch or grow their presence in this market. It is not a generic overview but a practical, data-driven roadmap. We’ll study how the global market is evolving, who the core customers are, and which business models prevail. We will also analyze the financial mechanics — utilization rates, average daily rates, total cost of ownership, and ROI — so that operators can plan realistically rather than optimistically. In the following parts, we’ll address fleet strategy, pricing approaches, operational management, compliance issues, marketing, and how technology fits in.

At the highest level, the aim is to pair ambition with a grounded approach. Boat and yacht rentals can be enormously profitable for those who align their fleets with market realities and who manage operations with discipline. At the same time, those who underestimate risks or skip proper planning often discover that costs spiral faster than revenue. With the right tools — including specialized platforms like TopRentApp — operators can navigate this balance, turning vessels into profitable assets and building businesses that endure.

Market Overview and Customer Segments

Shaped by geography, customer preferences, and infrastructure, the rental market remains highly varied and fragmented. Demand in the Mediterranean looks very different from demand in urban lakes, and the expectations of a tourist booking a half-day trip are not the same as those of a corporate executive planning a VIP retreat. Before acquiring vessels or creating packages, operators must first understand these dynamics.

Global and Regional Trends

Coastal/Tourist Hotspots

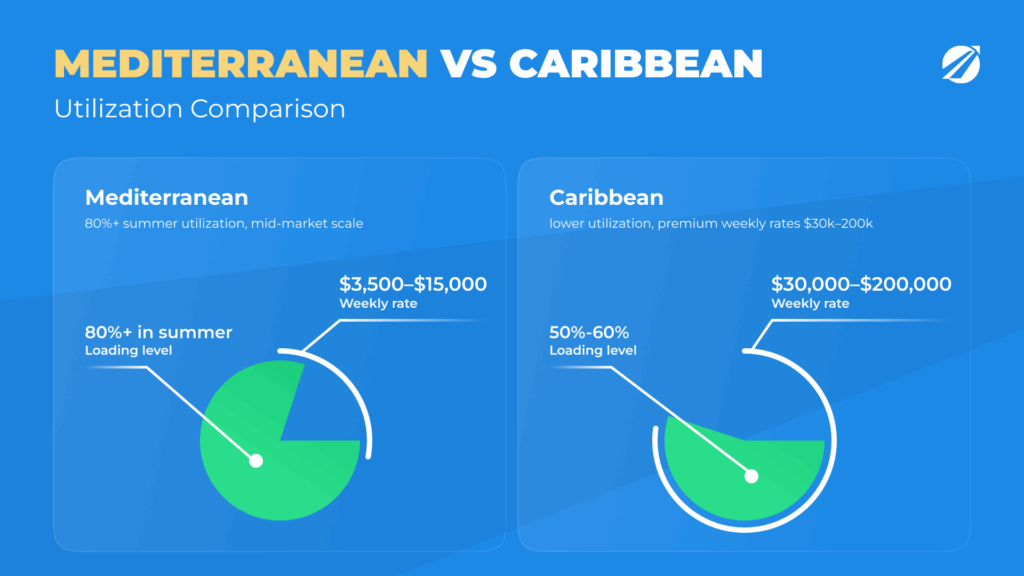

The coastline remains the primary hub for rental demand. The Mediterranean leads the global yacht charter industry, with Greece, Croatia, Italy, Spain, and Turkey hosting tens of thousands of bookings every summer. In Croatia alone, the sector generates €800 million annually, with charter utilization rates above 80% during peak months. Yachting here is not only about luxury but also about scale: bareboat charters are common, and middle-class European travelers account for a large share of demand.

The Caribbean, by contrast, represents a premium winter market. The Bahamas, St. Barts, and the British Virgin Islands attract high-net-worth travelers escaping colder climates. Weekly charters range from $30,000 to over $200,000, usually on fully crewed yachts with extensive services. Utilization is lower compared to Europe, but margins are higher, and demand is concentrated around Christmas, New Year’s, and spring break.

In Asia, growth in Phuket, Bali, and the Maldives is accelerating thanks to steady inflows of visitors from China, India, and the Middle East. Bundling is evident here, with yacht rentals linked to diving, snorkeling, or honeymoon packages to maximize customer value.

Urban Waterfronts and Lakes

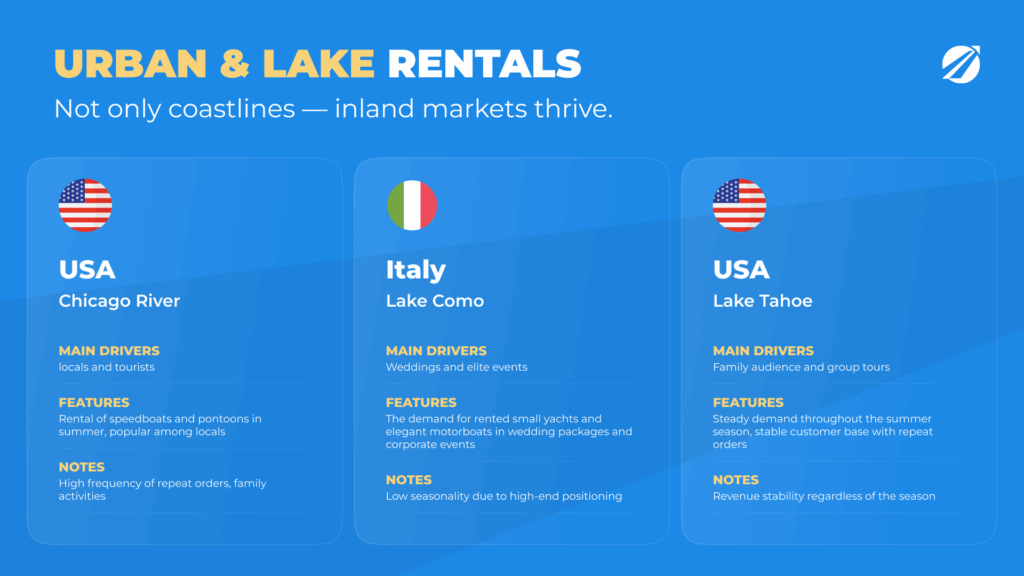

Not all opportunities lie by the sea. Inland and urban markets are becoming increasingly significant. Chicago’s river and Lake Michigan host thousands of pontoon and speedboat rentals each summer, often driven by locals rather than tourists. Toronto leverages Lake Ontario for corporate and leisure bookings, while Sydney Harbor combines local demand with global visibility.

Major lakes such as Como, Geneva, Tahoe, and Victoria also support thriving rental businesses. These markets are less seasonal than Mediterranean resorts and often focus on repeat customers. For example, operators around Lake Tahoe report strong demand for family and group bookings throughout summer, while Lake Como positions itself as a luxury destination where small yachts and stylish speedboats are bundled into wedding or event packages.

Key Customer Profiles

Tourists (Day Trips and Sightseeing)

Tourists represent the volume-driven foundation of the market. Customers typically reserve boats for sightseeing, day excursions, or water sports, with many bookings made at the last minute. Revenue per trip is relatively modest, from $300 to $600, but high turnover and strong seasonality can make this segment very profitable. In Miami, operators with fleets of five to ten speedboats often gross over $100,000 in just a three-month summer window.

Weddings, Parties, and Corporate Events

As a premium category, events consistently deliver high-margin returns. A mid-sized yacht in Santorini or Dubrovnik can command $5,000–$10,000 per day for weddings or private parties. Corporate bookings in hubs like Dubai, Barcelona, and Singapore often exceed $20,000, with catering, entertainment, and branding layered into the package. Price is not their main concern; flawless execution is — making partnerships with hotels and event organizers vital.

VIPs, Celebrities, and High-Net-Worth Individuals

Luxury charters target the wealthiest travelers, many of whom book through brokers rather than directly. This clientele expects discretion, tailored experiences, and service at a concierge standard. A mega-yacht in the Caribbean may charter for $150,000 per week, with APA charges covering fuel, food, and extras. While utilization is low — perhaps only 10–20 weeks annually — the revenue per booking is enormous. For operators, reputation, crew professionalism, and discretion are as important as the vessels themselves.

Fishing and Sports Enthusiasts

Fishing charters form a less glamorous but resilient niche. In regions like Florida, Mexico, and Southeast Asia, trips range from $500 to $2,500, appealing to groups of enthusiasts. Unlike luxury charters, this segment is less seasonal and less vulnerable to economic cycles. A number of operators add snorkeling or sightseeing to fishing trips, broadening their offer and boosting utilization.

Business Models in Boat and Yacht Rentals

Boat and yacht rental companies can operate under very different models, and each approach shapes not only revenue but also marketing, fleet requirements, and customer expectations. While it is tempting to see the business simply as “owning boats and renting them out,” the reality is far more nuanced. Selecting the right model, or blend of models, ranks among the most critical strategic choices for any operator.

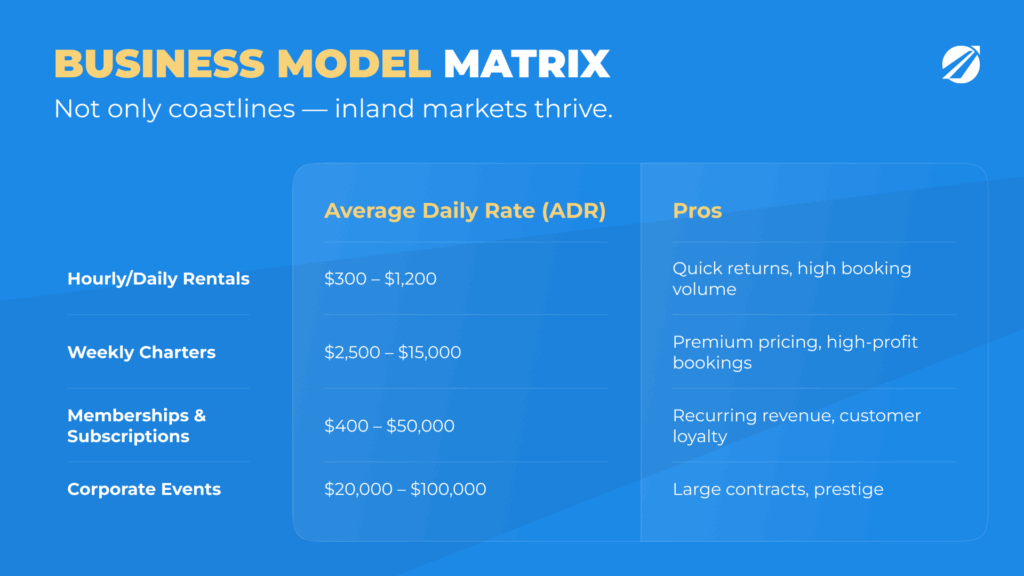

Short-Term Rentals (Hourly / Daily)

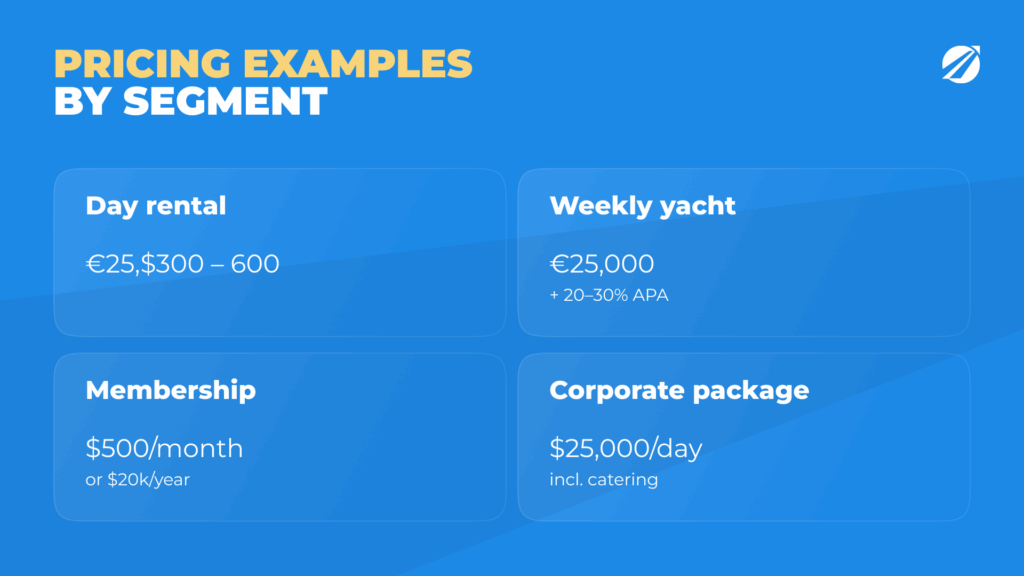

In tourism-driven markets, short-term rentals hold the largest share, particularly in coastal cities and lakeside areas. Customers in this segment are primarily leisure travelers or locals seeking quick experiences, such as sightseeing, family outings, or water sports. A half-day rental might cost $250 to $500, while full-day bookings for speedboats or pontoons typically range from $400 to $1,200, depending on location and season.

The financial success of this approach is driven by high booking volumes and intensive asset use. A single boat in Miami can bring in $50,000–$70,000 over a summer if booked consistently. The challenge, however, lies in competition: dozens of operators often compete for the same pool of spontaneous bookings, forcing businesses to differentiate themselves with superior service, online visibility, or partnerships with hotels and tour agencies.

Multi-Day and Weekly Charters

At the premium end, yachts designed for longer voyages form the backbone of the charter industry in the Mediterranean and Caribbean. These bookings often last a week and include accommodations, crew, and itineraries. Prices vary dramatically: a 40-foot sailing yacht may cost $8,000–$12,000 per week, while a 70-foot motor yacht may fetch $50,000–$100,000, excluding APA (advance provisioning allowance).

This model creates high-margin opportunities, as one or two charters can equal the annual revenue of a small boat. It also obliges larger initial outlays, dedicated crews, and disciplined upkeep. Unlike small boats, where customers tolerate minor imperfections, charter clients expect flawless experiences. Falling short damages reputation, and recovery can take years.

Memberships and Subscriptions

In urban areas and among wealthy residents, membership and subscription models are becoming increasingly popular. Customers pay monthly or annual fees for guaranteed access to a fleet. For example, memberships at clubs in the US often start at $400–$600 per month for smaller boats and climb to $20,000–$50,000 per year for premium yacht access.

It offers reliable recurring revenue that stabilizes earnings across seasonal cycles. Churn rates are relatively low, especially when combined with loyalty perks.The real difficulty comes from balancing scheduling with capacity control. If too many members compete for limited vessels during peak weekends, dissatisfaction can lead to cancellations. Successful clubs manage this by diversifying fleets, implementing tiered memberships, and using software to coordinate access.

Corporate Partnerships and Events

Corporate bookings represent an often underappreciated yet highly profitable segment. Companies rent vessels for client entertainment, team-building, or executive retreats. In Dubai or Singapore, for instance, a single day-long corporate charter may exceed $20,000 when bundled with catering, entertainment, and branding services.

Relationship-driven demand is the hallmark of this model. Unlike tourists who book spontaneously, corporate clients often return year after year, creating dependable pipelines. The challenge is in the sales cycle: building these partnerships requires time, networking, and credibility. Yet once secured, corporate contracts provide stability and significantly raise average booking values.

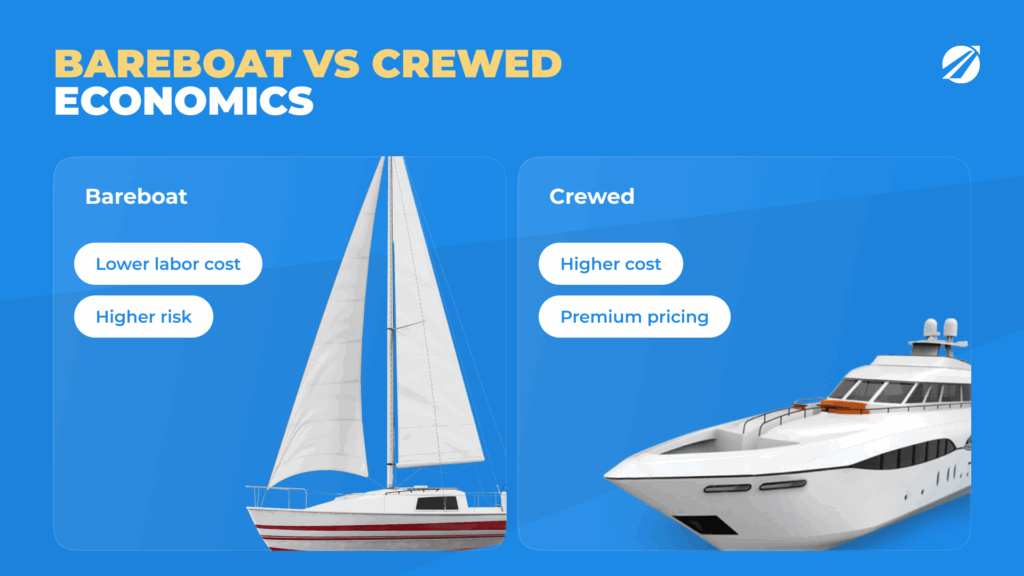

Bareboat vs Crewed Rentals

Across all models, operators must decide whether to offer bareboat or crewed services. Bareboat rentals, common in Croatia or Greece, appeal to experienced sailors who want independence. Although labor costs decrease, the risks of damage and liability rise. Crewed rentals dominate in the Caribbean and luxury markets, where customers expect not just a captain but also stewards, chefs, and deckhands.

The economics of these choices differ sharply. While margins per booking are higher in bareboat charters, operators face greater uncertainty and risk. Crewed charters demand higher fixed costs but create premium experiences that can command far higher rates. The choice is rarely binary; many operators offer both, adjusting based on region, season, and customer segment.

KPI Framework for Boat/Yacht Rentals

Success in the boat and yacht rental business depends not only on owning attractive vessels or marketing them well but also on tracking the right financial and operational metrics. Boats are costly assets to acquire and operate, and profitability often depends on how precisely performance is tracked. The following key performance indicators (KPIs) form the backbone of a reliable framework.

Utilization Rate (UR)

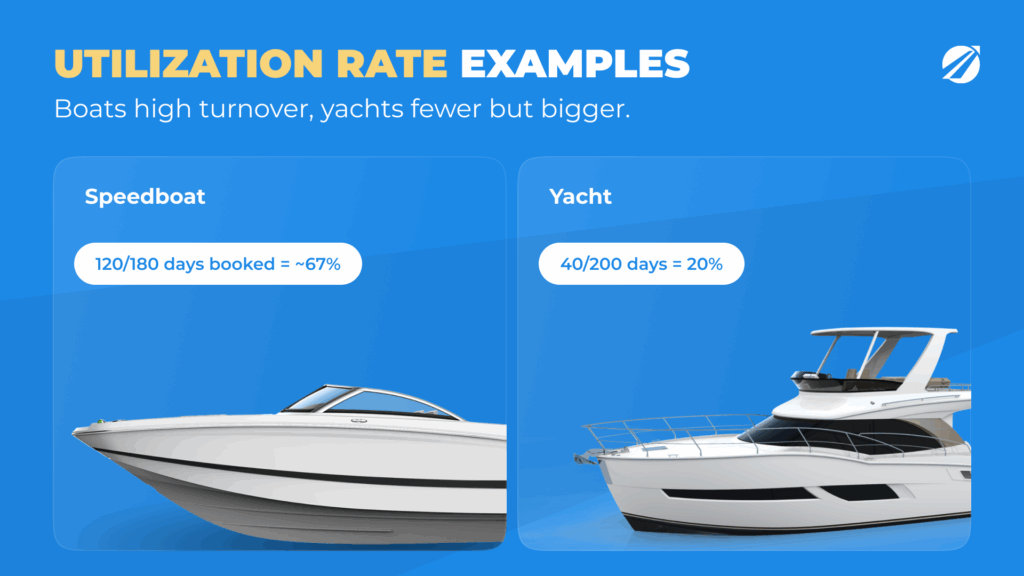

The utilization rate shows how frequently a vessel is rented compared to how often it is available for booking. To illustrate, imagine a speedboat that can be offered for rent on 180 days each year. If customers book it for 120 of those days, the utilization rate is around two-thirds. Now consider a luxury yacht available for 200 days but chartered only 40 times; the utilization rate is just one-fifth.

Performance benchmarks vary according to the type of vessel. Small boats are expected to achieve much higher usage, often averaging 40 to 50 percent annually, and peaking at 70 to 80 percent during the busiest summer months. Yachts, on the other hand, typically operate at 15 to 25 percent annual utilization, but each booking represents far greater revenue. A common pitfall for new operators is assuming unrealistically high utilization when building business plans — for example, projecting 30 booked weeks for a yacht when 12 weeks is already a very strong season.

Average Daily Rate (ADR) and Effective Daily Rate (EDR)

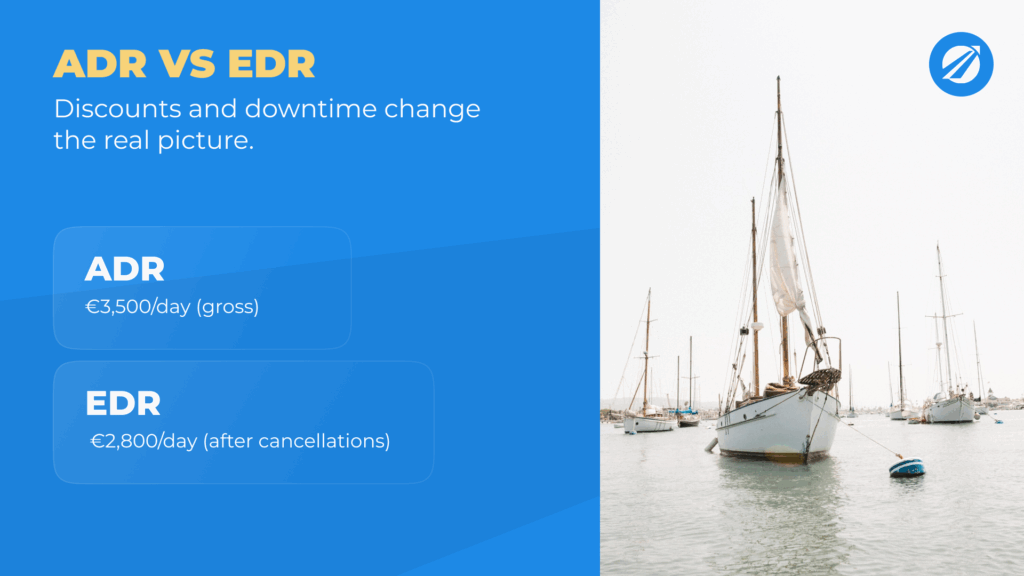

The average daily rate is the amount of revenue earned for each booked day. If a yacht brings in €35,000 over ten days of bookings, then its ADR is €3,500. The effective daily rate refines this figure by including discounts, cancellations, or periods of downtime. Using the same example, if cancellations reduce the actual income to €28,000, the effective rate drops to €2,800.

Price levels vary widely. Smaller boats are generally priced between $300 and $600 per day, mid-sized yachts fetch $2,500 to $6,000, while luxury yachts surpass $15,000 daily. Seasonality plays a major role as well: peak weeks in the Mediterranean or Caribbean often double the going rate compared to the shoulder season.

Revenue per Available Vessel (RevPAV)

While ADR focuses only on days actually booked, revenue per available vessel provides a broader measure of efficiency. It looks at total revenue earned against the entire pool of available vessel days. Imagine a company with ten boats, each available for 200 days per year, creating 2,000 available days in total. If the fleet generates $1,000,000 in revenue, then the company is effectively earning $500 for each available day across the fleet, whether booked or not.

For short-term boat rentals, RevPAV typically falls between $200 and $600 per day. Yacht charters, although fewer in number, can achieve $1,000 to $5,000 or more per day, depending on size, location, and season. It enables operators to compare different models fairly and consistently.

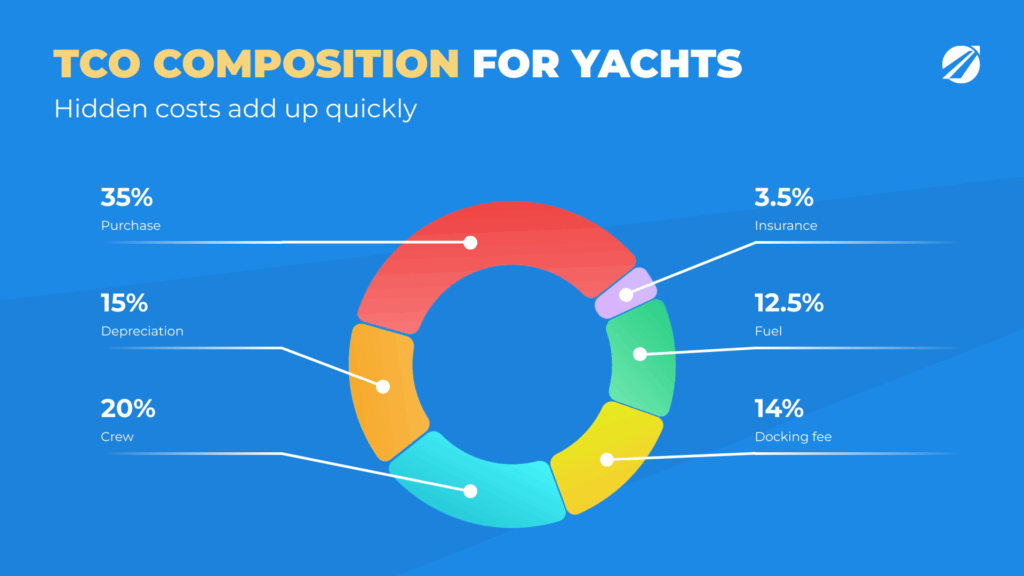

Total Cost of Ownership (TCO)

Owning and operating vessels is expensive, and ignoring costs is the fastest path to financial trouble. Total cost of ownership includes acquisition or lease expenses, depreciation, crew salaries, insurance, fuel, docking fees, and maintenance. Depreciation alone can reduce the value of a yacht by 10 to 20 percent annually. Fuel consumption on motor yachts may absorb 10 to 15 percent of charter revenue. Marina fees range from a few hundred dollars a month in smaller ports to several thousand in exclusive destinations such as Monaco. Crew salaries add substantial fixed costs, while insurance premiums typically equal two to five percent of vessel value per year.

Maintenance is the silent burden of the industry. Engines, onboard electronics, and interiors demand ongoing care, with unforeseen breakdowns bound to occur. For a 50-foot yacht, annual running costs often exceed $200,000 even before financing or marketing is considered. The issue for operators isn’t sidestepping these costs, but budgeting for them and making sure pricing and utilization offset the load.

Contribution Margin and ROI

Contribution margin measures what is left after subtracting operating costs from revenue. It shows if a vessel is genuinely contributing to profitability. For example, a speedboat might generate $60,000 in annual revenue against $25,000 in costs, leaving a margin of $35,000. With numbers like this, the boat can repay its acquisition cost within two to three years. A larger yacht could bring in $800,000 in revenue but consume $500,000 in costs, leaving a $300,000 margin. While this is a healthy contribution, the payback period extends to five to seven years.

Identifying break-even points offers additional insight. Small boats usually need 80 to 100 booked days per year to cover costs, while yachts often require at least 8 to 12 booked weeks annually to avoid losses.

Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC)

Not all bookings are equal. Tourists booking short trips are price-sensitive and rarely return, giving them low lifetime value. To capture them, operators often rely on advertising or online travel agencies, pushing acquisition costs up to $50 to $150 per booking. By contrast, corporate clients and subscription members are far more valuable. A single corporate contract may guarantee several events per year worth tens of thousands of dollars. Membership programs often retain 85 to 90 percent of subscribers annually, generating predictable recurring revenue and reducing the need for constant new acquisition.

Grasping the relationship between LTV and CAC is essential. A fleet that depends solely on low-value tourists will always struggle with high marketing costs. Building long-term relationships with corporate partners or members transforms the business model into something more stable and profitable.

Opportunities for Operators

The growth of the global boat and yacht rental market is not simply the result of wealthy travelers indulging in luxury. This reflects macroeconomic and cultural trends that benefit operators of every scale. Entrepreneurs can shape models that fit their ambitions and means thanks to the diversity and scalability of these opportunities.

Tourism Growth and Experiential Travel

International tourism has rebounded strongly and is projected to surpass 1.8 billion arrivals by 2030. At the same time, traveler behavior has shifted. Travelers now delve beyond the crucible of standard sightseeing, seeking a kaleidoscopic mosaic of moments that transcend routine and orchestrate truly unforgettable memories. A boat trip provides precisely that combination of adventure and exclusivity. In Santorini, sunset cruises have become so popular that many operators book out weeks in advance. In Cancun, speedboat tours through lagoons and reefs appeal to families and young travelers alike. This cultural shift toward experiences creates a steady stream of demand that is far less price-sensitive than traditional tourism services.

Premium Margins with Luxury Yachts

Luxury yachts stand out as assets capable of producing margins unmatched by smaller vessels. In the Caribbean, a 70-foot crewed motor yacht can command $50,000 per week, while mega-yachts in Monaco during peak summer events such as the Grand Prix or the Cannes Film Festival can fetch daily rates exceeding $100,000. Even after deducting fuel, docking, and crew costs, operators often retain contribution margins that outperform most sectors of the travel industry. Wealthy clients are less likely to negotiate on price; instead, they prioritize exclusivity, privacy, and service. Companies that can deliver effectively gain reputational advantages and enjoy high customer loyalty in this segment.

Ancillary Revenue (Add-ons, Catering, Activities)

One underappreciated strength of the industry is its ability to drive ancillary income. Customers rarely book just the vessel. A wedding party might want catering, floral arrangements, and a photographer. Corporate groups may request audiovisual setups, DJs, or branded décor. Fishing enthusiasts often rent specialized gear and pay extra for guided services. Every add-on boosts average booking value while enhancing the feeling of a well-rounded, curated experience for the customer. In practice, the most profitable operators view their boats and yachts not just as rentals but as platforms for bundled services.

Partnerships with Hotels, Resorts, and Travel Agencies

Strategic partnerships extend reach beyond what most operators could achieve on their own. A boutique hotel in the Amalfi Coast that includes private boat tours in its premium packages can funnel dozens of bookings to a single operator every season. Event agencies in Dubai frequently bundle yacht charters into high-end corporate packages, creating reliable, recurring business. Travel agencies and online booking platforms such as GetYourGuide or Click&Boat make it possible for small operators to attract international clients long before they set foot in the destination. These partnerships bring dual benefits — lower marketing costs and higher trust — since customers usually prefer recognized names.

Challenges and Risks

The very factors that drive the appeal of boat and yacht rentals also introduce major barriers and risks. Operators who underestimate these challenges often find themselves overwhelmed by costs or exposed to liabilities. Resilience is built by recognizing risks early and putting the right plans in place.

High Capex and Operating Costs

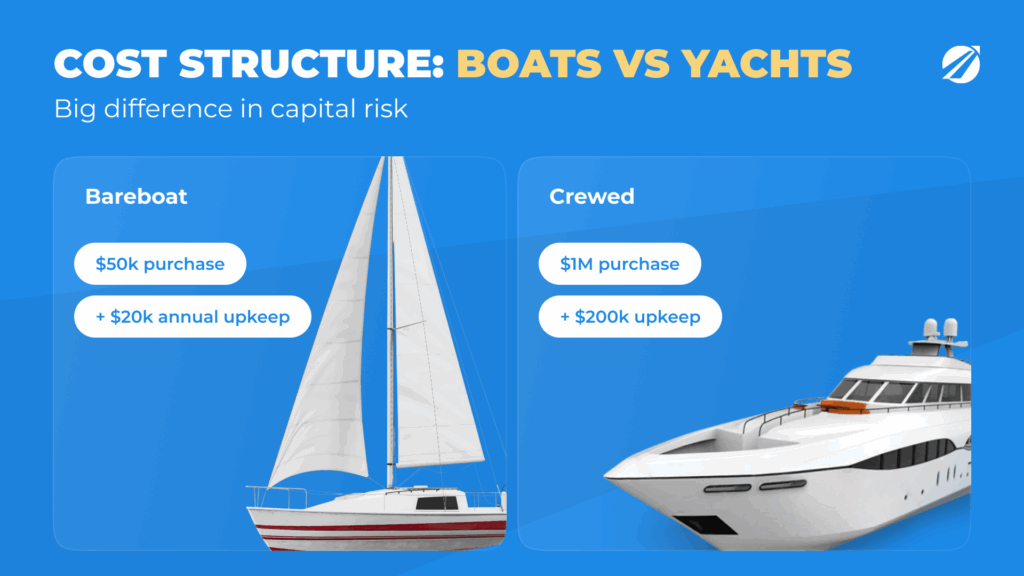

Yachts vs Boats — Cost Structure Differences

The biggest challenge is financial. Boats and yachts require substantial upfront investment, followed by ongoing expenses that do not stop when bookings slow down. Purchasing a small speedboat can run about $50,000, with yearly upkeep near $20,000, whereas a 50-foot yacht may exceed $1 million upfront and $200,000 annually in operating costs. Unlike cars or apartments, vessels depreciate quickly, often losing 10 to 20 percent of their value annually. This makes financial discipline critical; without strong utilization, assets can become liabilities in just a few seasons.

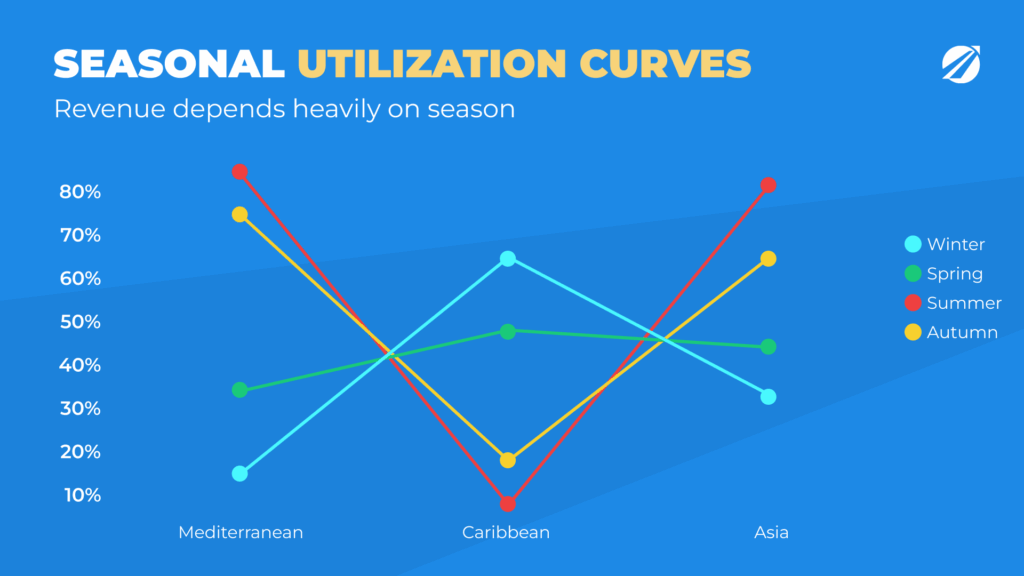

Seasonality and Weather Dependence

Boat rentals are inherently seasonal. In the Mediterranean, most revenue is earned in just four to five summer months, while in the Caribbean, the season peaks during winter holidays but drops sharply during hurricane season. Even in tropical destinations, storms or monsoons can cancel weeks of bookings. Managing cash flow becomes vital in the face of these fluctuations. Operators who do not set aside reserves during peak season often struggle to cover fixed costs in low season.

Safety, Compliance, and Licensing

Maritime regulations are stricter than in many other rental businesses. Captains must hold professional licenses, vessels must comply with passenger limits, and safety equipment must be inspected regularly. Customers — especially corporate groups and high-net-worth individuals — expect professional safety protocols, and any lapses can result in accidents, lawsuits, or reputational damage. Compliance is not just about avoiding fines; it is a matter of survival in a business where trust defines long-term success.

Liability and Insurance

Insurance is another unavoidable cost. Comprehensive coverage includes hull protection, passenger liability, and third-party claims, but premiums are steep, often amounting to 2–5 percent of vessel value annually. Even with these costs, many policies contain exclusions, particularly for bareboat rentals where inexperienced clients may cause damage. Operators should examine contracts thoroughly to ensure no unexpected issues arise in the event of an incident. A single uninsured accident can erase years of profits.

Theft, Fraud, and Damage

Among the risks are theft, fraudulent bookings, and damages directly caused by customers. Fraudulent credit card payments or last-minute cancellations can create both financial and reputational problems. Theft of equipment or, in rare cases, entire vessels has been reported in regions with weak marina security. Day-to-day wear and tear, such as engine strain, upholstery damage, or electronic failures, is inevitable. Without strict inspection routines, deposit policies, and maintenance schedules, these small issues can accumulate into major losses.

Fleet Planning and Vessel Choices

Selecting the right mix of vessels is one of the most strategic decisions in the rental business. A poorly chosen fleet can lock up capital, drive up operating expenses, and struggle to draw customers. The right fleet, on the other hand, balances customer demand, seasonality, and profitability.

Boat Categories

Entry-level operations are largely built on smaller boats like speedboats, pontoons, fishing vessels, and sailboats. Affordable to buy, easier to maintain, and attractive to both tourists and families, they make versatile assets. Speedboats are ideal for short sightseeing tours, while pontoons work well for group leisure. A loyal niche customer base supports fishing boats, whereas small sailboats appeal to those who prize the joy of sailing over high-end comfort.

They provide dependable turnover and enable operators to shift strategies when needed. For example, a fleet of five speedboats in Miami or Ibiza can gross over $250,000 in a summer season, provided utilization rates remain high. While margins per booking are smaller than yachts, volume and frequency ensure healthy returns.

Yacht Categories

Yachts represent the premium segment. Motor yachts between 40 and 70 feet are common in Mediterranean charters, offering comfort, speed, and high daily rates. Sailing yachts attract customers who value tradition, while catamarans are increasingly popular for group charters thanks to their stability and spacious layout. Mega-yachts, over 100 feet, cater to the ultra-wealthy, often generating six-figure weekly revenues.

Every type caters to a specific market segment. A 50-foot motor yacht in Greece might rent for €25,000 per week, while a catamaran in the Caribbean appeals to families seeking comfort and space at half the price. Many operators blend categories to spread risk and cater to different customer needs.

Crew vs No Crew Requirements

A major operational choice is whether to provide crewed or bareboat rentals. Bareboat charters cut staffing expenses, though they demand that customers carry valid licenses. In regions like Croatia, their popularity is fueled by the high number of tourists with sailing experience. Crewed rentals dominate in the Caribbean and luxury markets, where clients expect not only a captain but also chefs, stewards, and deckhands.

Choosing between crewed and bareboat models carries clear financial trade-offs. While costlier to run, crewed yachts deliver top-tier experiences that enable higher rates and foster customer loyalty. Bareboat rentals, on the other hand, offer stronger margins per booking but expose operators to higher risks of damage and liability.

Maintenance, Storage, and Logistics

Whatever the mix, all vessels require continuous care. Engines, hulls, and electronics must be serviced regularly, while interiors must remain in pristine condition. Seasonal storage is another factor: in regions with harsh winters, boats must be hauled out, cleaned, and stored indoors. Tropical regions bring added difficulties, with humidity and salt speeding up wear and tear.

Efficient logistics also matter. Turnaround times between bookings must be short to maximize utilization. A well-trained crew can inspect and clean a yacht in hours, ensuring it is ready for the next guests. Operators who neglect this lose revenue not from lack of demand but from operational bottlenecks.

Pricing and Packaging Strategies

Pricing in boat and yacht rentals is both an art and a science. Set rates too low, and operators leave money on the table. Set them too high, and utilization suffers. The most profitable businesses design layered strategies that reflect seasonality, vessel type, and customer segments.

Short-Term Rentals (Hourly/Day Trips)

For short-term rentals, simplicity and transparency win. Tourists booking on impulse prefer clear, all-inclusive prices. A two-hour speedboat ride in Miami might cost $300, while a full-day pontoon rental in Chicago averages $600. Operators increase revenue by setting dynamic rates that rise with demand surges around weekends, holidays, and festivals.

Multi-Day/Weekly Charters

Longer charters require a different structure. A 50-foot yacht in Greece may rent for €25,000 per week during peak season, excluding additional expenses such as fuel, food, and marina fees. These extras are usually billed through an advance provisioning allowance (APA), which often adds 20–30 percent to the final bill. To avoid misunderstandings, operators must communicate clearly so clients understand what is included in the base rate and what comes extra.

Subscriptions, Memberships, and Loyalty Programs

Such models bring in recurring revenue that operators can forecast with confidence. In urban markets, clubs may charge $500 per month for unlimited small-boat access or $20,000 annually for premium yacht privileges. Programs that reward loyal customers with discounts or perks play an important role as well. The difficulty lies in delivering value to customers while managing capacity, so peak weekends don’t get overbooked.

Corporate/Event Pricing

Corporate clients and event planners are less concerned with raw vessel costs and more focused on convenience, exclusivity, and bundled services. A company hosting an executive retreat in Dubai may pay $25,000 for a one-day charter with catering and entertainment included. They are lucrative and drive loyalty, but only if operators deliver faultless service that warrants the higher price.

Preventing Cannibalization Across Offers

When offering multiple products — short-term rentals, weekly charters, and memberships — operators must avoid cannibalization. For instance, if a one-week yacht rental costs €20,000 but the same vessel is available through a club membership for a fraction of that, customers will gravitate to the cheaper option. The answer is to build packages strategically and use dynamic pricing to align value across offerings. Advanced operators track booking patterns carefully and fine-tune rates to optimize revenue while protecting premium segments.

Operations and Customer Experience

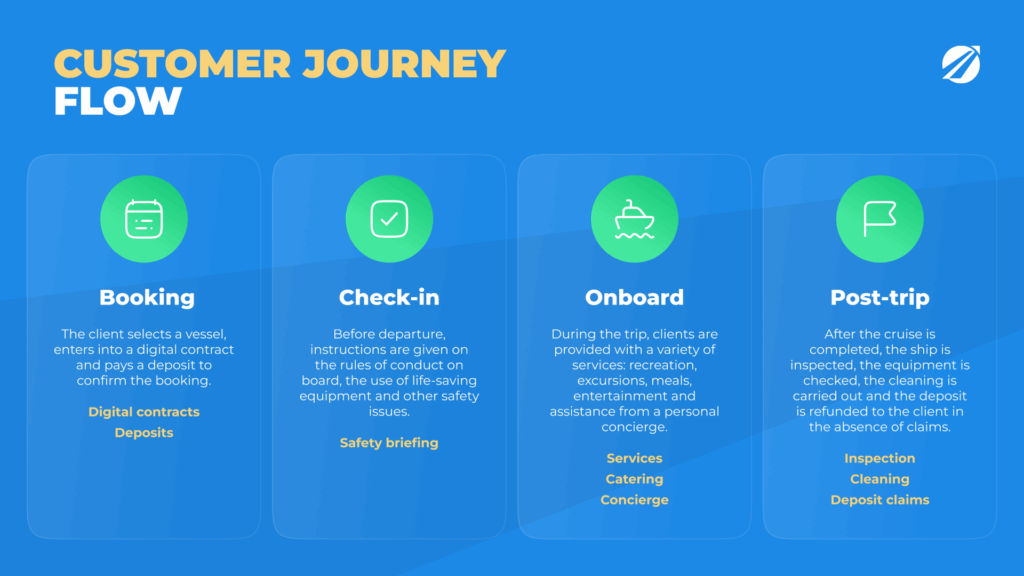

Running a boat or yacht rental business goes far beyond making vessels available. The customer journey spans from the initial booking through onboarding, the actual trip, and the post-rental process. Customer satisfaction, word-of-mouth reputation, and sustained profitability are all influenced by each stage.

Booking and Check-In

Digital Contracts, KYC, and Deposits

Modern customers look for a booking experience that is seamless, clear, and fully digital. Online reservations with instant confirmations, electronic signatures, and secure payment gateways have become the industry standard. Operators increasingly rely on digital KYC (know-your-customer) processes that verify identity before a booking is confirmed. Deposits — often 20 to 50 percent of the total cost — are essential for reducing no-shows and protecting against last-minute cancellations.

Trust grows and errors shrink when contracts are automated and personal documents are managed securely. A guest who books online, signs digitally, and receives a clear deposit receipt perceives the service as professional before ever stepping onto the vessel.

Safety Briefings and Training

Crew Protocols and Passenger Instructions

Safety is both a regulatory obligation and a customer expectation. Before departure, passengers must be given a clear safety briefing. For small boats, this might mean instructions on life jackets, navigation limits, and emergency contacts. For yachts, a more detailed process is required — one that covers evacuation, fire safety, and equipment maintenance.

Skilled crews elevate the customer experience by presenting safety instructions clearly and calmly, without instilling fear. Thorough safety practices are perceived by clients as professional conduct, cutting liability and increasing satisfaction. Operators who invest in training — regular drills, updated certifications, and hospitality skills — create safer environments and stronger reputations.

On-Trip Services and Support

Catering, Entertainment, and Concierge

The experience on the water is what guests remember most. For smaller boats, this may involve providing snorkeling gear, coolers, or local route suggestions. For yachts, the range of services expands dramatically. With chefs, stewards, and deckhands onboard, crewed charters transform ordinary trips into luxury events. Exclusive concierge services such as drone photography, private DJs, or tailored catering enhance the journey further.

Profitability is affected to a great extent. Ancillary services can increase revenue per booking by 20–40 percent, while at the same time deepening customer loyalty. A guest who feels they have received a curated, once-in-a-lifetime experience is far more likely to return and to recommend the operator to others.

Post-Trip Processes

Inspection, Cleaning, and Claims

The post-trip stage is as critical as the booking process. Every vessel must be inspected immediately upon return, documenting any damage with photos or checklists. Cleaning must be handled quickly and to a professional standard to prepare the vessel for the next booking. During high season, turnaround time can be as short as a few hours.

Deposit claims must be managed transparently. Customers are more willing to accept deductions when operators provide clear evidence of damage. Mishandling these interactions can result in negative reviews, which are far more costly than the repair itself. Handled professionally, post-trip management reinforces customer trust, boosts reputation, and drives loyalty.

Legal and Regulatory Framework

For boat and yacht rentals, compliance is the basis of legitimacy and resilience. Regulations here are extensive — governing licensing, safety standards, maritime operations, and insurance coverage.

Licensing Requirements (Captains and Operators)

Most jurisdictions require professional licenses for captains operating vessels above certain sizes. Even smaller boats may require operators to hold valid local permits. In bareboat rentals, responsibility shifts to the client, who must present internationally recognized licenses such as ICC (International Certificate of Competence). In countries like Greece and Italy, charter companies can face fines or shutdowns if they allow unqualified clients to take a vessel.

Maritime Regulations (Local and International)

Rules around passenger numbers, navigation boundaries, and safety equipment vary by region. In the United States, the Coast Guard enforces strict capacity rules, while in Europe, regulations such as SOLAS (Safety of Life at Sea) govern larger yachts. International charters that cross borders must comply with multiple jurisdictions simultaneously, adding complexity. Non-compliance doesn’t just bring fines; vessel detentions can follow, directly lowering utilization and profitability.

Insurance Models and Coverage Gaps

Insurance is vital yet complicated. Typical policies cover the hull, provide liability protection for passenger injuries, and include third-party coverage for damages to others. However, many policies exclude high-risk scenarios such as weather-related incidents, piracy in certain regions, or accidents caused by unlicensed operators. For bareboat rentals, some insurers demand higher premiums or refuse coverage entirely. Operators must work with specialized maritime brokers to secure policies that fit their business model and geographic market.

Annual insurance costs are significant — typically 2 to 5 percent of vessel value. For a $1 million yacht, this can mean $20,000–$50,000 each year. Cutting corners on insurance is extremely risky: one uninsured incident can erase years of profit.

Contracts, Waivers, and Liability

Contracts protect operators through the clear allocation of responsibilities. A strong rental agreement outlines what the customer may and may not do, who is responsible for damages, and how disputes will be resolved. Waivers add another layer of legal protection by having clients formally accept the risks. While waivers do not eliminate liability entirely, they strengthen an operator’s defense in case of claims.

Storing contracts digitally is increasingly standard, driven by both convenience and compliance needs. In many jurisdictions, operators are legally required to retain these documents for several years. Automating this process with rental management software saves time, minimizes mistakes, and guarantees access when required.

Marketing and Sales Channels

No matter how impressive a fleet may be, without effective marketing and strong distribution channels, vessels risk sitting idle. Unlike cars, boats and yachts are not considered essential; they are discretionary purchases driven by aspiration, celebration, or adventure. As a result, marketing becomes not only important but the core driver of profitability.

SEO and Local Discovery

Most journeys begin online. Travelers search for terms such as “yacht rental in Mykonos” or “fishing charter Miami.” To capture this demand, operators must invest in search engine optimization. A well-structured website with detailed service pages, high-quality photos, and blog content about local attractions improves rankings. Local SEO is especially powerful: keeping a Google Business profile updated with photos, descriptions, and customer reviews can make the difference between being booked and being invisible.

A practical example comes from operators in Santorini, where competition is fierce. Those who consistently update their Google Maps profiles with new reviews and respond promptly to inquiries often outperform larger rivals who rely only on offline partnerships.

OTAs and Booking Marketplaces

GetYourGuide, Boatsetter, Click&Boat

Online travel agencies and rental marketplaces act as powerful demand generators. These platforms deliver global visibility, helping small operators draw in customers from abroad. Boatsetter in the US, Click&Boat in Europe, and GetYourGuide worldwide are among the most influential platforms.

The downside is commission: platforms often charge between 15 and 30 percent per booking. However, many operators treat OTAs as acquisition funnels, using them to capture first-time clients and later nurturing them into direct bookers via loyalty offers or repeat discounts. It keeps exposure and profitability in proper balance.

Partnerships and Cross-Promotions

Hotels, Resorts, Event Agencies

Partnerships can deliver value equal to that of online marketing. Resorts and boutique hotels frequently include boat trips in their premium packages. For example, hotels on the Amalfi Coast sell packages with private boat tours included, guaranteeing steady business for local operators. In key markets like Dubai, event agencies package yachts into premium corporate deals, frequently priced at $20,000 or more. These arrangements cut acquisition costs and create sustainable pipelines.

Social Media and Influencers

Instagram, TikTok, YouTube

This industry is a perfect fit for social media. Platforms thrive on visual storytelling, and few products are as visually compelling as boats at sunset or mega-yachts in turquoise waters. A single viral TikTok clip can generate thousands of inquiries. Instagram remains the top choice for luxury branding, while YouTube offers opportunities for longer storytelling — virtual tours, customer testimonials, and destination features.

Influencer marketing can be especially effective. Collaborating with travel influencers or celebrities often creates authenticity and aspirational pull that traditional ads cannot match. Of course, it must be executed carefully: influencers should align with the brand’s target audience, whether luxury, family, or adventure travel.

Reviews, Referrals, and Loyalty

Growth still relies heavily on word-of-mouth referrals. Customer decisions are strongly shaped by online reviews on Google, TripAdvisor, and booking sites. A single negative review about poor service or unclear deposit handling can deter dozens of potential customers. Motivating happy clients to post reviews, offering discounts for referrals, and building loyalty programs generate multiplying benefits.

In practice, operators who deliver consistent service quality and actively manage their online reputation often see year-over-year growth without significantly increasing advertising budgets.

Technology and Software for Boat/Yacht Rentals

With so many moving parts — fleets, reservations, finances, and compliance — technology is no longer optional. Manual spreadsheets and paper contracts may suffice for a small family-run operation, but they quickly collapse under the demands of scaling. Digital systems make operations smoother, improve service quality, and — above all — unlock actionable insights from data.

Booking and Scheduling Systems

At the core of every modern rental business is a booking system. Customers want to check real-time availability, book instantly, and receive confirmations by email or SMS. For operators, centralized calendars prevent double-bookings and simplify resource allocation. Platforms that handle deposits, cancellations, and waitlists in one place make operations even more efficient.

Payment Processing and Contracts

Automated, secure payment systems lower risk while strengthening cash flow. Modern platforms handle deposits, refunds, and even split payments between group members. When combined with digital contracts, the process becomes seamless: clients sign electronically, receive copies instantly, and operators keep legally compliant records without administrative overhead.

Telematics, GPS, and Fleet Tracking

In the rental of boats and yachts, fleet tracking is a core requirement. GPS units provide live location updates, ensuring vessels operate only within authorized zones. They measure fuel usage and engine activity, guiding maintenance planning and identifying irregularities. In bareboat rentals, telematics double as a safety measure and compliance control, offering operators reassurance that customers follow the rules.

Maintenance Scheduling and Alerts

Maintenance ranks among the largest expense categories in this sector. Digital systems that log service histories, flag upcoming checks, and send automated reminders prevent breakdowns and extend asset lifespans. Rather than responding after problems occur, operators can plan in advance to reduce downtime and secure revenue.

How TopRentApp Supports Operators

Booking and Fleet Calendar

TopRentApp offers a centralized fleet calendar that ensures no double-bookings occur and that operators always have a clear overview of vessel availability.

Dynamic Pricing and Utilization Analytics

The platform keeps track of usage levels while allowing dynamic pricing control. For example, peak weekends can be priced higher while off-season days can be discounted to improve occupancy.

Maintenance Alerts and Contract Automation

Through automated contracts and maintenance reminders, TopRentApp makes operations smoother. Op erators receive servicing alerts, while clients get professional agreements with e-signatures —delivering less risk, more transparency, and assured compliance.

With data steering decisions, operations run seamlessly. For ambitious operators, software isn’t optional — it’s the core of long-term sustainability.

Financial Modeling and Case Scenarios

Behind every successful boat or yacht rental business is a robust financial model. The industry has many cases where passion and design took precedence over financial logic. Operators purchased impressive vessels, invested in marketing, and then discovered that revenues failed to cover depreciation and fixed costs. Adhering to financial discipline safeguards against mistakes and guarantees long-term viability.

Building a P&L for Boat vs Yacht Rentals

A profit and loss statement for maritime rentals looks different from other industries. Revenue lines may include charter fees, event rentals, membership subscriptions, and ancillary sales such as catering or guided tours. Expenses, however, are unusually heavy. In addition to fuel, docking, and maintenance, owners must account for depreciation — which can erode 10 to 20 percent of vessel value each year.

For a small fleet of speedboats, annual revenue might total $300,000 with costs of $150,000, leaving a healthy contribution margin. For a single luxury yacht generating $800,000 in annual revenue, operating costs may reach $500,000, and depreciation could add another $100,000. Without recognizing these expenses in a P&L, operators may mistakenly believe they are profitable when, in reality, asset value is steadily declining.

Break-Even Analysis

Through break-even analysis, operators can calculate the number of bookings needed to offset expenses. A speedboat costing $50,000 to purchase and $20,000 annually to run might need 80 to 100 booked days per year to break even. A 50-foot yacht, by contrast, may require eight to twelve full weeks of charters annually.

Consider an operator in Barcelona. A yacht priced at €25,000 per week needs at least 10 weeks of bookings to cover €250,000 in operating costs. Anything beyond that contributes to profit. If the vessel only secures six weeks, the operator faces a loss despite seemingly impressive headline revenue.

Sensitivity to Seasonality and Weather

Seasonal fluctuations intensify risk in the maritime rental business. Mediterranean fleets depend heavily on a 12- to 16-week summer window. Caribbean fleets thrive in winter but face hurricane threats. Asian markets like Thailand and Indonesia rely on dry seasons that may last only half the year. Weather disruptions — such as storms, heavy rain, or strong winds — can cancel bookings unexpectedly.

Financial models should build in these risks by projecting multiple scenarios: best case, base case, and worst case. Operators who assume smooth sailing every season risk cash-flow crises when reality strikes. Those who plan for variability — by setting aside reserves or diversifying across regions — are more resilient.

Example ROI Scenarios (Tourist City vs Corporate Market)

The significance of market alignment is illustrated by two scenarios. In Barcelona, a fleet of five yachts operating 20 weeks per year could generate €1.5 million in gross revenue. After deducting €1 million in combined operating costs and depreciation, the operator still clears €500,000.

By contrast, in a smaller market with weaker demand, the same fleet might achieve only 10 booked weeks per vessel. Gross revenue would fall to €750,000, while costs remain nearly identical. The outcome is margins so thin they verge on losses. This demonstrates that vessel management alone is not enough — destination strategy is equally decisive.

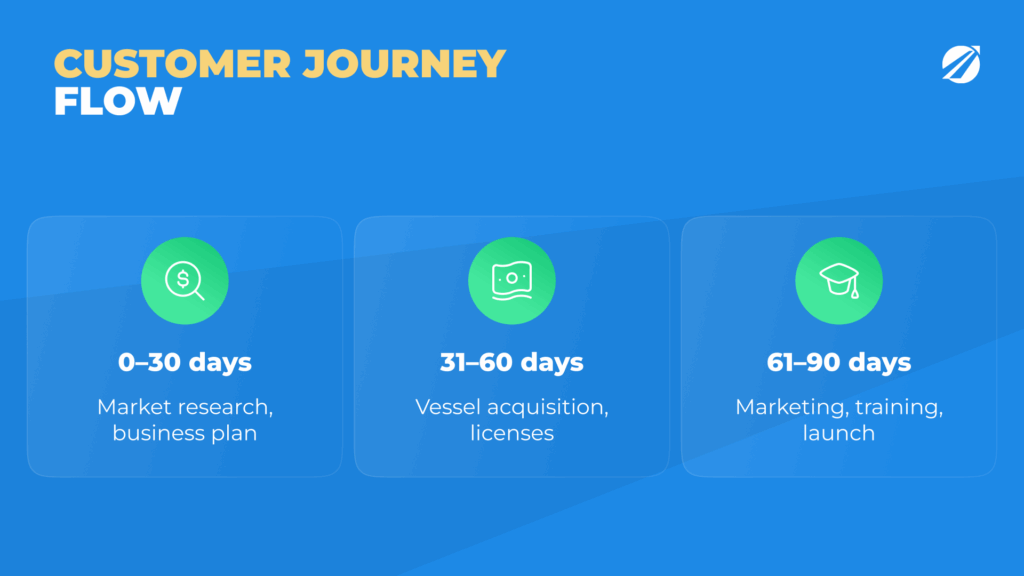

Implementation Roadmap: From Idea to Launch

Transforming an idea into a functioning boat or yacht rental business requires structure. Enthusiasm can carry an entrepreneur only so far; without a roadmap, critical tasks get overlooked, licenses delayed, or fleets underutilized. A phased approach over the first 90 days ensures that foundations are strong.

0–30 Days: Market Research and Business Plan

The first month is about validation. Entrepreneurs must study demand drivers such as tourist arrivals, hotel occupancy, and marina availability. Analyzing the competition exposes typical pricing, fleet utilization rates, and customer demands. Interviews with potential partners — hotel managers, event planners, travel agents — help identify collaboration opportunities.

By the end of this phase, a draft business plan should outline the target market, customer profiles, fleet strategy, pricing, and projected financials. This plan is not static but provides a decision framework: either move forward with confidence or pivot before capital is committed.

31–60 Days: Vessel Acquisition and Licensing

In the second month, attention shifts to assets and compliance. Depending on strategy, vessels may be purchased, leased, or secured through revenue-sharing partnerships with owners. Each option has trade-offs: ownership provides control, leasing reduces capital intensity, and partnerships lower risk but require profit sharing.

At the same time, operators must secure licenses, permits, and insurance. Regulatory approvals vary by country but often involve captain certifications, vessel inspections, and safety compliance checks. Docking arrangements are also crucial; marinas in popular destinations often have waiting lists, so securing space early is essential.

61–90 Days: Marketing Launch and Operations Setup

By the third month, attention shifts to customer-facing systems and service readiness. Websites, booking platforms, and digital payment systems must be tested and live. Crews need training not only in safety but also in hospitality. Marketing campaigns should launch before operations begin, creating awareness and generating pre-bookings.

A soft launch — inviting friends, family, or a limited number of early clients — provides valuable feedback on processes such as check-in, safety briefings, and turnaround times. Adjustments made during this stage prevent costly mistakes once the business opens fully.

By day 90, a well-prepared operator has vessels ready, licenses approved, marketing pipelines active, and operational workflows tested. Rather than improvising under pressure, they launch with discipline and credibility.

Conclusion — Building a Profitable Boat and Yacht Rental Business

The year 2026 finds the boat and yacht rental sector full of growth potential, balanced by the need for discipline and vision. Owning beautiful boats isn’t enough for success; it takes a fleet aligned with demand, smart pricing strategies, professional operations, and strict compliance with maritime regulations. Operators who master these fundamentals not only achieve profitability but also build brands that customers trust and recommend.

Key Takeaways

The industry’s economics are unforgiving. Whether an asset generates profit or consumes capital depends on utilization rates, contribution margins, and total cost of ownership. Small boats generate volume, yachts create premium margins, and ancillary services add incremental revenue that often makes the difference between a good and a great season. Partnerships with hotels, agencies, and event planners multiply demand, while digital marketing and reputation management expand reach.

Operational efficiency and quality service translate into customer loyalty. Seamless booking systems, digital contracts, safety briefings, and well-delivered onboard services create experiences that customers remember and share. In a market where reviews influence buying decisions, consistency and professionalism are as valuable as luxury.

Balancing Opportunities and Challenges

Tourism growth and luxury trends provide strong opportunities, yet challenges — capital costs, seasonality, insurance, and compliance — pose serious threats to unprepared operators. Success goes to operators who plan thoroughly, mitigate financial risks, and invest in resilience.

The decisive edge now comes from technology. Platforms equip operators to track fleet usage, automate documentation, plan maintenance, and update pricing instantly. With guesswork removed, operators make sharper decisions and grow profits.

Stop Guessing — Start Optimizing

Smooth operations are essential in the marine rental industry.

👉 Request a free demo to explore how TopRentApp simplifies bookings, fleet maintenance, pricing, and availability.

A boat rental management software supports faster, more reliable operations.